This document is the Direct Taxes Code Bill of 2010 from India. It contains 113 clauses that cover topics such as:

1) Establishing the basis of income tax liability and defining types of income like employment, house property, business, capital gains, and residuary sources.

2) Detailing how to compute total income under each head and aggregate income across sources.

3) Providing tax incentives like deductions for savings, insurance, education, donations, etc.

4) Covering special provisions for non-profit organizations and provisions to prevent tax avoidance.

5) Outlining tax administration and procedures as well as authorities' powers.

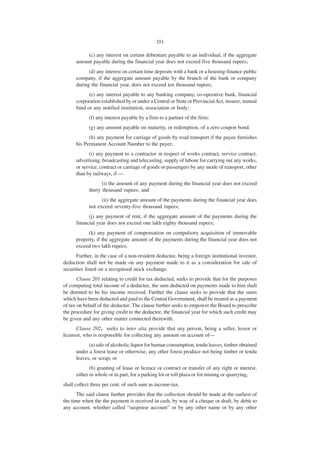

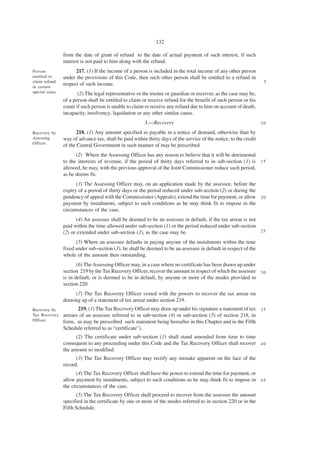

![21

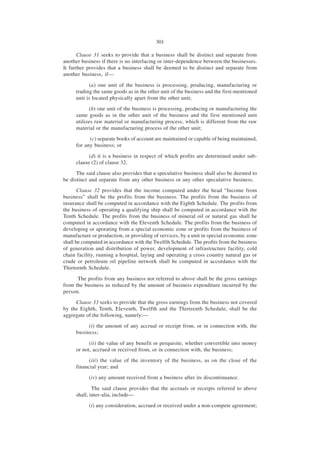

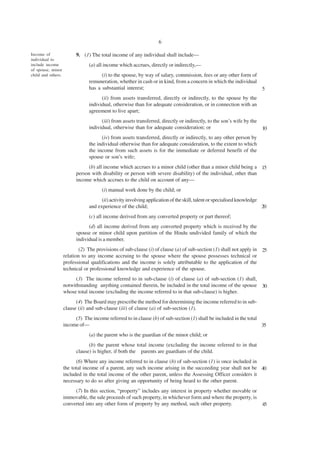

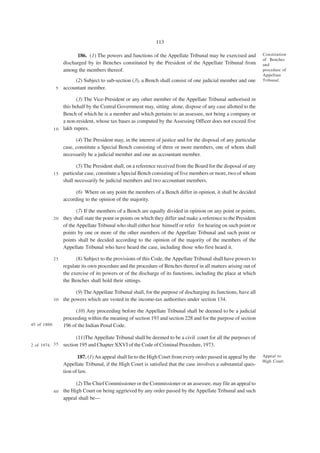

C= the actual cost of any asset falling within that block of

assets, acquired during the financial year;

(2) The profit referred to in sub-section (1) shall be treated as ‘nil’, if the net

result of the computation, thereunder, is negative.

5 (3) The amount of profit, where a business capital asset other than that referred

to in sub-section (1) is transferred, discarded, destroyed or destructed, shall be

computed in accordance with the formula-

A-B

Where A= Amount accrued or received in respect of the asset

10 which is transferred, discarded, destroyed or destructed

during the financial year together with the amount of

scrap value, if any;

B= The actual cost of the asset.

43. (1) The deduction for any capital allowance referred to in section 37 shall, in a case Special provi-

15 where business reorganisation has taken place during the financial year, be allowed in sions relating

accordance with the provisions of this section. to business

reorganisation.

(2) The amount of deduction allowable to the predecessor shall be determined in

accordance with the formula-

Ax B

20 C

Where

A= the amount of deduction allowable as if the business

reorganisation had not taken place;

B= the number of days comprised in the period beginning

25 with the first day of the financial year and ending on the

day immediately preceding the date of business

reorganisation;

C= the total number of days in the financial year in which

the business reorganisation has taken place.

30 (3) The amount of deduction to the successor shall be determined in accordance

with the formula —

Ax B

C

Where

35 A= the amount of deduction allowable as if the business

reorganisation had not taken place;

B= the number of days comprised in the period beginning

with the date of business reorganisation and ending on

the last day of the financial year; and

40 C= the total number of days in the financial year in which

the business reorganisation has taken place.

44. (1) The actual cost of a business capital asset to the person shall be computed in Meaning of

accordance with the formula– actual cost.

A-[B+(C x A)]

45 D

Where

A= cost of the business capital asset to the person including

the interest paid on the capital borrowed for acquiring

50 the asset if such interest is relatable to the period before

the asset is put to use;](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-32-320.jpg)

