This document summarizes the 2009 Medicare & You handbook. It provides information about Medicare coverage, costs, and options. Key points include:

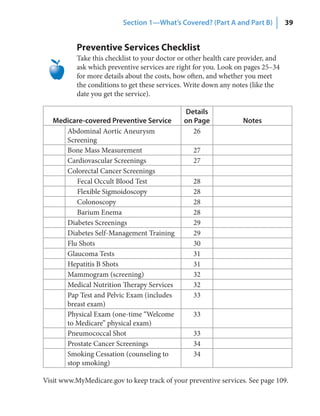

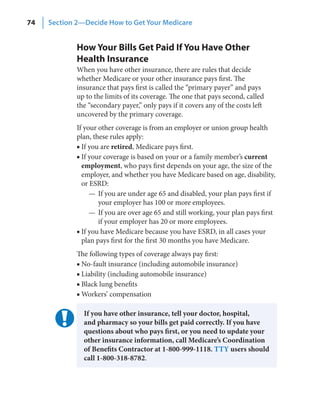

- Medicare covers hospital insurance (Part A), medical insurance (Part B), Medicare Advantage plans (Part C), and prescription drug coverage (Part D).

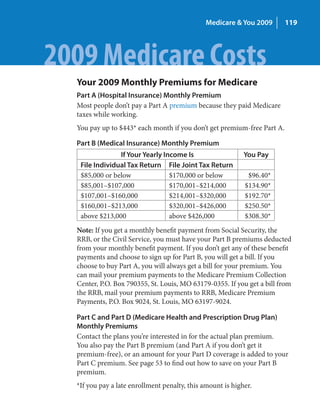

- Coverage and costs vary depending on the plan. Part A has a deductible and Part B has a premium and deductible. Advantage plans have premiums, deductibles, and other costs.

- Individuals have choices in how they receive Medicare benefits, including Original Medicare or Medicare Advantage plans. Plans must be joined during specific enrollment periods.

- The handbook provides information to help