Bba502 & financial management

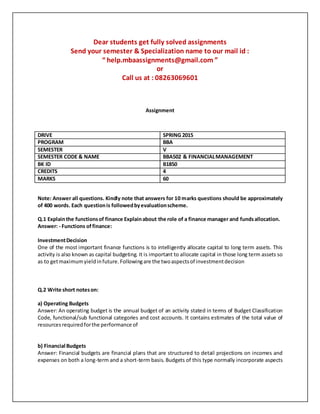

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 Assignment DRIVE SPRING 2015 PROGRAM BBA SEMESTER V SEMESTER CODE & NAME BBA502 & FINANCIALMANAGEMENT BK ID B1850 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each questionis followedbyevaluationscheme. Q.1 Explainthe functionsof finance Explainabout the role of a finance manager and fundsallocation. Answer: - Functions offinance: InvestmentDecision One of the most important finance functions is to intelligently allocate capital to long term assets. This activity is also known as capital budgeting. It is important to allocate capital in those long term assets so as to getmaximumyieldinfuture.Followingare the twoaspectsof investmentdecision Q.2 Write short noteson: a) Operating Budgets Answer: An operating budget is the annual budget of an activity stated in terms of Budget Classification Code, functional/sub functional categories and cost accounts. It contains estimates of the total value of resourcesrequiredforthe performance of b) Financial Budgets Answer: Financial budgets are financial plans that are structured to detail projections on incomes and expenses on both a long-term and a short-term basis. Budgets of this type normally incorporate aspects

- 2. of other types of budgeting strategies, including the preparation of a detailed budgeted balance sheet, a sectionthatfunctionsasa cash flowbudgetand c) Capital Budgets Answer: - Capital budgeting, or investment appraisal, is the planning process used to determine whether an organization's long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are worth the funding of cash through the firm'scapitalizationstructure (debt,equityor Q.3 Explainon cost ofcapital and cost of preference capital. Answer: - Cost of capital: In accounting, the cost of capital is the cost of a company's funds (both debt and equity), or, from an investor's point of view "the shareholder's required return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new projecthas to meet. The cost of debt is relatively simple to calculate, as it is composed of the rate of interest paid. In practice, the interest-rate paid by the company can be modeled as the risk-free rate plus a risk component (risk premium), which itself incorporates a probable rate of default (and amount of recovery givendefault).Forcompanieswithsimilarrisk Q.4 Solve the given problembelow: Sales 25,00,000 ; Variable cost 15,00,000 ; Fixed cost 5,00,000 (including interest on 10,00,000). Calculate degree of financial leverage. Answer: - Q.5 Explainthe capital budgetingprocess.Why isNet PresentValue (NPV) important? Answer: Capital budgeting process: Capital budgeting is the planning process used to determine which of an organization'slongterminvestmentsare worthpursuing. Netpresentvalue Internal rate of return Paybackperiod Profitabilityindex Equivalentannuity Q.6 Write about cash planning and explainabout cash forecastingand budgeting. Answer: cash planning: Cash planning is nothing but simply to forecast the cash needs well in advance for a given period with a view to maintain adequate cash balance in hand, sufficient to met the payments and obligations as and when they mature. Thus it includes forecasting of cash inflows and cash outflows. Cash control involves proper implementation of policies and procedures regarding inflow and outflow of cash. It includes short term investment plans when cash in surplus and borrowing programmes duringthe daysof cash deficit.

- 3. Cash forecasting and budgeting: A cash flow forecast indicates the likely future movement of cash in and out of the business. It's an estimate of the amount of money you expect to flow in (receipts) and out (payments) of yourbusinessandincludesall Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601