![76

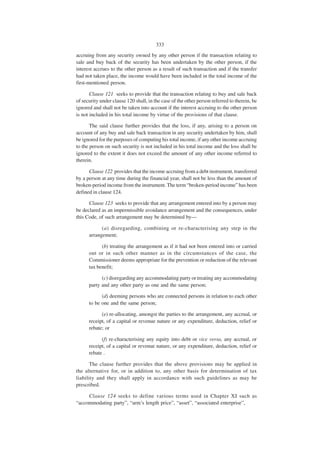

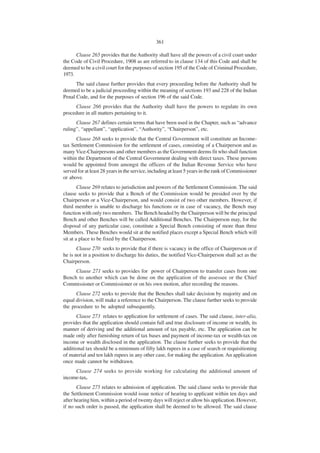

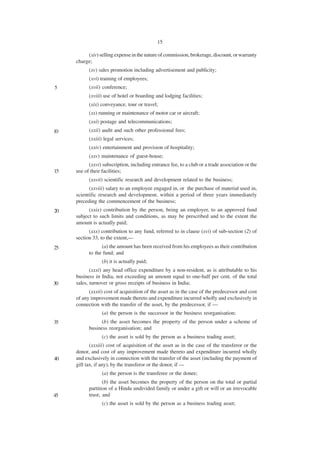

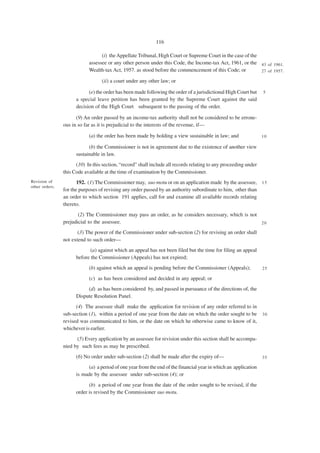

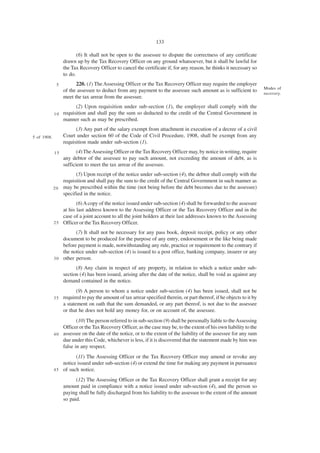

Appointment 127. (1) The Central Government may appoint such persons as it thinks fit to be

and control of

income-tax authorities.

income-tax

authorities.

(2) Without prejudice to the provisions of sub-section (1), and subject to the rules

and orders of the Central Government regulating the conditions of service of persons in

public services and posts, the Central Government may authorise the Board, or a Director- 5

General, a Chief Commissioner or a Director or a Commissioner to appoint income-tax

authorities below the rank of an Assistant Commissioner.

(3) Subject to the rules and orders of the Central Government regulating the conditions

of service of persons in public services and posts, an income-tax authority authorised in this

behalf by the Board may appoint such executive or ministerial staff as may be necessary to 10

assist it in the execution of its functions.

(4) The Board may, by notification, direct that any income-tax authority or authorities

specified in the notification shall be subordinate to such other income-tax authority or

authorities as may be specified in such notification.

Power of 128. Any income-tax authority, above the rank of Assessing Officer, shall have all the 15

higher

powers that an Assessing Officer has under this Code in relation to the making of inquiries

authorities.

129. (1) The Board may, from time to time, issue such orders, instructions, directions or

Powers of the circulars to other income-tax authorities as it may consider expedient or necessary for the

Board to issue

instructions.

proper administration of this Code.

(2) The Board shall not exercise its powers under sub-section (1) so as to— 20

(a) require any income-tax authority to make a particular assessment or to dispose

of a particular case in a particular manner;

(b) require the Commissioner of Income-tax (Appeals) to dispose off any matter

before it in a particular manner.

(3) The Board may, without prejudice to the generality of the provisions of sub-section 2 5

(1), if it considers expedient or necessary so to do, issue general or special orders in respect

of —

(a) any class of tax bases or class of cases, explaining the principles, specifying

the guidelines or procedures, whether by way of relaxation of any provision of this

Code or otherwise, to be followed by other income-tax authorities in the work relating 30

to assessment or collection of revenue including charging of interest or the initiation

of proceedings for the imposition of penalties;

(b) any case or class of cases, for avoiding genuine hardship, authorising any

income-tax authority [other than Commissioner of Income-tax (Appeals)] to admit any

application or claim for any exemption, deduction, refund or any other relief under this 3 5

Code after the expiry of the period specified by or under this Code for making the

application or claim and deal with the same on merits in accordance with law;

(c) any case or class of cases, relaxing any requirement or conditions contained

in this Code in relation to grant of any relief , on fulfilment of the following conditions,

namely:— 40

(i) such relaxation is for avoiding genuine hardship;

(ii) the reasons for exercise of power have been specified in the order;

(iii) the default in complying with such requirement or condition was due

to circumstances beyond the control of the assessee;

(iv) the assessee has complied with such requirement or condition before 45

50](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-87-320.jpg)

