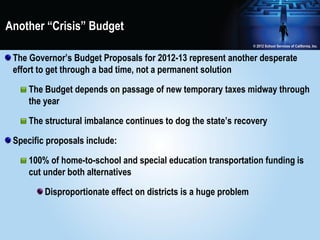

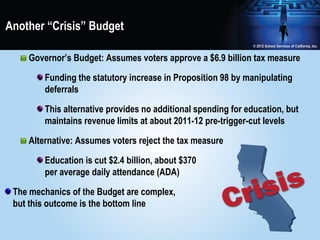

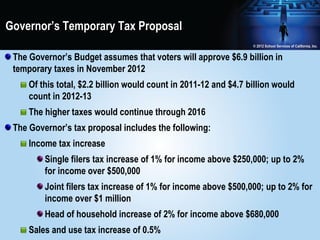

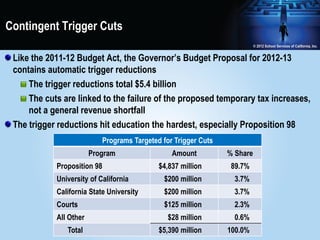

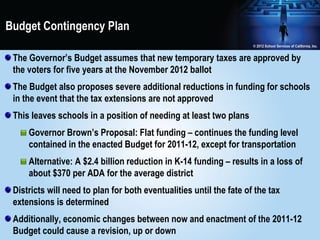

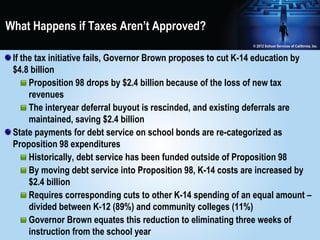

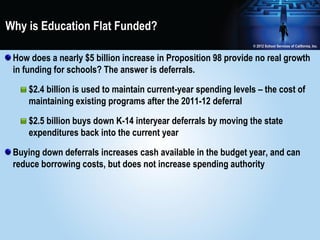

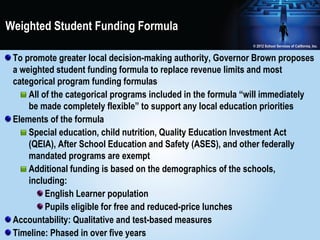

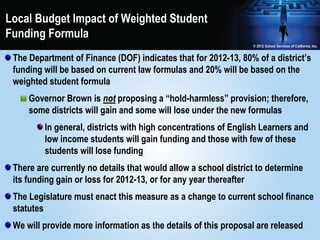

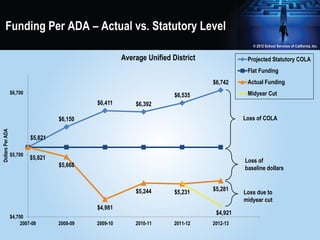

The Governor's budget update proposes another "crisis" budget that relies on temporary tax increases to avoid deep cuts to education. If the tax measure fails, K-14 education would be cut by $4.8 billion, reducing per-student funding by about $370. The budget also introduces a weighted student funding formula to replace most categorical programs and revenue limits over five years, but districts could gain or lose funding depending on their student demographics. Locally-funded districts may see impacts from changes to redevelopment agency funding and the new finance model. Districts must develop budgets with uncertain funding levels and await the final state budget.