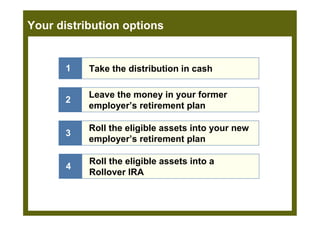

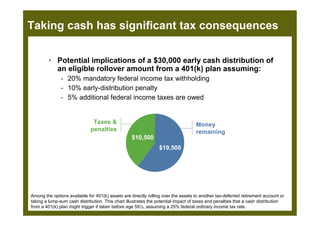

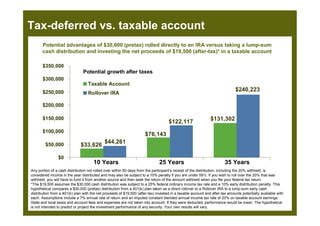

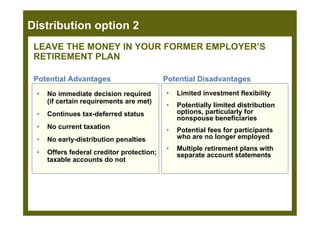

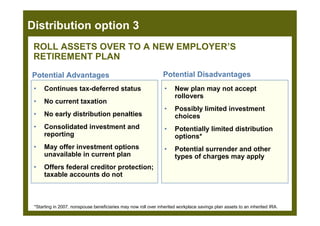

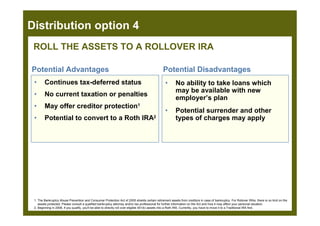

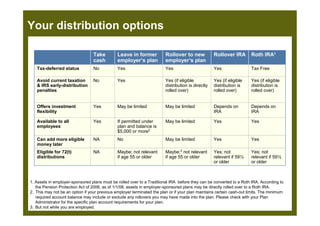

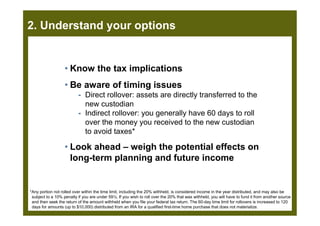

This document provides an overview of retirement plan rollover options for those changing jobs or retiring. It discusses leaving money in a former employer's plan, rolling over to a new employer's plan, rolling over to an IRA, or taking a cash distribution. It notes potential tax implications and advantages of each option, such as continuing tax-deferred growth or avoiding penalties. It also provides tips for evaluating options like consolidating accounts, using special situations strategies, reviewing investments and goals, and seeking expert advice.