![81

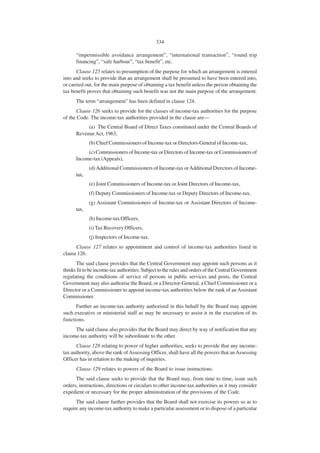

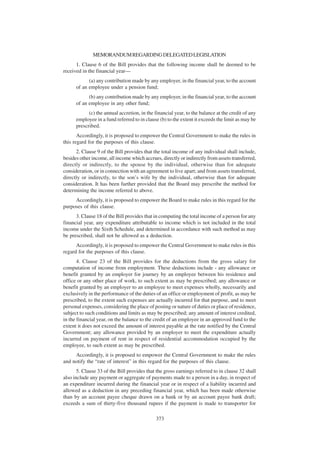

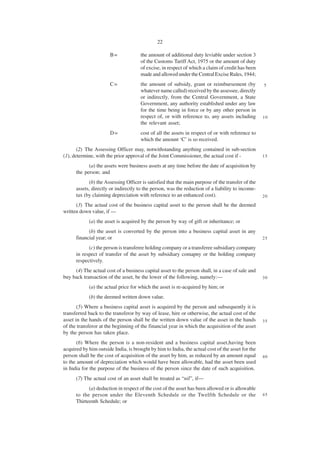

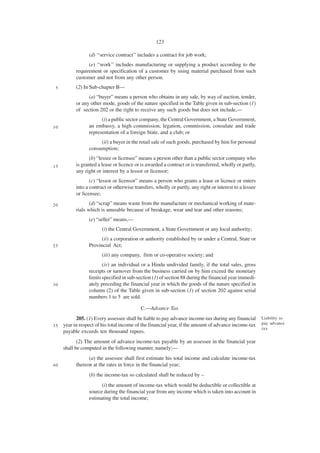

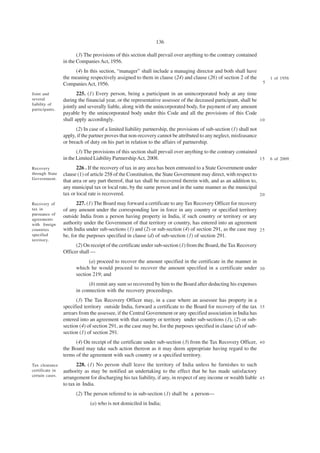

(7) The Authorised Officer may serve an order on the owner or the person, who is in

immediate possession or control of any material, that he shall not remove, part with or

otherwise deal with it except with his prior permission, where in the opinion of the Authorised

Officer—

5 (a) it is not possible or practicable to take physical possession of such material,

not being stock-in-trade, to a safe place due to its volume, weight or other physical

characteristics (including its dangerous nature) and such action of the Authorised

Officer shall be deemed to be seizure under clause (e) of sub-section (2); or

(b) it is not practicable to seize such material [for reasons other than those

10 mentioned in clause (a)] and such action of the Authorised Officer shall not be deemed

to be seizure under clause (e) of sub-section (2).

(8) The order under clause (b) of sub-section (7) shall remain in force for a period not

exceeding two months from the end of the month in which the order was served and the

Authorised Officer may take such steps as may be necessary for ensuring compliance with

1 5 the order.

(9) The Authorised Officer may, during the course of the search or seizure, examine on

oath any person who is found to be in possession or control of any material and any

statement made by such person during such examination may thereafter be used in evidence

43 of 1961. in any proceeding under the Income-tax Act, 1961or the Wealth-tax Act, 1957, as they stood

27 of 1957. 0

2 before the commencement of this Code, or under this Code.

2 of 1974. (10) The provisions of the Code of Criminal Procedure, 1973, relating to search and

seizure shall apply, so far as may be, to search and seizure under this section.

(11) For the purposes of this section the Board may prescribe—

(a) the procedure to be followed by the Authorised Officer—

25 (i) for obtaining ingress into any building, place, vessel, vehicle or aircraft

to be searched where free ingress thereto is not available; and

(ii) for ensuring safe custody of any material seized; and

(b) any other matter in relation to search and seizure under this section.

136. (1) The Competent Investigating Authority may authorise any income-tax Power to

requisition

30 authority (hereinafter referred to as the “Requisitioning Officer”) to require any officer or

material taken

authority to deliver the material, which have been taken into custody by such officer or into custody.

authority under any other law for the time being in force, to the Requisitioning Officer.

(2) The authorisation for requisition under sub-section (1) shall be issued by the

Competent Investigating Authority if he has, in consequence of information in his possession,

35 reasons to believe that —

(a) any person to whom a summons or a notice under sub-section (1) of section

43 of 1961. 131 or sub-section (1) of section 142 of the Income-tax Act, 1961or under section 37 or

27 of 1957. sub-section (4) of section 16 of the Wealth-tax Act, 1957, as they stood before the

commencement of this Code, or under sub-section (1) of section 134 or section 146 or

40 section 150 of this Code was issued, has omitted or failed to produce, or cause to be

produced, such material; or

(b) any person to whom a summons or notice as aforesaid has been or might be

issued will not, or would not, produce or cause to be produced, such material which](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-92-320.jpg)

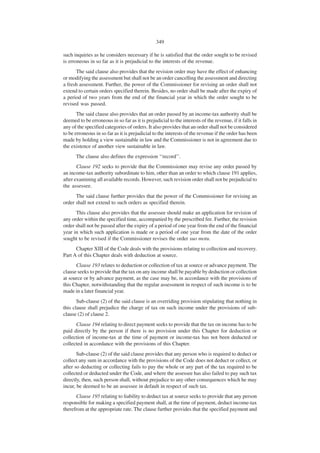

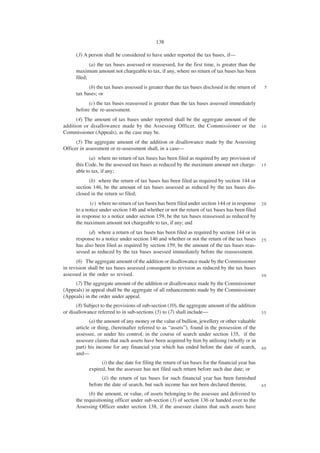

![191

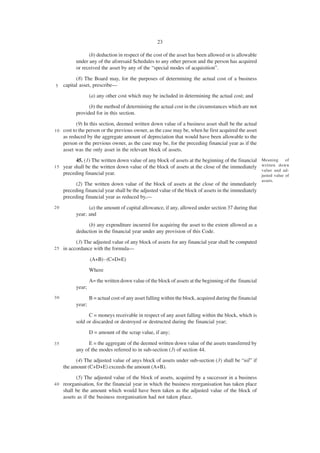

(b) the value of any amenity, facility, privilege or service, other than those

referred to in sub-clause (a) computed in such manner as may be prescribed but

does not include,—

(i) the value of any medical treatment provided to an employee or

5 any member of his family in a hospital maintained by the employer;

(ii) any sum paid by an employer in respect of any expenditure

actually incurred by an employee on medical treatment of himself or his

family members in any hospital maintained by the Government or any local

authority or any other hospital approved by the Government;

10 (iii) any sum paid by an employer in respect of any expenditure

actually incurred by an employee on medical treatment of himself or his

family members with regard to specified diseases, in any hospital approved

by the Chief Commissioner in accordance with such guidelines as may be

prescrbed;

