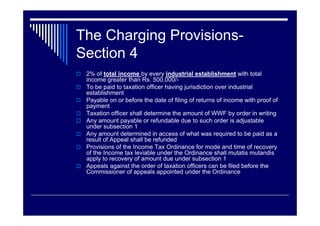

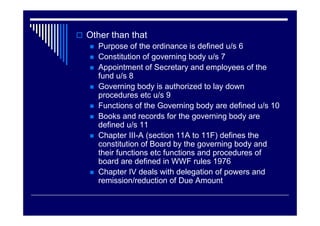

The document defines key terms under the Worker's Welfare Fund Ordinance 1971, such as employer, fund, industrial undertaking, total income, and worker. It outlines that 2% of total income must be paid by industrial establishments earning over Rs. 500,000 to the taxation officer. Additional amounts may be determined by committees examining the financial circumstances of each industrial undertaking. The person liable for income tax on the industrial establishment's income is also liable to pay the worker's welfare fund amount. The ordinance establishes a governing body and board to administer the fund and perform other functions.