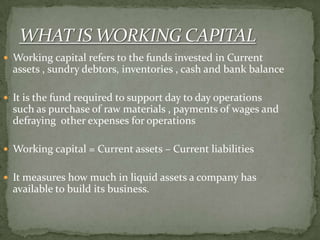

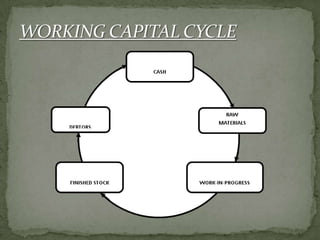

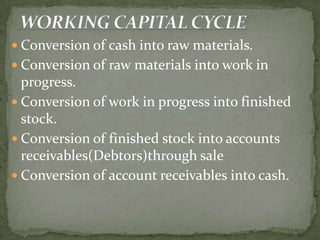

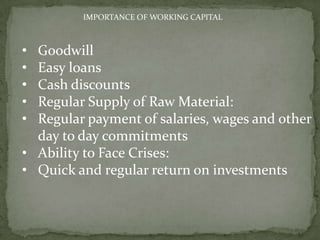

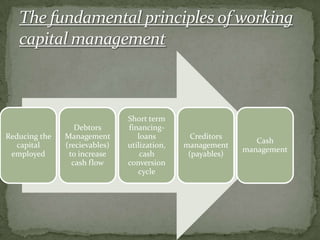

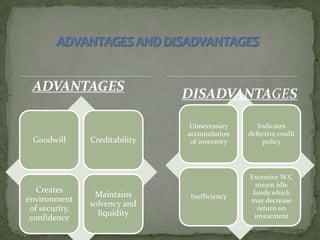

Working capital refers to a company's current assets and current liabilities. It represents the funds available for day-to-day operations, including purchasing raw materials and paying wages. Positive working capital ensures a firm can continue operations and meet short-term debts and expenses as they become due. The management of working capital involves managing inventory, receivables, payables, and cash. It is important for operational efficiency, securing credit, cash flow management, and maintaining liquidity and solvency. Both too much and too little working capital can negatively impact a business.