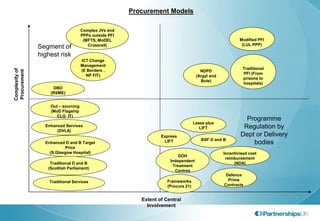

This document discusses challenges and opportunities in public services delivery. It notes that the future will see more complex procurement models, strategic infrastructure planning, and a focus on efficiency and transformation. New challenges include funding, prioritizing spend, and new procurement approaches. The role of the state will be as a champion for users, and markets for public services may continue developing. The future public sector buyer will focus more on outcomes, while the provider side will likely involve a mixed economy of cross-sector partners working to improve outcomes.