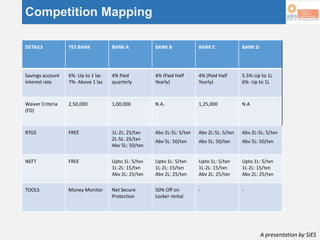

YES Bank is a new generation private sector bank founded in 2004 that uses advanced technology to ensure customer satisfaction and promote growth. It has over 430 branches across India and recognizes technology as key to its philosophy of providing exclusive, personalized service like a European bank. YES Bank offers innovative products like mobile POS, money monitoring, multi-currency travel cards, and competitive interest rates on savings accounts and car loans to attract customers. Management insights highlight how YES Bank has established itself as a tech-savvy bank and gained a competitive advantage through innovative products and state-of-the-art technology.