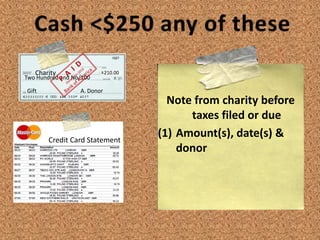

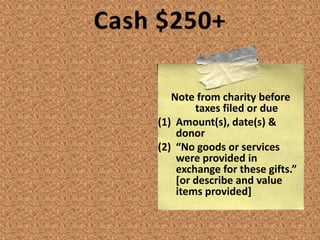

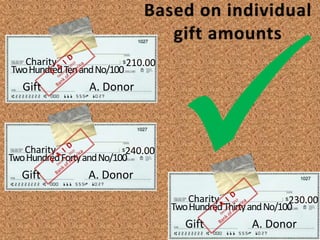

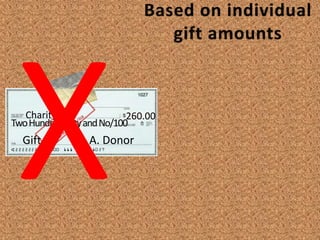

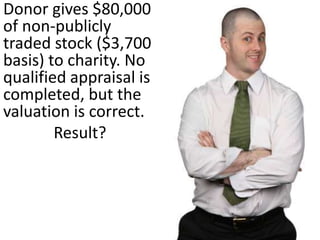

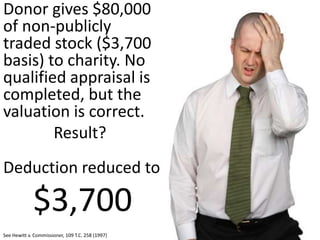

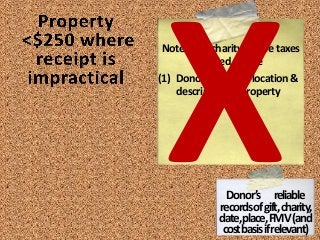

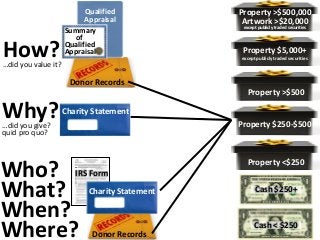

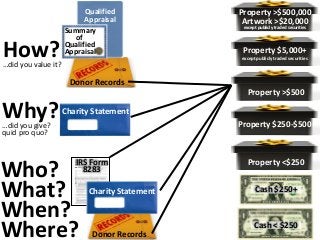

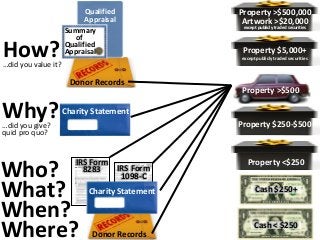

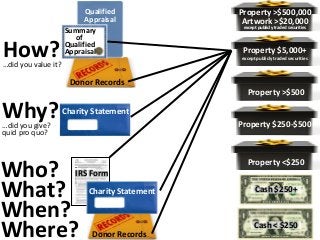

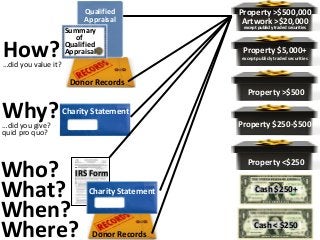

The document discusses the documentation requirements for charitable contributions under U.S. tax law. It outlines the different documentation needed based on the amount and type of contribution, including donor records, charity receipts, appraisals and IRS forms. For cash contributions under $250, the donor needs only their own records. For contributions over $500 of property, including non-publicly traded stock and vehicles, the donor needs additional documentation like a qualified appraisal. Failure to follow the documentation rules can result in reduced or disallowed deductions.

![Note from charity before

taxes filed or due

(1) Amount(s), date(s) &

donor

(2) “No goods or services

were provided in

exchange for these gifts.”

[or describe and value

items provided]](https://image.slidesharecdn.com/documentingcharitablecontributions-101209134721-phpapp01/85/Documenting-Charitable-Contributions-23-320.jpg)

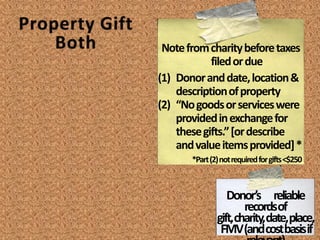

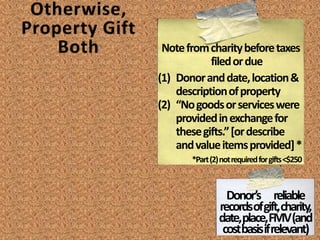

![Notefromcharitybeforetaxes

filedordue

(1) Donoranddate,location&

descriptionofproperty

(2) “Nogoodsorserviceswere

providedinexchangefor

thesegifts.”[ordescribe

andvalueitemsprovided]*

*Part(2)notrequiredforgifts<$250

Donor’s reliable

recordsofgift,charity,

date,place,FMV(and

costbasisifrelevant)](https://image.slidesharecdn.com/documentingcharitablecontributions-101209134721-phpapp01/85/Documenting-Charitable-Contributions-35-320.jpg)

