Mb0045 – financial managemen

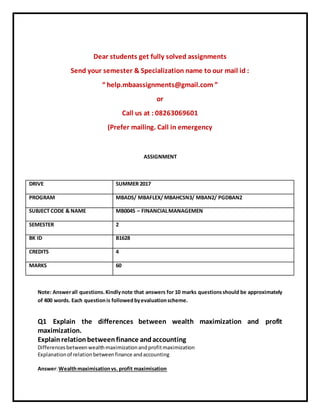

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency ASSIGNMENT DRIVE SUMMER 2017 PROGRAM MBADS/ MBAFLEX/ MBAHCSN3/ MBAN2/ PGDBAN2 SUBJECT CODE & NAME MB0045 – FINANCIALMANAGEMEN SEMESTER 2 BK ID B1628 CREDITS 4 MARKS 60 Note: Answerall questions.Kindlynote that answers for 10 marks questionsshould be approximately of 400 words. Each questionis followedbyevaluationscheme. Q1 Explain the differences between wealth maximization and profit maximization. Explainrelationbetweenfinance andaccounting Differencesbetweenwealthmaximizationandprofitmaximization Explanationof relationbetweenfinance andaccounting Answer:Wealthmaximisationvs. profit maximisation

- 2. Wealthmaximisationisbasedoncashflow.Itisnot basedonthe accountingprofitas inthe case of profitmaximisation. Through the process of discounting,wealth maximisationtakes care of the quality of cash flow. Converting uncertain distant cash flow into comparable values at base period facilitates better comparison of projects. The risks that are associated with cash flow are adequately reflected whenpresent valuesare takentoarrive at the Q2 Explain about the doubling period and future value. Solve the below given problem: Under the ABC Bank’s Cash MultiplierScheme, deposits canbe made for periods ranging from 3 months to 5 years and for every quarter, interest is addedto the principal. The applicable rate of interest is 9% for deposits less than 23 months and 10% for periods more than 24 months. What will be the amount of Rs. 1000 after 2 years? Answer:Doubling period Doubling period is the period which makes the investmentas "Doubled", that is the amount invested fetches100% return. 1. Rule of 72 The initial amountof investmentgetsDoubledwithinwhich72/I Where,I= InterestRate of the investment. Q3 Write short notes on: a) Irredeemable bonds Answer:Irredeemable bondsor perpetual bonds Bonds which will never mature are known as irredeemable or perpetual bonds. Indian Companies Act restrictsthe issue of such bondsand therefore,theseare veryrarelyissuedbycorporates these days.In case of these bonds,the terminal value ormaturityvaluedoesnotexistbecause theyare notredeemable. The face value is known, and the interest received on such bonds is constant and received at regular intervalsandhence,the interestreceipt b) Zerocoupon bonds Zero coupon bonds

- 3. InIndia,zerocouponbondsare alternativelyknownasDeepDiscount Bonds(DDBs).Thesebondsbecame verypopularinIndiafor overa decade c) Valuationof Shares Valuationof Shares A company’ssharescanbe categorisedinto: Ordinaryor equityshares Preference shares The returnsthe shareholdersreceive in Q3. Explain the factors affecting Capital Structure. Solve the below given problem: Givenbelow are two firms, A and B, which are identical in all aspects except the degreeofleverage,employedbythem.What is theaveragecostof capitalof both firms? Details of Firms A and B Firm A Firm B Netoperating income EBIT Rs. 1, 00, 000 Rs. 1, 00, 000 Intereston debenturesI Nil Rs.25,000 Equity earningsE Rs.1,00,000 Rs.75,000 Cost of equityKe 15% 15% Cost of debenturesKd 10% 10% Market value of equityS = E/Ke Rs. 6, 66, 667 Rs.5,00,000 Market value of debt B Nil Rs.2,50,000 Total value of firmV Rs. 6, 66, 667 Rs,7,50,000 Explanationof factorsaffectingcapital structure Solutionforthe problem Interpretation Answer:Factors AffectingCapital Structure Leverage:The use of sourcesof fundsthat have a fixedcostattachedtothem, suchaspreference shares, loansfrom banksand financial institutions,and debenturesinthe capital structure,isknownas “trading onequity”or“financial leverage”.If the assetsfinancedbydebtyieldareturngreaterthanthe costof the debt, the EPS will increase without an increase in the owner’s investment. Similarly,the EPS will also increase if preference share capital isused Q4. Explain the capital Budgeting process andits appraisals Solve the belowgivenproblem:

- 4. Givenbelow are the details on the cash flows of two projects A and B. Compute payback periodfor A and B. Cash flows of A and B Year Project A cash flows(Rs.) Project B cash flows(Rs.) 0 (4,00,000) (5,00,000) 1 2,00,000 1,00,000 2 1,75,000 2,00,000 3 25,000 3,00,000 4 2,00,000 4,00,000 5 1,50,000 2,00,000 Explanation ofcapital budgetingprocess and its appraisals. Solutionfor the problem Answer:Capital budgetingprocess After the screening of proposals for potential involvement is over, the company should take up the followingaspectsof capital budgetingprocess: A proposal should be commercially viable. The following aspects are examined to ascertain the commercial viabilityof anyinvestment proposal: Market for the product Availabilityof rawmaterials Sourcesof raw materials Q5. Explainthe concepts of working capital. Explainthe determinants of working capital. Explanationof conceptsof workingcapital Explanationof determinantsof workingcapital Answer:Concepts ofWorking Capital Gross working capital: Gross working capital refers to the amounts invested in various components of currentassets.It basicallyreferstothe currentassets.Thisconcepthas the followingpractical relevance: Managementof currentassetsis the crucial aspectof workingcapital management Gross workingcapital helpsinthe fixationof marketconditions. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601

- 5. (Prefer mailing. Call in emergency