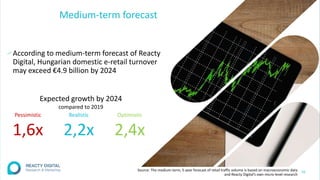

The Hungarian e-commerce market is rapidly growing, bolstered by the COVID-19 pandemic, with expectations for turnover to exceed €4.9 billion by 2024. Key trends include a significant increase in online shopping frequency, diverse product categories, and the popularity of cash on delivery as a payment method. Cultural factors, such as language preferences and price sensitivity, play a crucial role for businesses looking to enter the market.