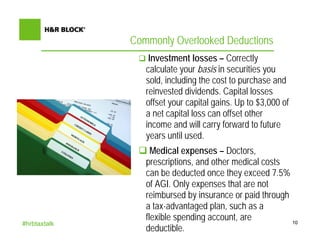

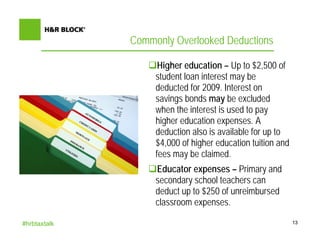

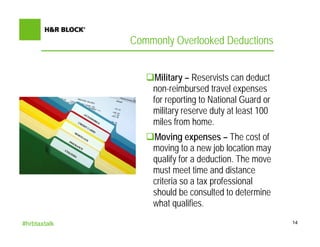

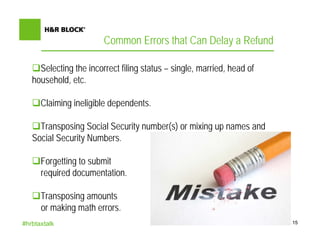

This document provides a summary of a webinar on last minute tax advice presented by H&R Block and hosted by Jenn Fowler. The webinar agenda included opening remarks, an introduction to the master tax advisor Chris Wilson, discussions on last minute tax tips, new tax credits and deductions, commonly overlooked deductions, common errors that can delay refunds, and a Q&A session. Technical assistance was provided by Paul Huffman, and participants were encouraged to submit questions via chat.