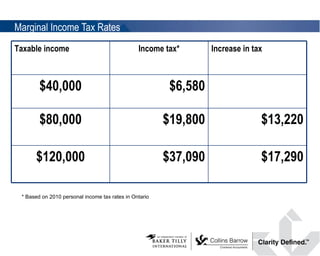

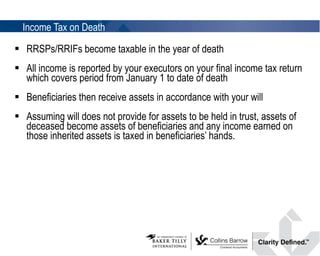

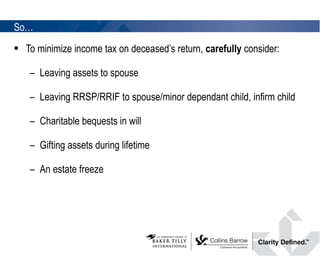

Karen Sands discusses key challenges to retirement income and estate planning, focusing on income splitting and minimizing taxes. Income splitting can be done through investing in assets that generate capital gains for children or prescribing loans between family members. Tax can be deferred through RRSPs or paid at lower rates through capital gains, eligible dividends, or pension income splitting. Planning like setting up trusts can reduce taxes paid by heirs. Proper planning through income splitting and upon death can substantially reduce taxes paid over a lifetime and for heirs.

![Partner Attention A Highly Collaborate Culture including the assignment of Colleague Assurance Partners on mandates Accountability – for the client, the engagement and our people Experience & Industry-specific Expertise With 36 offices from coast to coast, our audit, tax and advisory professionals make your business our focus. WHY COLLINS BARROW? Karen Sands, CA Tax Partner Collins Barrow SEO LLP [email_address]](https://image.slidesharecdn.com/slpmarch2011-110324145545-phpapp01/85/Key-Challenges-to-Retirement-Income-Estate-Planning-21-320.jpg)