15 (iv) any premium paid or reimbursed by an employer to effect or to

keep in force an insurance on the health of an employee under any scheme

approved by the Central Government or the Insurance Regulatory and

Development Authority;

(v) any sum paid by an employer in respect of any expenditure

20 actually incurred by an employee on medical treatment of himself or his

family members [other than the expenditure on treatment referred to in

items (i), (ii) and (iii)] to the extent it does not exceed fifty thousand

rupees in a financial year;

(vi) any sum paid by an employer in respect of any expenditure

25 actually incurred by an employee outside India on medical treatment of

himself or his family members (including expenditure incurred on travel

and stay abroad) if,—

(A) the expenditure does not exceed the amount permitted by

the Reserve Bank of India; and

30 (B) the income from employment excluding the amount of

expenditure referred to in this sub-clause of such employee does

not exceed five lakh rupees in the financial year;

(192) “place of effective management” means—

(i) the place where the board of directors of the company or its executive

35 directors, as the case may be, make their decisions; or

(ii) in a case where the board of directors routinely approve the commercial

and strategic decisions made by the executive directors or officers of the company,

the place where such executive directors or officers of the company perform

their functions:

40 (193) “plant” includes ships, aircrafts, vehicles, books, scientific apparatus and

surgical equipment but does not include tea bushes, livestock, buildings or furniture

and fittings;

(194) “political party” means a political party registered and recognised under

43 of 1951. the Representation of the People Act, 1951;

45 (195) “predecessor” in relation to a business reorganisation means—

(a) the amalgamating company, in the case of amalgamation;

(b) the merging company in the case of business reorganisation referred

to in sub-clause (b) of clause (41);

(c) the demerged company, in the case of demerger; or](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-202-320.jpg)

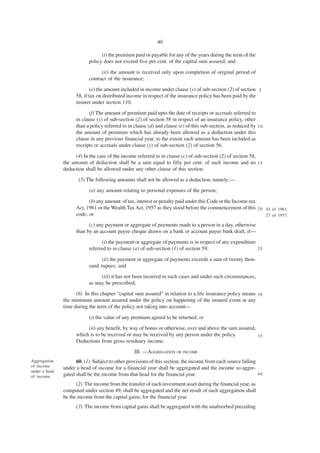

![THE FIRST SCHEDULE

[See sections 2(4), 15(1), 62(1), 211(3), 230(11), 314(120)(K) and (158)]

RATES OF INCOME-TAX

PART I

5 The liability to income tax, of any person, in respect of his total income of a financial

year, which does not include income from any special source, shall be the amount of income-

tax calculated at the rate specified, and in the manner provided, in the following Paragraph

A to Paragraph F:

Paragraph A

10 (I) In the case of every individual, other than the individual referred to in item (II) of

this Paragraph, Hindu undivided family or artificial juridical person, not being a case to

which any other Paragraph of this Part applies,—

Rates of income-tax

(1) where the total income does not Nil;

15 exceed Rs. 2,00,000

(2) where the total income exceeds 10 per cent. of the amount by which

Rs. 2,00,000 but does not exceed the total income exceeds Rs.2,00,000;

Rs. 5,00,000

(3) where the total income exceeds Rs.30,000 plus 20 per cent. of the

20 Rs.5,00,000 but does not exceed amount by which the total income

Rs.10,00,000 exceeds Rs.5,00,000 ;

(4) where the total income exceeds Rs.1,30,000 plus 30 per cent. of the

Rs.10,00,000 amount by which the total income

exceeds Rs.10,00,000;

25 (II) In the case of every individual, being a resident in India, who is of the age of

sixty-five years or more at any time during the financial year—

Rates of income-tax

(1) where the total income does not Nil;

exceed Rs. 2,50,000

30 (2) where the total income exceeds 10 per cent. of the amount by which the

Rs.2,50,000 but does not total income exceeds Rs. 2,50,000

exceed Rs.5,00,000;

(3) where the total income exceeds Rs. 25,000 plus 20 per cent. of the amount

Rs. 5,00,000 but does not exceed by which the total income exceeds

3 5 Rs. 10,00,000 Rs. 5,00,000;

(4) where the total income exceeds Rs. 1,25,000 plus 30 per cent. of the

Rs.10,00,000 amount by which the total income

exceeds Rs. 10,00,000;

Paragraph B

40 (I) In the case of every co-operative society—

Rates of income-tax

(1) where the total income does not 10 per cent. of the total income;

exceed Rs.10,000

211](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-222-320.jpg)

![212

(2) where the total income exceeds Rs.1,000 plus 20 per cent. of the

Rs.10,000 but does not exceed amount by which the total income

Rs. 20,000 exceeds Rs. 10,000;

(3) where the total income exceeds Rs. 3,000 plus 30 per cent of the

Rs. 20,000 amount by which the total income 5

exceeds Rs. 20,000.

(II) In the case of every other society—

Rate of income-tax

On the whole of the total income 30 per cent.

Paragraph C 10

In the case of every non-profit organisation,—

Rate of income-tax

(i) when the total income does not Nil;

exceed Rs. 1,00,000

(ii) where the total income exceeds 15 per cent. of the amount by which 15

Rs. 1,00,000 the total income exceeds Rs. 1,00,000

Paragraph D

In the case of every unincorporated body,—

Rate of income-tax

On the whole of the total income 30 per cent. 20

Paragraph E

In the case of a company,—

Rate of income-tax

On the whole of the total income 30 per cent.

