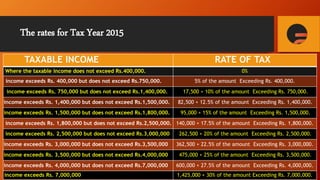

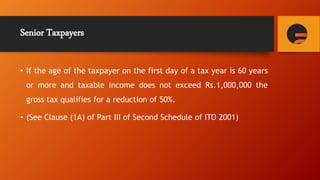

The document provides information about income tax laws and calculations related to salary income in Pakistan. It discusses key concepts like withholding tax, taxable salary, tax rates, tax reducers for senior citizens and teachers/researchers, filing requirements, and responsibilities of withholding tax agents. Withholding taxes on salary have grown exponentially in Pakistan and now contribute 41% of total direct tax revenues. The tax on salary is calculated by applying the prescribed tax rates to taxable salary income after including all allowances except a few exempt items. [/SUMMARY]