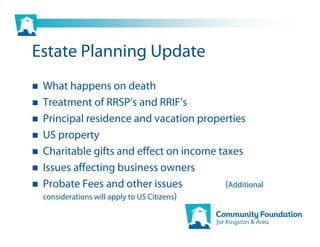

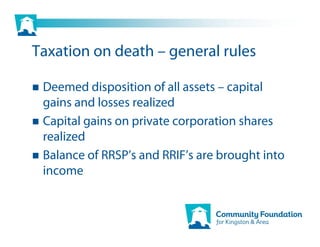

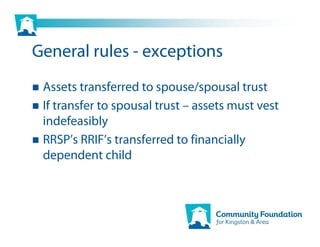

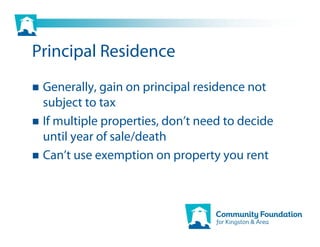

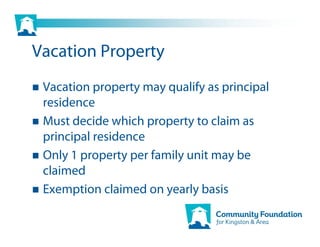

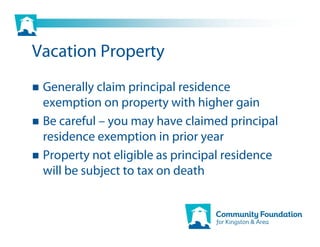

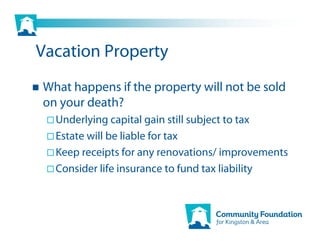

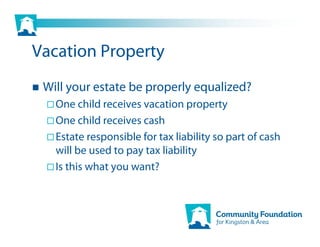

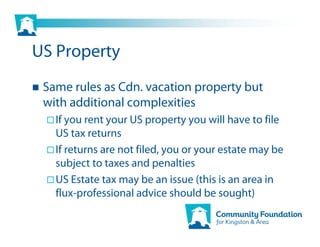

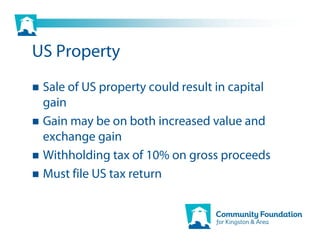

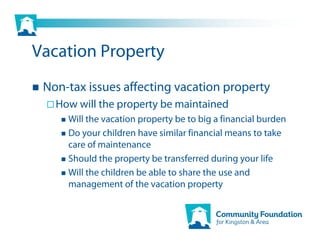

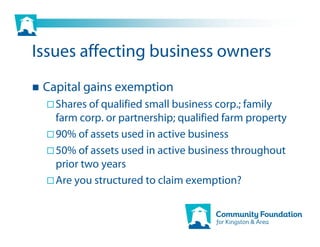

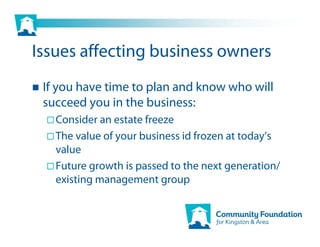

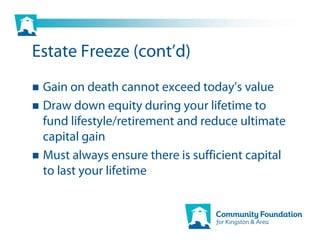

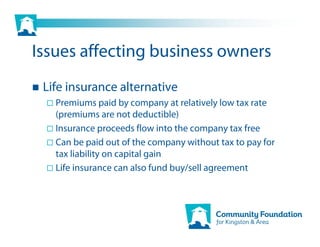

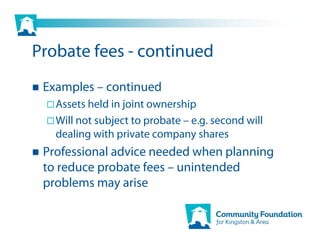

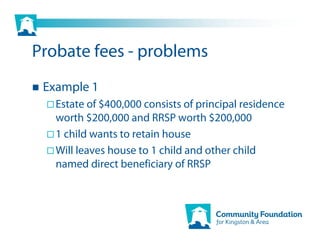

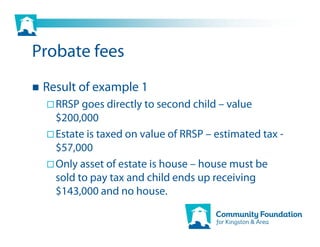

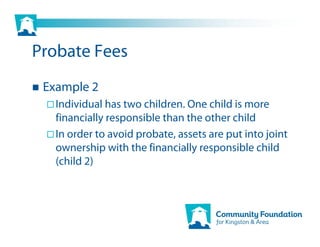

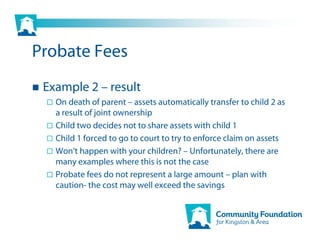

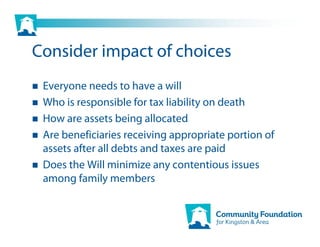

This document provides a summary of key estate planning considerations and taxation rules that apply on death. It discusses the deemed disposition of assets and taxation of capital gains, exceptions for transfers to spouses and dependent children, principal residence and vacation property rules, issues related to US and business properties, charitable gifts, probate fees, and trusts. Readers are advised to seek professional advice when planning their estate to navigate complex tax implications and avoid unintended consequences.