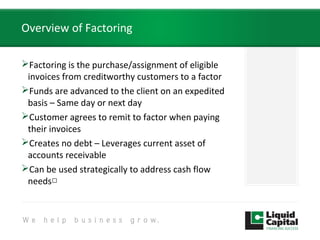

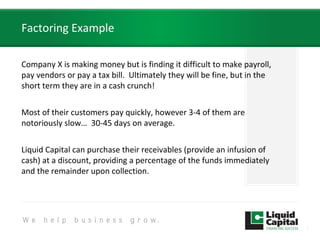

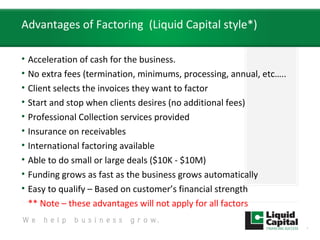

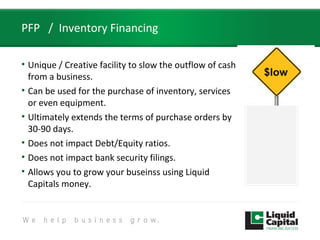

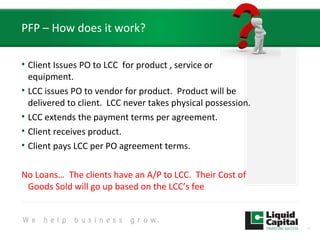

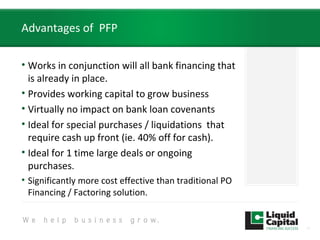

Liquid Capital provides financing solutions like factoring and purchase order financing to help businesses improve their cash flow. They have a network of over 80 offices in the US and Canada that have collectively handled $500 million in financing. The document introduces Scott Kaufman, owner of the local Liquid Capital franchise, and provides an overview of the factoring and purchase order financing services Liquid Capital offers.