The document discusses various US tax credits including:

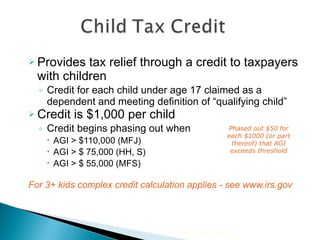

- The child tax credit of $1000 per qualifying child, phasing out above certain income thresholds.

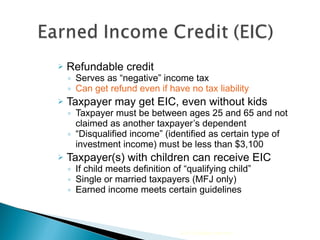

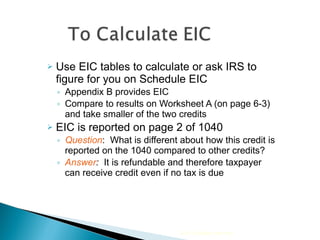

- The earned income tax credit which is refundable and available to low-income workers with or without children.

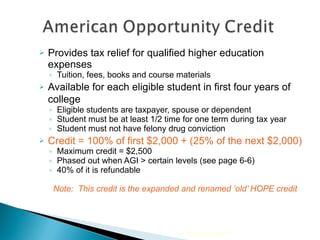

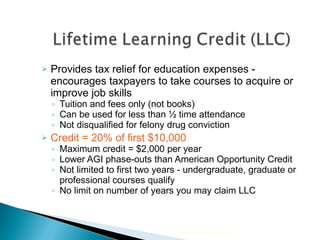

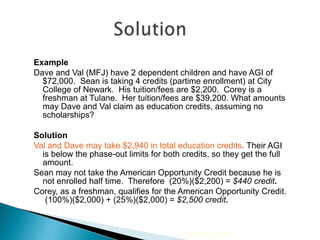

- Education credits like the American Opportunity credit and Lifetime Learning credit that provide tax relief for higher education expenses.