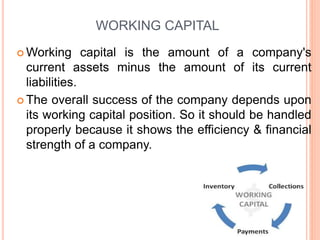

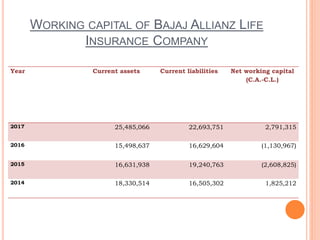

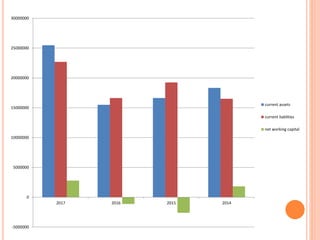

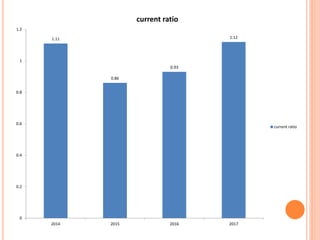

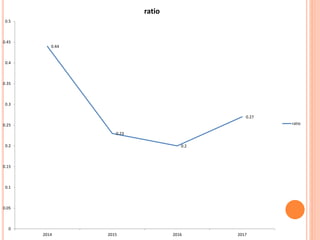

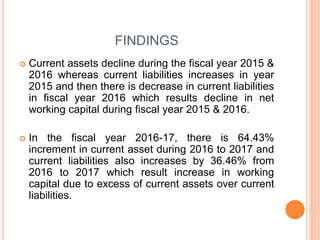

The document discusses the study of working capital management in Bajaj Allianz Life Insurance, focusing on the definitions, components, and importance of working capital. It analyzes the company's financial statements over four years, highlighting trends in current assets, current liabilities, and liquidity ratios, concluding that effective working capital management plays a crucial role in the company's financial performance. The findings indicate an overall positive trend in working capital, emphasizing the importance of balancing profitability, risk, and liquidity.