PART II 25

In the cases to which Paragraph A of Part 1 applies, where the person has, in the

financial year, any net agricultural income exceeding five thousand rupees, in addition to

total income from ordinary sources and the total income exceeds the threshold limit, then,—

(a) the net agricultural income shall be taken into account, in the manner provided

in clause (b) [that is to say, as if the net agricultural income were comprised in the total 3 0

income after the threshold limit but without being liable to tax], only for the purpose

of charging income-tax in respect of the total income; and

(b) the income-tax chargeable shall be calculated as follows:

(i) the total income and the net agricultural income shall be aggregated

and the amount of income-tax shall be determined in respect of the aggregate 35

income at the rates specified in the said Paragraph A, as if such aggregate

income were the total income;

(ii) the net agricultural income shall be increased by the amount of

threshold limit, and the amount of income-tax shall be determined in respect of

the net agricultural income as so increased at the rates specified in the said 4 0

Paragraph A, as if the net agricultural income as so increased were the total

income;](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-223-320.jpg)

![213

(iii) the amount of income-tax determined in accordance with sub-clause

(i) shall be reduced by the amount of income-tax determined in accordance with

sub-clause (ii) and the sum so arrived at shall be the income-tax in respect of

the total income.

5 PART III

Where, if the total income of a person specified in column (2) of the Table given below

includes income from any special source specified in the corresponding entry in column (3)

of the said Table, the liability to income-tax of the person shall be the aggregate of—

(a) the amount calculated at the rate specified in the corresponding entry in

10 column (4) of the said Table on the income specified in the corresponding entry in

column (3); and

(b) the amount of income-tax calculated in accordance with the provisions of

Part I and Part II in respect of the balance of his total income, that is, the “total income

from ordinary sources”:

15 TABLE

Serial Person Nature of income Rate of tax

Number

(1) (2) (3) (4)

(1) Non-resident (a) On investment income by way of-

20 (i) interest 20 per cent.

(ii) dividends on which distribution tax

has not been paid under section 109.

(iii) Profit distributed by a fund on

which tax on distributed income has

25 not been paid under section 110 20 per cent.

(b) On income by way of royalty 20 per cent.

or fees for technical services

(c ) On income by way of 20 per cent.

insurance including reinsurance.

30 (2) Non-resident sportsperson, On income by way of—

who is not a citizen of India (i) participation in India in any 10 per cent.

game [other than a game the

winnings wherefrom are taxable

under item (ii) or item (iii) of

35 serial number 4] or sport;

(ii) advertisement; or 10 per cent.

(iii) contribution of articles relating 10 per cent.

to any game or sport in newspapers,

magazines or journals in India.

40 (3) Non-resident sports On income by way of guarantee 10 per cent.

association or institution money in relation to any game or

sports played in India.

(4) Any assessee whether Income by way of winnings from— 30 per cent.

resident or non-resident (i) any lottery or crossword puzzle;

45 (ii) race, including horse race (not

being the income from the activity

of owning and maintaining race

horses); or

(iii) card game or any other game

50 or gambling or betting](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-224-320.jpg)

![THE SECOND SCHEDULE

[See Sections 104(1), (6), 109(2), 110(3), 111(2), 112(2), 230(11) and 314(225)]

RATES OF OTHER TAXES

A.—Tax on book profit

1. The income-tax referred to in sub-section (1) of section 103 shall be calculated 5

at the rate specified hereunder:—

Rate of tax

On the amount of book profit 20 per cent.

B.—Tax on distributed profits of a domestic company

2. The tax referred to in sub-section (2) of section 109 shall be calculated at the rate 1 0

specified hereunder:—

Rate of tax

On the amount of dividend declared, distributed 15 per cent.

or paid by a domestic company

C.—Tax on distributed income 15

3. The tax referred to in sub-section (3) of section 110 shall be calculated at the rates

specified hereunder:—

Rates of tax

On the amount of income distributed by

(i) a mutual fund to the unit holders of equity 05 per cent. 2 0

oriented fund; or

(ii) life insurer to the policy holders of an

approved equity oriented life insurance scheme 05 per cent.

D.—Tax on branch profits

4. The tax referred to in sub-section (2) of section 111 shall be calculated at the rate 2 5

specified hereunder:—

Rate of tax

On the branch profits 15 per cent.

E.—Tax on net wealth

5. The tax referred to in sub-section (2) of section 112 shall be calculated at the rates 3 0

specified and in the manner provided hereunder:—

Rates of tax

(1) where the net wealth as on the valuation NIL

date does not exceed one crore rupees

(2) where the net wealth, as on the valuation date 1 per cent. of the 35

exceeds rupees one crore amount by which

the net wealth exceeds

one crore rupees

214](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-225-320.jpg)

![THE THIRD SCHEDULE

[see sections 195(2) and 314(187)(b)]

RATES FOR DEDUCTION OF TAX AT SOURCE

(Rates for deduction of tax at source in the case of resident deductee)

5 Serial Nature of payment Rate

number (Specified payment)

(1) (2) (3)

1. Income from employment The average rate of income-tax

on estimated income from

10 employment during the

financial year, computed on the

basis of the rates specified in

Part 1 of the First Schedule

2. Payment in respect of — 2 per cent.

15 (a) works contract;

(b) service contract;

(c) broadcasting and telecasting;

(d) supply of labour for carrying

out any works, or service contract;

20 (e) advertising; or

(f) carriage of goods and passengers

by any mode of transport other than

by railways.

3. Interest. 10 per cent.

25 4. Dividend other than dividend in respect of 10 per cent.

which dividend distribution tax is paid

5. Income distributed by mutual fund on which 10 per cent.

income distribution tax is not paid,-

(i) where the deductee is an Individual 20 per cent.

30 or a Hindu undivided family;

(ii) any other deductee

6. Payment made by a life-insurer in respect of

a life insurance policy other than the policy

referred to in clause (d) or clause (e) of sub-

35 section (3) of section 59—

(i) where the deductee is an Individual 10 per cent.

or a Hindu undivided family;

(ii) any other deductee 20 per cent.

7. Commission, brokerage, remuneration, 10 per cent.

40 or prize (by whatever name called) for

rendering any services

8. Fees for professional or technical services 10 per cent.

9. Payment for royalty or non-compete fee 10 per cent.

10. Payment of compensation on compulsory 10 per cent.

45 acquisition of immovable property other

than agricultural land.

11. Rent—

(i) for the use of machinery or plant or 2 per cent.

equipment; 10 per cent.

