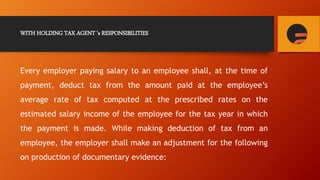

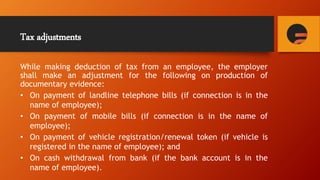

The document discusses income tax laws and calculations related to salary income in Pakistan. It provides information on key concepts like withholding tax, taxable salary, tax rates, tax reducers for senior citizens and teachers/researchers, filing requirements, and responsibilities of withholding tax agents. The main points are:

- Withholding taxes contribute 41% of direct tax revenues in Pakistan and their contribution has grown exponentially from Rs. 5 billion in 1991 to over Rs. 422 billion in 2012.

- Salary income includes pay, allowances, and perquisites but some allowances like medical and special duty allowances are exempt from tax.

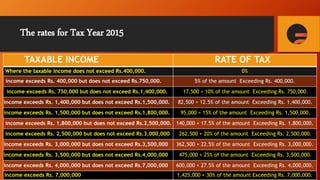

- Tax rates on taxable salary income range from 0-30% depending