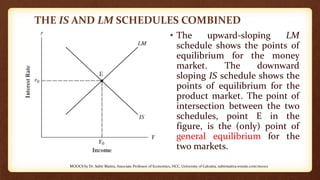

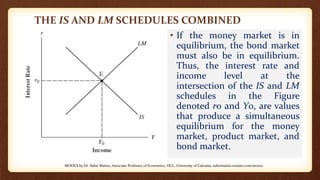

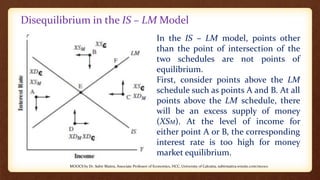

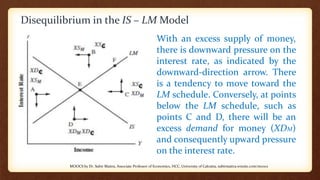

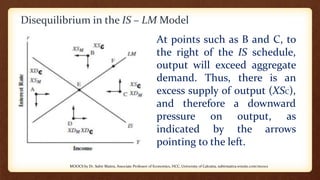

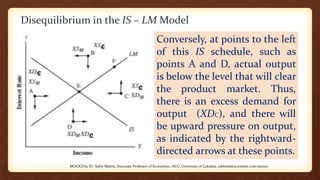

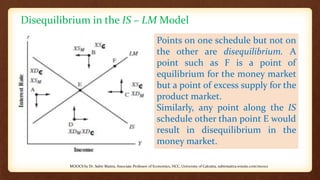

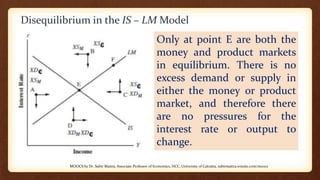

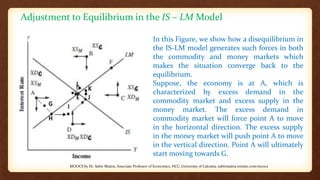

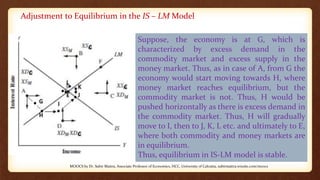

This document is a lecture on macroeconomic equilibrium using the IS-LM model. It discusses how the IS and LM curves intersect at a single point of general equilibrium where both the goods and money markets are in balance. It then explains how different points on or outside the curves represent disequilibrium situations, and how economic forces push the economy toward the equilibrium point through adjustments in interest rates and output levels. The lecture concludes by showing graphically how an economy initially in disequilibrium will gradually move along the curves toward the point of general equilibrium.