215](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-226-320.jpg)

![THE FOURTH SCHEDULE

[See sections 195(3) and (4), 314(187)(b)]

(Rates for deduction of tax at source in the case of non-resident deductee)

Serial Nature of payment Rate

5 number (Specified payment)

(1) (2) (3)

1. Income from employment The average rate of income-tax

on estimated income from

employment during the

10 financial year, computed on the

basis of the rates specified in

Part 1 of the First Schedule

2. Payment by way of — 20 per cent.

(i) interest; or

15 (ii) dividends on which dividend

distribution tax has not been paid

under secton 109; or

(iii) profit distributed by a fund on

which tax on distributed income

20 has not been paid under section 110.

3. Payment by way of royalty or fees for 20 per cent.

technical services.

4. Winnings from lotteries, crossword puzzles, 30 per cent.

card games or any other game or gambling

25 or betting.

5. Winnings from horse races (not related to 30 per cent.

the activity of owning and maintaining

race horses).

6. Payment to a non-resident sportsperson 10 per cent.

30 (not being a citizen of India) by way of—

(i) participation in India in any game or

sport (other than winnings referred to at

serial numbers 4 and 5);

(ii) advertisement; or

35 (iii) contribution of articles relating to

any game or sport in newspapers,

magazines or journals in India

7. Payment by way of guarantee money to a 10 per cent.

non-resident sports association or institution

40 in relation to any game or sports played in India

8. Any other sum chargeable to tax. 30 per cent.

217](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-228-320.jpg)

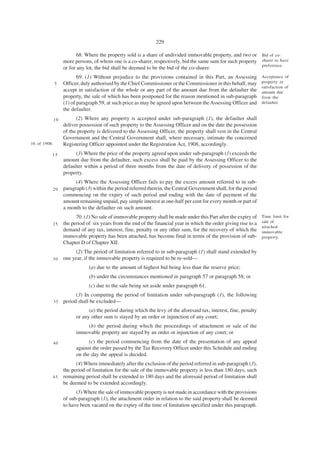

![THE FIFTH SCHEDULE

[See sections 139(4), 219(1), (5), 220(14), 16, 238, 279(1) and 297(1)]

PROCEDURE FOR RECOVERY OF TAX

PART I

GENERAL PROVISIONS 5

Issue of 1. (1) The Tax Recovery Officer shall, upon assumption of jurisdiction under

notice. section 219, cause to be served upon the defaulter a notice requiring the defaulter to pay the

amount specified in the certificate within a period of fifteen days from the date of service of

the notice.

(2) The notice under sub-paragraph (1) shall also intimate to the defaulter the steps 1 0

which shall be taken to realise the amount under this Schedule, if he defaults to make

payment within the time specified therein or within such further time as the Tax Recovery

Officer may in his discretion, grant.

When 2. (1) No step in execution of a certificate shall be taken until the period of fifteen days

certificate has elapsed since the date of the service of the notice required under paragraph. 15

may be

executed. (2) The Tax Recovery Officer may attach the whole or any part of the movable property

of the defaulter, as would be liable to attachment in execution of a decree of a civil court,

within the said period of fifteen days if—

(a) he is satisfied, for reasons to be recorded in writing, that the defaulter is

likely to conceal, remove or dispose of the whole or any part of the movable property; 20

and

(b) the realisation of the amount of the certificate would in consequence be

delayed or obstructed.

(3) The defaulter whose property has been so attached may furnish security to the

satisfaction of the Tax Recovery Officer and on such acceptance of the security by the Tax 2 5

Recovery Officer, the attachment shall be cancelled from the date on which the security is

accepted.

Mode of 3. (1) If the amount mentioned in the notice is not paid within the time specified

recovery. therein, or within such further time as the Tax Recovery Officer may grant in his discretion,

the Tax Recovery Officer shall proceed to realise the amount by one or more of the following 3 0

modes, namely:—

(a) by attachment and sale of the defaulter’s movable property;

(b) by attachment and sale of the defaulter’s immovable property;

(c) by arrest of the defaulter and his detention in prison in accordance with the

provisions of the Code of Criminal Procedure, 1973; 3 5 2 of 1974.

(d) by appointing a receiver for the management of the defaulter’s movable and

immovable properties.

(2) The defaulter’s movable or immovable property, referred to in sub-paragraph (1),

shall include any property transferred directly, or indirectly, otherwise than for adequate

consideration by the defaulter to— 40

(a) his spouse; or

(b) minor child.

(3) In respect of any arrears due from the defaulter for the period prior to the date of

attainment of majority by the minor child, the property shall continue to be included in the

defaulter’s movable or immovable property even after the date. 45

Interest, costs 4. There shall be recoverable, in the proceedings in execution of every certificate—

and charges

recoverable.

(a) such interest upon the amount of tax or penalty or other sum to which the

certificate relates as is payable in accordance with section 213, and

218](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-229-320.jpg)

![THE EIGHTH SCHEDULE

[See section 32(2)]

COMPUTATION OF PROFITS OF THE INSURANCE BUSINESS

1. The profits of the business of life insurance shall be the profit determined in the

Shareholders’ Account (Non-Technical Account) in accordance with the Insurance Act, 5

1938. 36 of 2003.

2. The profits referred to in paragraph 1 shall be—

(a) increased by the aggregate of the amounts referred to in sub-section (2) of

section 33 to the extent such amounts are not included in the profits referred to in that

paragraph and the amounts referred to in sub-section (4) of section 35 and sub- 1 0

section (2) of section 36 to the extent such amounts have been claimed as deductions

while computing the said profits; and

(b) decreased by the amount allowable as deduction under clause (xxx) of sub-

section (2) of section 35 and finance charges allowable as deduction under sub-

section (1) of section 36 to the extent such amount has been included under clause 1 5

(a).

3. The profits of the business of insurance other than life insurance shall be the

profits disclosed in the annual accounts, copies of which are required to be furnished under

the Insurance Act, 1938, to the Controller of Insurance. 4 of 1938.

