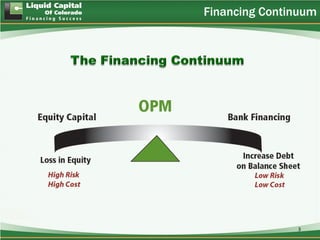

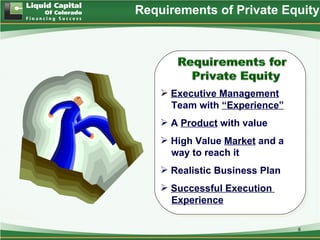

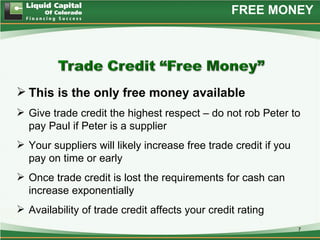

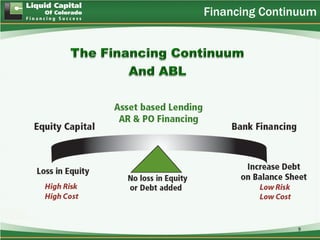

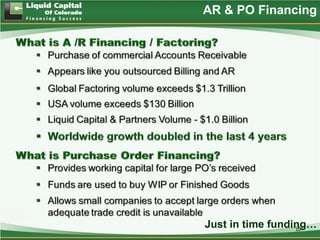

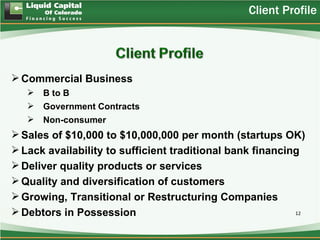

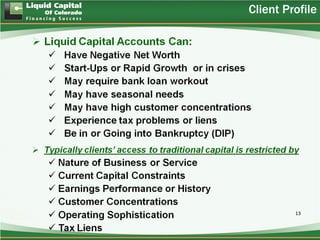

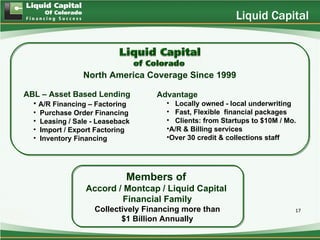

This document provides information for business owners on funding startups and growing businesses. It discusses that startups are harder, take longer, and cost more than anticipated. The best approach to funding combines several options like trade credit, private equity, loans, and lines of credit to create a financing portfolio. Private equity requires an experienced management team, valuable product, access to markets, a realistic plan, and execution experience. Alternative funding options like asset-based lending can unlock value from a company's assets like accounts receivable and inventory to provide cash flow. Factoring receivables and purchase order financing are presented as "just in time" funding options.