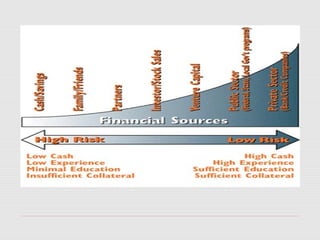

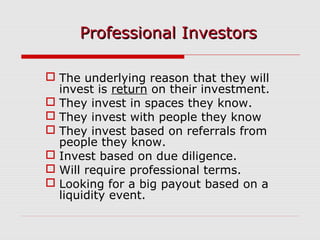

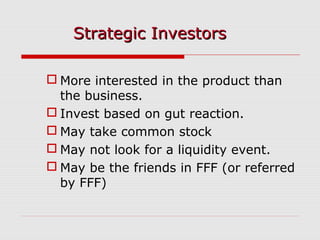

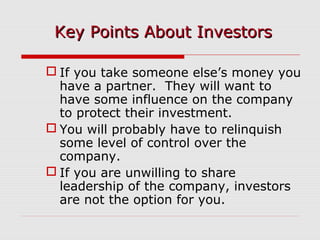

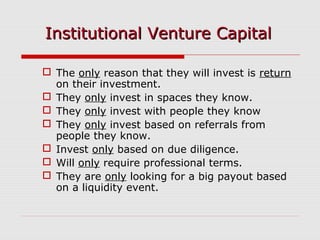

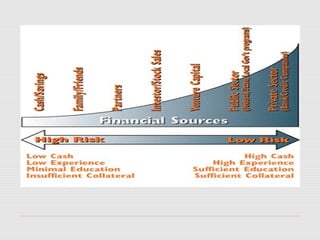

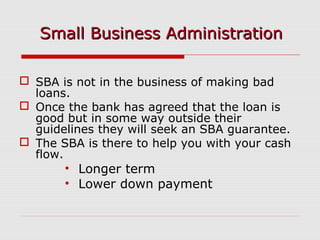

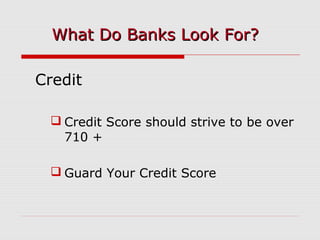

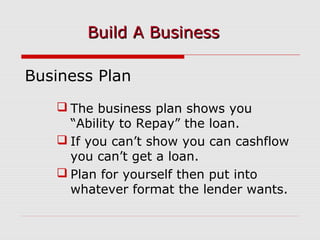

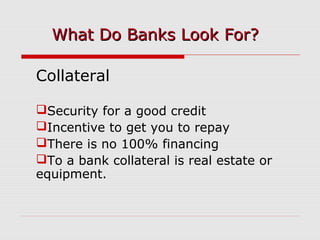

This document discusses alternative financing options for small businesses. It covers bootstrapping using internally generated funds, angel investors who are high-net-worth individuals interested in emerging businesses, institutional venture capital firms looking for high returns, commercial banks that typically lend for assets and require collateral, the Small Business Administration that helps with longer term loans, and creative options like peer-to-peer lending, factoring accounts receivable, merchant financing using credit card sales, vendor financing from major customers, and crowdfunding by raising small amounts from many people online. The key is finding the right option based on the business needs, creditworthiness, and ability to repay loans.