4. The profits referred to in paragraph 3 shall be— 20

(a) increased by the aggregate of,—

(i) the amounts referred to in sub-section (2) of section 33 to the extent

such amounts are not included in the profits referred to in that paragraph; and

(ii) the amounts referred to in sub-section (4) of section 35 and sub-

section (2) of section 36 to the extent such amounts have been claimed as a 2 5

deduction in computing the profits referred to in that paragraph;

(b) decreased by—

(i) the amount allowable as deductions under clause (xxx) of sub-

section (2) of section 35 to the extent such amount has been included under

sub-clause (i) of clause (a); 30

(ii) the amount of finance charges allowable as deduction under sub-

section (1) of section 36 to the extent such amount has been included under

sub-clause (ii) of clause (a); and

(iii) such amount carried over to a reserve for unexpired risks as may be

prescribed. 35

5. The profits of the branches in India of a person not resident in India and carrying

on any business of insurance, may, in the absence of more reliable data, be deemed to be

that proportion of the world income of such person which corresponds to the proportion

which his premium income derived from India bears to his total premium income.

6. The profits of the business of insurance determined under paragraphs 1 to 5 shall 40

be aggregated and the profits so aggregated shall be the profit from the business of

insurance.

7. The profit from the business of insurance shall be aggregated with unabsorbed

preceding year loss from the business of insurance, if any, and the net result of such

aggregation shall be the current profit from the business of insurance for the financial year. 45

8. The current profit from the business of insurance shall be treated as nil, if the net

result of aggregation in paragraph 7 is negative and the absolute value of the net result of

the aggregation shall be the amount of unabsorbed current loss of the business of insurance

for the financial year.

244](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-255-320.jpg)

![THE NINTH SCHEDULE

[See section 15(2)]

COMPUTATION OF INCOME FROM SPECIAL SOURCES

1. The income from any special source shall be computed in accordance with the

provisions of this Schedule. 5

2. The income from any special sources shall be the aggregate of—

(a) any amount by way of accrual or receipt, as the case may be;

(b) any amount accrued or received as reimbursement of any expenditure in-

curred by the person; and

(c) any tax borne by the person by whom the income is payable. 10

3. No deduction or allowance or set-off of any loss shall be allowed in computation of

income from the special sources.

4. The income computed under paragraph 2 shall be presumed to have been computed

after giving full effect to every loss, allowance or deduction under this Code.

5. The written down value of any business asset used for the purposes of earning 15

income from any special source shall be computed as if the person has claimed and has been

actually allowed the deduction in respect of depreciation under section 38, initial deprecia-

tion under section 39 and terminal allowance under section 40.

6. The amount of common costs (including depreciation) attributable to the special

source and presumed to have been allowed under paragraph 4 shall be determined in such 20

manner as may be prescribed.

246](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-257-320.jpg)

![THE TENTH SCHEDULE

[See sections 32 (2) and 314 (262))]

COMPUTATION OF PROFITS OF BUSINESS OF OPERATING A QUALIFYING SHIP

1. The profits of the business of operating a qualifying ship for a financial year,—

5 (a) shall be computed in accordance with the provisions of this Schedule, at the

option of the assessee; and

(b) on exercise of the option, shall be determined in accordance with the for-

mula—

A+B-C

10 Where

A = the total tonnage income of the financial year;

B = the aggregate of the amounts referred to in sub-section (2) of section

33; and

C = the amount of negative profit computed under this Schedule in re-

15 spect of the business of operating a qualifying ship, for the financial year imme-

diately preceding the relevant financial year.

2. The tonnage income of the financial year in respect of each qualifying ship shall be

the daily tonnage income of the ship multiplied by the number of days during which the ship

is operated by the company as a qualifying ship.

20 3. The daily tonnage income of a qualifying ship having tonnage referred to in column

(1) of the Table given below shall be the amount specified in the corresponding entry in

column (2) of the said Table:

TABLE

Serial Qualifying ship having Amount of daily tonnage income

25 Number net tonnage

(1) (2) (3)

1. up to 1,000 tons Rs. 46 for each 100 tons

2. exceeding 1,000 tons but not more than Rs. 460 plus Rs. 35 for each100 tons exceeding

10,000 tons 1,000 tons

30 3. exceeding 10,000 tons but not more Rs. 3,610 plus Rs. 28 for each 100 tons

than 25,000 tons exceeding 10,000 tons

4. exceeding 25,000 tons Rs.7,810 plus Rs. 19 for each100 tons exceed

ing 25,000 tons.

4. The profits of the business of operating a qualifying ship shall be treated as ‘nil’ for

the financial year if the profits determined under paragraph 1 is negative.

35 5. The profits computed under this Schedule shall be presumed to have been com-

puted—

(a) after giving full effect to every loss, allowance or deduction referred to in

sections 35 to 40 (both inclusive);

(b) after giving full effect to any deduction allowable under Sub-Chapter IV of

40 Chapter III in relation to the profits of the business of operating a qualifying ship.

6. The written down value of any business asset used in the business of operating a

qualifying ship shall be computed as if the assessee has claimed and has been actually

allowed the deduction in respect of depreciation under section 38, initial depreciation under

section 39 and terminal allowance under section 40.

247](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-258-320.jpg)

![THE ELEVENTH SCHEDULE

[See sections 32(2) 44(8), 314(161) and 318(2)(s)(i)]

COMPUTATION OF PROFITS OF THE BUSINESS OF

MINERAL OIL OR NATURAL GAS

5 1. The profits of the business of mineral oil or natural gas shall be the gross income

from the business carried on by the assessee at any time during the financial year as reduced

by the amount of business expenditure incurred by the assessee, wholly and exclusively, for

the purposes of the business during the year.

