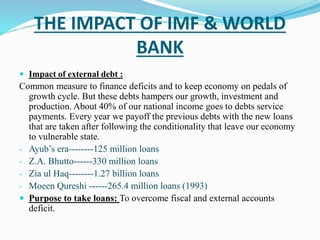

The document summarizes the purpose and history of the World Bank and IMF. The World Bank provides low-interest loans and grants to developing countries for projects to reduce poverty, while the IMF provides short-term loans to countries facing currency crises. Both were created at Bretton Woods in 1944 to help rebuild Europe after WWII. While the World Bank lends for development projects, the IMF aims to stabilize global economies and prevent financial crises. The document also discusses the large external debts Pakistan has accumulated from World Bank and IMF loans and how this has negatively impacted the country's economy.