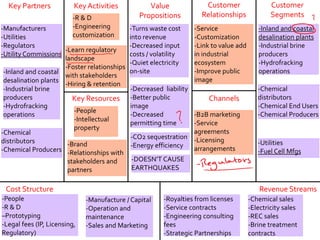

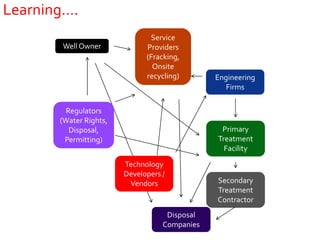

The document outlines the key aspects of Red Ox's electrochemical desalination cell technology which desalinates brine waste from oil and gas industries and other sources while also generating electricity, and produces saleable inorganic materials. It then provides details on the founders, advisors, and mentors involved in the company who have expertise in relevant areas like desalination membrane technology, sustainability, chemistry markets, and finance. The document also includes Red Ox's business model canvas outlining their value propositions, customer relationships, revenue streams, and other aspects.