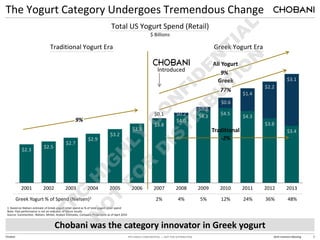

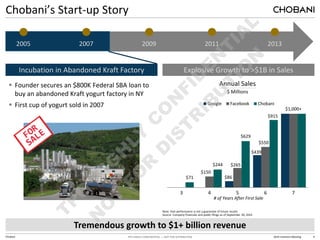

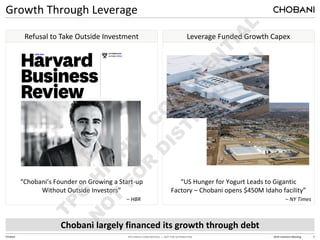

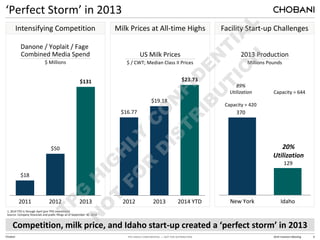

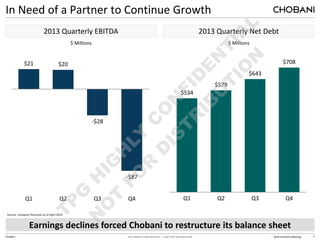

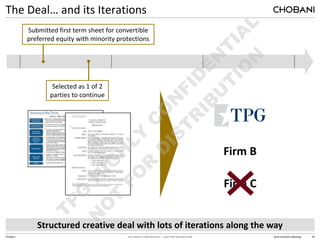

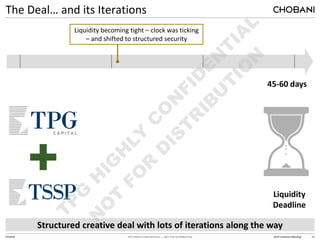

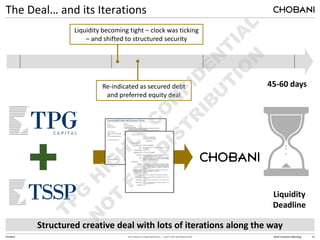

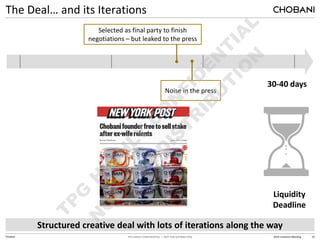

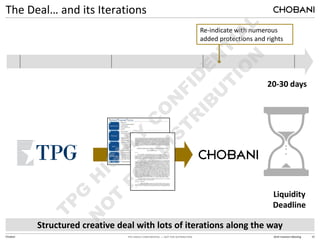

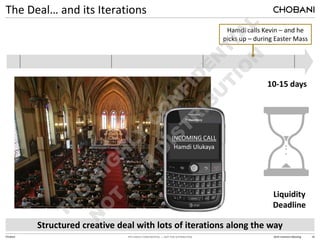

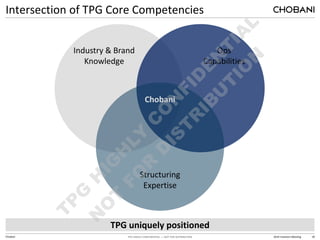

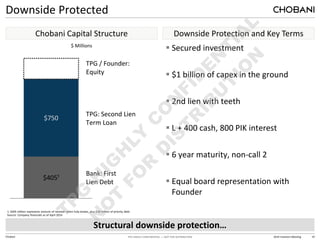

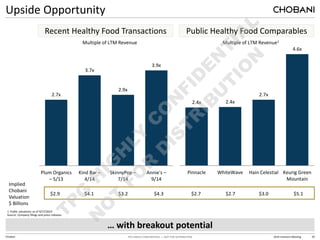

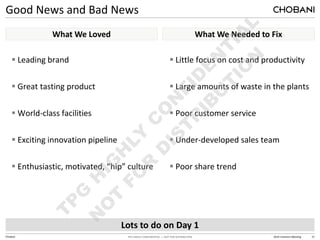

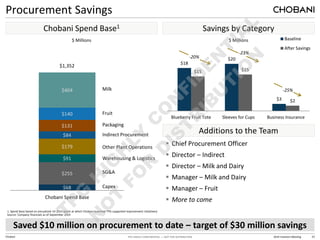

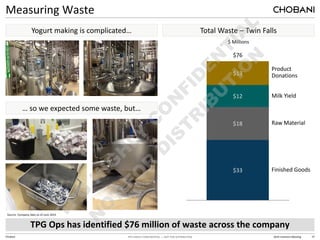

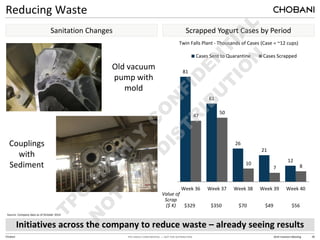

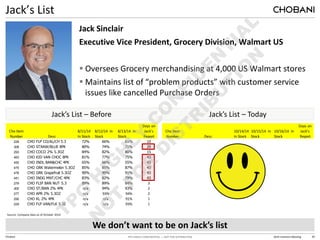

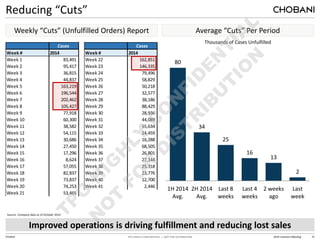

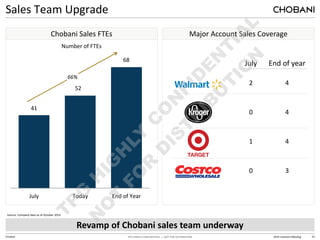

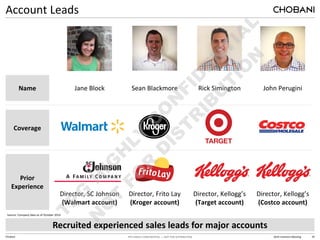

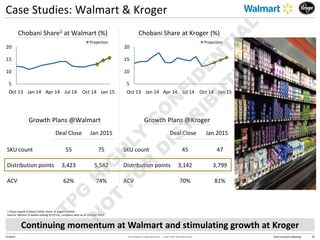

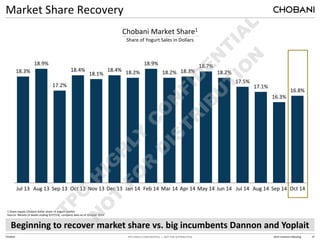

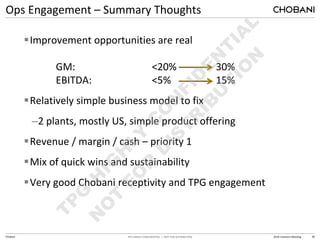

Chobani, a leader in the U.S. Greek yogurt market, received a $671 million investment from TPG to address financial challenges and restructure its operations. The document outlines Chobani's growth story, competitive landscape, operational challenges, and strategies for improving efficiency and customer service. It emphasizes the need for cost-saving measures and expanding the sales team to support ongoing growth and mitigate waste.