Embed presentation

Download to read offline

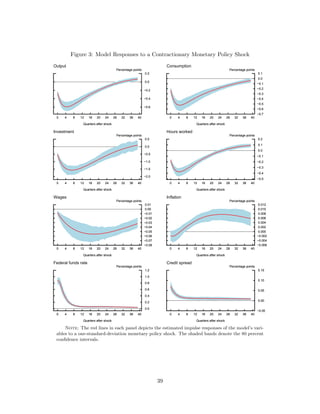

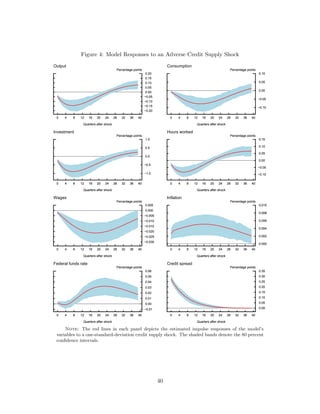

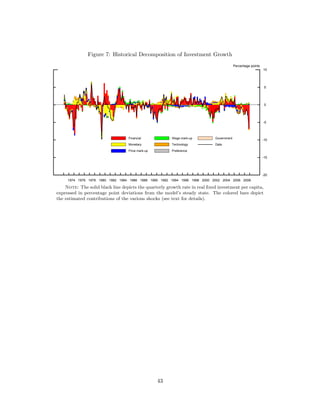

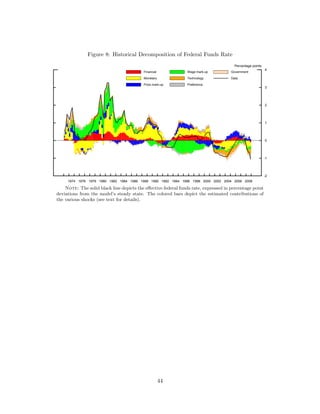

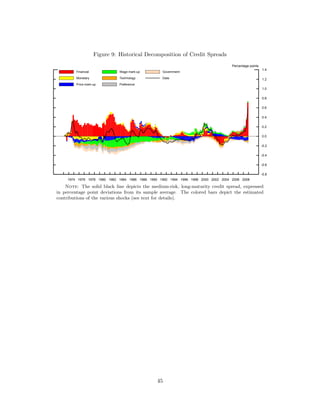

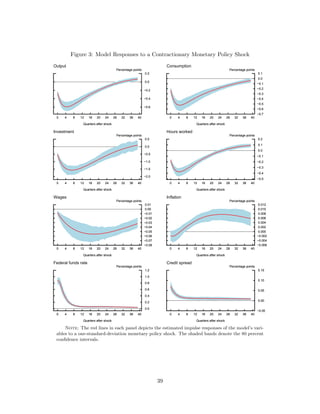

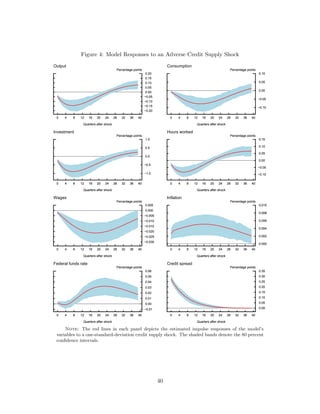

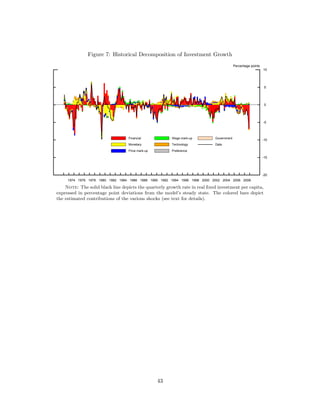

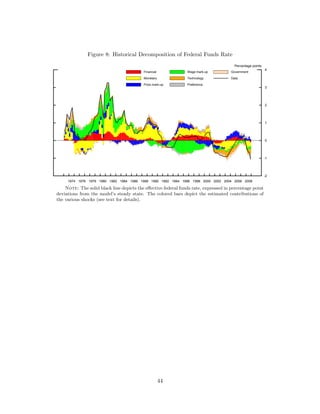

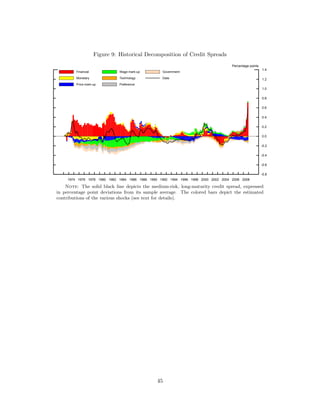

This document summarizes a study that estimates a dynamic stochastic general equilibrium (DSGE) model to quantify the role of financial frictions, known as the financial accelerator mechanism, in U.S. business cycle fluctuations from 1973 to 2008. The model incorporates a high-information content credit spread index to identify the financial accelerator parameters and measure the impact of financial shocks on the real economy. Estimation results identify an operative financial accelerator, where increases in external financing costs significantly reduce investment and output. Financial disturbances accounted for significant portions of investment and output declines during economic downturns, particularly in the 1970s.