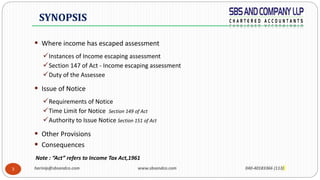

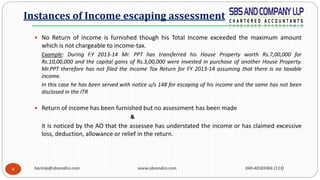

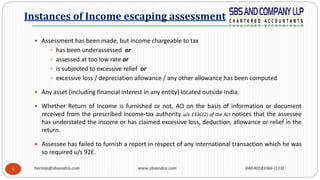

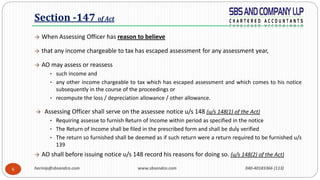

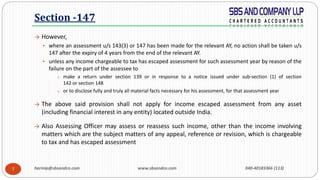

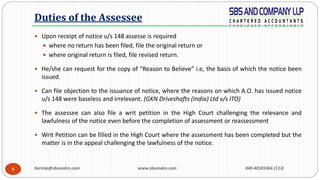

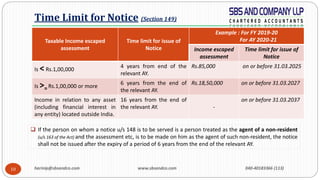

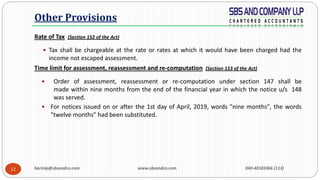

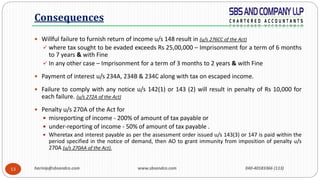

Section 148 of the Income Tax Act allows the tax authorities to issue a notice to assess or reassess income that has escaped assessment for a particular year. If the Assessing Officer has reason to believe that income has escaped assessment, they may assess such income by serving a notice on the assessee within 4-16 years from the end of the relevant assessment year, depending on the amount of income escaped. Upon receiving the notice, the assessee must file a return. If the assessment is completed, the assessee will be liable to pay tax on the escaped income along with interest and potential penalties.