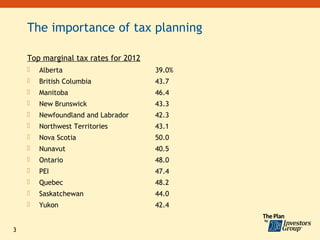

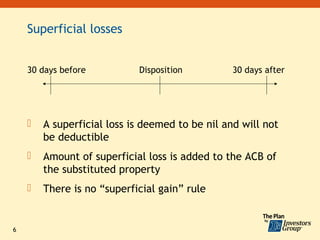

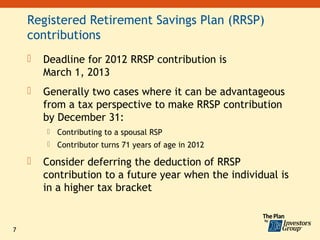

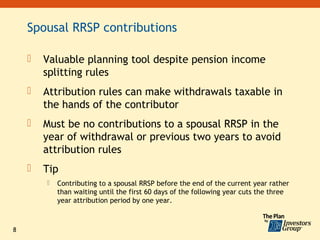

The document discusses year-end tax planning strategies for individuals and businesses, emphasizing the importance of timely contributions to registered accounts, tax deductions, and understanding capital gains and losses. It provides specific advice on various tax credits, registered plans, and tax planning considerations to maximize tax benefits before the year-end. Additionally, it outlines Canada Pension Plan changes and new partnership filing criteria, underscoring the need for careful and proactive tax management.