2. The gross income referred to in paragraph 1 shall be the aggregate of,—

10 (a) the accruals or receipts derived by the assessee from,—

(i) the business of mineral oil or natural gas;

(ii) the leasing or transfer of whole of, or part of, or any interest in, any—

(A) mineral oil or natural gas rights; and

(B) asset used in the business of mineral oil or natural gas; and

15 (iii) the demolition, destruction, discarding or transferring of any busi-

ness capital asset (other than land, goodwill or financial instrument) in respect

of which deduction has been allowed, or allowable, under paragraph 3 in any

financial year; and

(b) the amounts referred to in sub-section (2) of section 33.

20 3. The amount of business expenditure referred to in paragraph 1 shall be the aggre-

gate of the amount of,-

(a) operating expenditure referred to in section 35, incurred by the assessee;

(b) finance charges referred to in section 36, incurred by the assessee;

(c) expenditure on any license charges, rental fees or other charges, if actually

25 paid;

(d) capital expenditure incurred by the assessee;

(e) expenditure on infructuous or abortive exploration of any area;

(f) expenditure referred to in clauses (a) to (e) incurred before the commence-

ment of the business.

30 (g) payment to Site Restoration Accomulate maintained in State Bank of India in

accordance with the Schemes may be prescribed.

4. The profits computed under paragraph 1 shall be presumed to have been com-

puted,-

(a) after giving full effect to every loss, allowance or deduction referred to in

35 sub-sections 35 to 40 (both inclusive);

(b) after giving full effect to any deduction allowable under Sub-Chapter-IV of

Chapter III in relation to the profits of the business of mineral oil or natural gas.

5. The written down value of any business asset used in the business of mineral oil or

natural gas shall be computed as if the assessee has claimed and has been actually allowed

40 the deduction in respect of depreciation under section 38, initial depreciation under section

39 and terminal allowance under section 40.

6. The amount of common costs including depreciation attributable to the business of

mineral oil or natural gas and any other business shall be determined in such manner as may

be prescribed.

251](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-262-320.jpg)

![THE TWELFTH SCHEDULE

[See sections 32(2) 44(8) and 318(2)(P) (i)]

COMPUTATION OF PROFITS OF THE BUSINESS OF DEVELOPING OF A SPECIAL ECONOMIC ZONE

5 MANUFACTURE OR PRODUCTION OF ARTICLE OR THINGS OR PROVIDING OF ANY SERVICE

BY A UNIT ESTABLISHED IN A SPECIAL ECONOMIC ZONE

1. The provisions of this Schedule shall apply to the business specified herein

below—

(a) the business of developing a special economic zone; and

10 (b) a unit established in a special economic zone engaged in the business of

manufacture or production of article or things or providing of any service.

2. The profits of the specified business under paragraph 1 shall be the gross income

from such business carried on by the assessee at any time during the financial year as

reduced by the amount of business expenditure incurred by the assessee, wholly and exclu-

1 5 sively, for the purposes of the business during the year.

3. The gross income referred to in paragraph 2 shall be the aggregate of—

(a) the accruals or receipts derived by the assessee from the specified business;

(b) the accruals or receipts derived by the assessee from the demolition, de-

struction, discarding or transferring of any business capital asset (other than land,

20 goodwill or financial instrument) in respect of which deduction has been allowed, or

allowable, under paragraph 4 in any financial year; and

(c) the amounts referred to in sub-section (2) of section 33.

4. The amount of business expenditure referred to in paragraph 2 shall be the aggre-

gate of the amount of—

25 (a) operating expenditure referred to in section 35, incurred by the assessee;

(b) finance charges referred to in section 36, incurred by the assessee;

(c) expenditure on any licence charges, rental fees or other charges, if actually

paid;

(d) capital expenditure incurred by the assessee;

30 (e) expenditure referred to in clauses (a) to (d) incurred before the commence-

ment of specified business.

5. The profits computed under paragraph 2 shall be presumed to have been

computed—

(a) after giving full effect to every loss, allowance or deduction referred to in

35 sub-sections (1) to (3) of section 35, sub-section (1) of section 36 and sections 37 to

40 (both inclusive);

(b) after giving full effect to any deduction allowable under Sub-Chapter-IV of

Chapter III in relation to the profits of the specified business.

6. The written down value of any business asset used in the specified business shall

40 be computed as if the assessee has claimed and has been actually allowed the deduction in

respect of depreciation under section 38, initial depreciation under section 39 and terminal

allowance under section 40.

7. The amount of common costs (including depreciation) attributable to the specified

business shall be determined in such manner as may be prescribed.

253](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-264-320.jpg)

![THE THIRTEENTH SCHEDULE

[See sections 32(2) 44(8) and 318(o)(i), (q)(i), (r)(i)]

COMPUTATION OF PROFITS OF A SPECIFIED BUSINESS

1. The provisions of this Schedule shall apply to the following specified businesses

5 which fulfill such conditions as may be prescribed by the Central Government:—

(a) business of generation, transmission or distribution of power;

(b) business of developing, or operating and maintaining, any infrastructure

facility;

(c) business of operating and maintaining a hospital in any area, other than the

10 excluded area;

(d) business of processing, preservation and packaging of fruits and vegetables;

(e) business of laying and operating a cross country natural gas or crude or

petroleum oil pipeline network for distribution, including storage facilities being an

integral part of the network;

15 (f) business of setting up and operating a cold chain facility;

(g) business of setting up and operating a warehousing facility for storage of

agricultural produce;

(h) business of building and operating, anywhere in India, a new hotel of two-

star or above category as classified by the Central Government and commences op-

20 eration on or after the 1st day of April, 2010;

(i) business of building and operating, anywhere in India, a new hospital with at

least one hundred beds for patients and commences operation on or after the 1st day

of April, 2010;

(j) business of developing and building a housing project under a scheme for

25 slum re-development or rehabilitation framed by the Central Government or a State

Government, as the case may be, and notified by the Board in this behalf in accor-

dance with the guidelines as may be prescribed and commences operation on or after

the 1st day of April, 2010.

2. The profits of every specified business shall be computed separately under this

30 Schedule.

3. The profits of any specified business sh](https://image.slidesharecdn.com/dtc110of2010tobe-130106094156-phpapp01/85/Direct-Tax-Code-266-320.jpg)