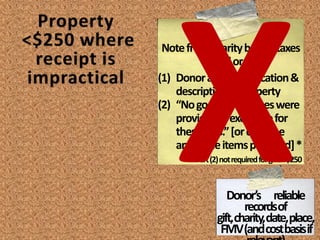

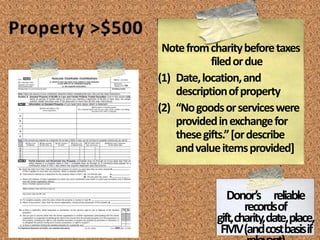

![Notefromcharitybeforetaxes

filedordue

(1) Date,location,and

descriptionofproperty

(2) “Nogoodsorserviceswere

providedinexchangefor

thesegifts.”[ordescribe

andvalueitemsprovided]

Donor’s reliable

recordsofgift,charity,

date,place,FMV(and

costbasisifrelevant)](https://image.slidesharecdn.com/documentingcharitablecontributions-101209134721-phpapp01/85/Documenting-Charitable-Contributions-37-320.jpg)

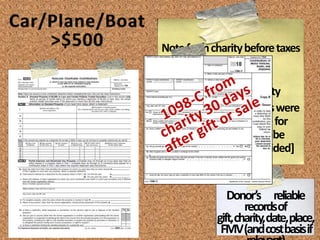

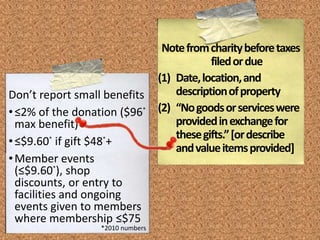

![Notefromcharitybeforetaxes

filedordue

(1) Date,location,and

descriptionofproperty

(2) “Nogoodsorserviceswere

providedinexchangefor

thesegifts.”[ordescribe

andvalueitemsprovided]

Donor’s reliable

recordsofgift,charity,

date,place,FMV(and

costbasisifrelevant)](https://image.slidesharecdn.com/documentingcharitablecontributions-101209134721-phpapp01/85/Documenting-Charitable-Contributions-39-320.jpg)

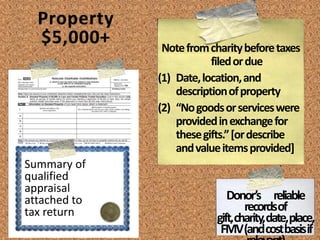

![Summary of

qualified

appraisal

attached to

tax return

Notefromcharitybeforetaxes

filedordue

(1) Date,location,and

descriptionofproperty

(2) “Nogoodsorserviceswere

providedinexchangefor

thesegifts.”[ordescribe

andvalueitemsprovided]

Donor’s reliable

recordsofgift,charity,

date,place,FMV(and

costbasisifrelevant)](https://image.slidesharecdn.com/documentingcharitablecontributions-101209134721-phpapp01/85/Documenting-Charitable-Contributions-41-320.jpg)

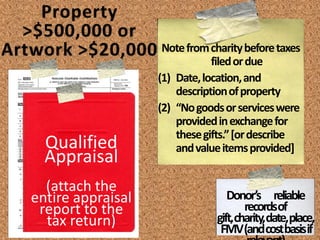

![Qualified

Appraisal

(attach the

entire appraisal

report to the

tax return)

Notefromcharitybeforetaxes

filedordue

(1) Date,location,and

descriptionofproperty

(2) “Nogoodsorserviceswere

providedinexchangefor

thesegifts.”[ordescribe

andvalueitemsprovided]

Donor’s reliable

recordsofgift,charity,

date,place,FMV(and

costbasisifrelevant)](https://image.slidesharecdn.com/documentingcharitablecontributions-101209134721-phpapp01/85/Documenting-Charitable-Contributions-43-320.jpg)

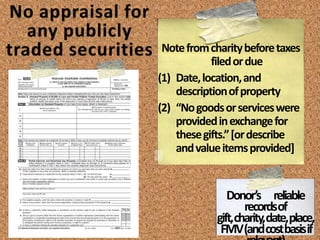

![Notefromcharitybeforetaxes

filedordue

(1) Date,location,and

descriptionofproperty

(2) “Nogoodsorserviceswere

providedinexchangefor

thesegifts.”[ordescribe

andvalueitemsprovided]

Donor’s reliable

recordsofgift,charity,

date,place,FMV(and

costbasisifrelevant)](https://image.slidesharecdn.com/documentingcharitablecontributions-101209134721-phpapp01/85/Documenting-Charitable-Contributions-44-320.jpg)