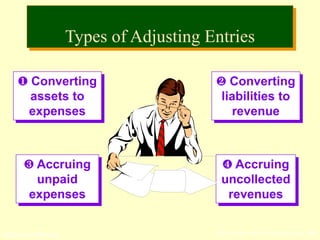

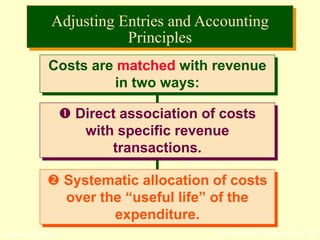

Adjusting entries are made at the end of an accounting period to properly record revenues and expenses that relate to multiple periods. There are four main types of adjusting entries:

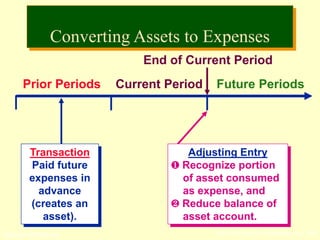

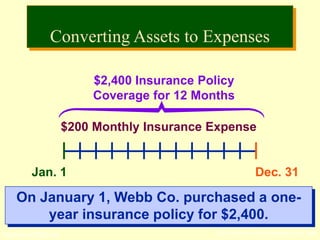

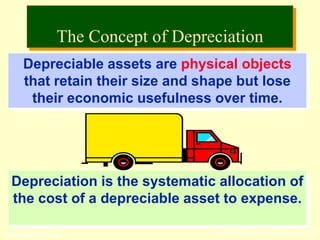

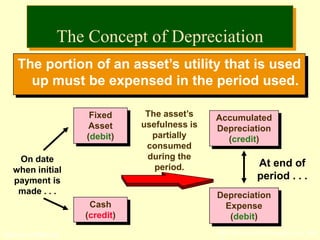

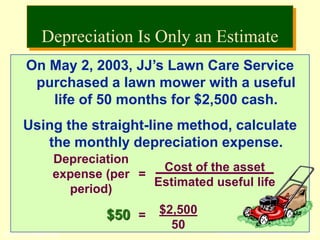

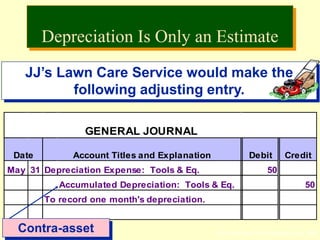

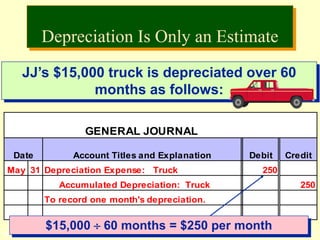

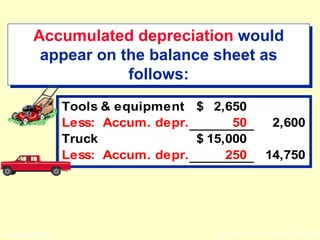

1) Converting assets to expenses, such as depreciating the cost of long-term assets over time.

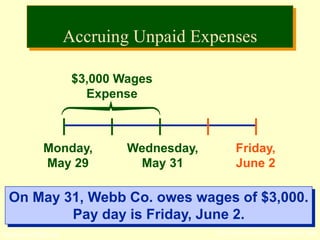

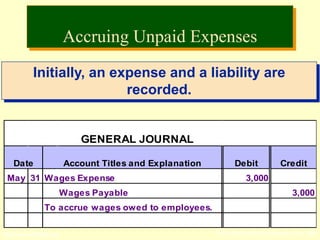

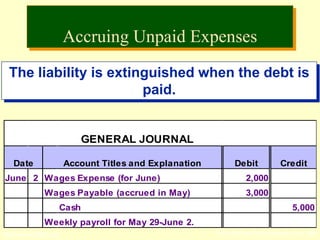

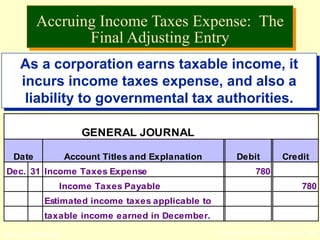

2) Accruing unpaid expenses, like wages owed to employees at the end of a period.

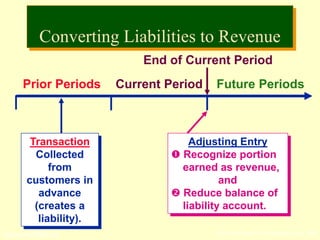

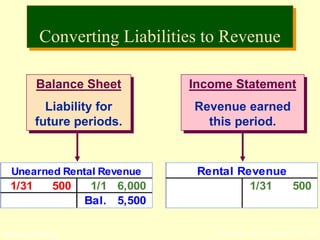

3) Converting liabilities to revenue, including recognizing revenue from customer payments received in advance.

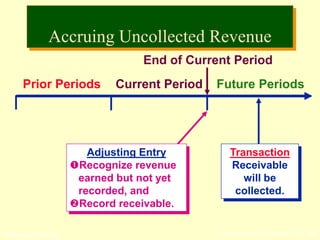

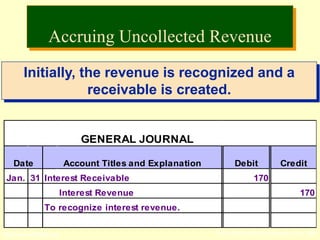

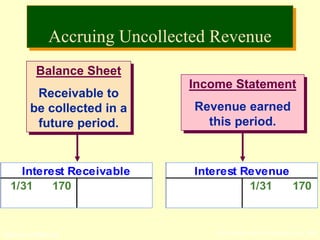

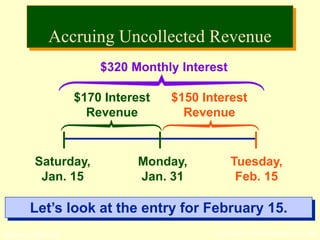

4) Accruing uncollected revenue, like interest earned but not yet received from a bank.