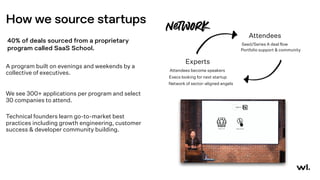

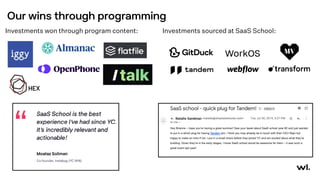

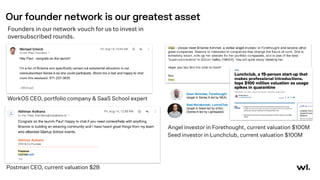

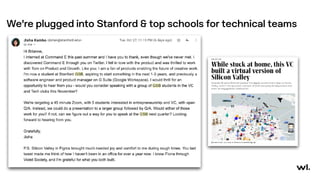

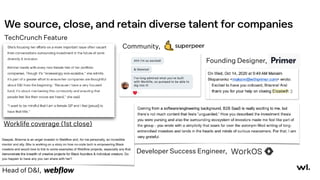

The document outlines a venture firm focused on building the future of work, backed by prominent tech leaders and featuring a strong network of operators and angel investors. It highlights their successful track record with unicorns and high returns on investments, as well as their proprietary programs like SaaS School for sourcing and supporting startups. The firm is committed to fostering a community of founders and executives, facilitating connections, and hosting events to drive innovation in the tech industry.