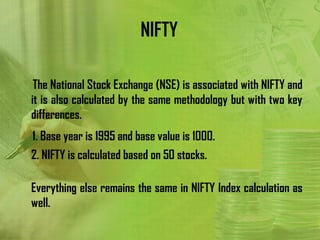

The document discusses the National Stock Exchange of India (NSE) and its key stock market indices - SENSEX and NIFTY. It provides details on how the NSE was established in 1992 as India's first electronic stock exchange. It operates from Mumbai and tracks over 1,600 companies. The NIFTY 50 index, owned by NSE, tracks the performance of 50 large companies across sectors. It is one of the main benchmarks for the Indian equity market and widely used for derivatives.

![NSE: National Stock Exchange

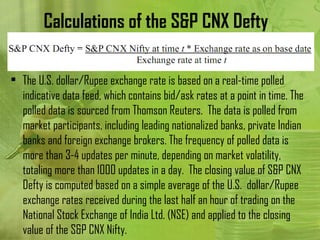

Type Stock Exchange

Location Mumbai, India

Coordinates 19°3′37″N 72°51′35″E

Founded 1992

Owner National Stock Exchange of India Limited

Key people Ravi Narain (MD)

Currency Indian rupee ( )

No. of listings 1,646

MarketCap US$1 trillion (Jul 2012)[1]

Indexes S&P CNX Nifty

CNX Nifty Junior

S&P CNX 500

Website www.nseindia.com](https://image.slidesharecdn.com/niftyedited-121213080902-phpapp01/85/NSE-NIFTY-calculations-7-320.jpg)

![• Graph of S&P CNX Nifty from January 1997 to March 2011

• The S&P CNX Nifty covers 22 sectors of the Indian economyand offers investment

managers exposure to the Indian market in one portfolio. The S&P CNX Nifty stocks

represents about 67.27% of the free float market capitalization of the stocks listed at

National Stock Exchange (NSE) as on September 30, 2012.

• The S&P CNX Nifty index is a free float market capitalisation weighted index. The index

was initially calculated on full market capitalisation methodology. From June 26, 2009,

the computation was changed to free float methodology. The base period for the S&P

CNX Nifty index is November 3, 1995, which marked the completion of one year of

operations of NSE's Capital Market Segment. The base value of the index has been set at

1000, and a base capital of Rs 2.06 trillion. [1] The S&P CNX Nifty Index was developed by

Ajay Shah and Susan Thomas.](https://image.slidesharecdn.com/niftyedited-121213080902-phpapp01/85/NSE-NIFTY-calculations-14-320.jpg)