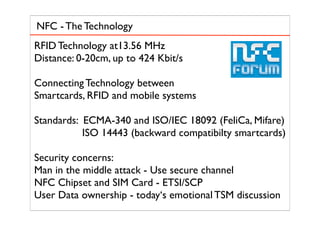

Martin Gutberlet discusses mobile payment trends and technologies, specifically near field communication (NFC) and whether it will unlock new opportunities. NFC uses RFID technology to enable contactless transactions between devices within close proximity. While NFC shows potential, challenges include security vulnerabilities and defining business models and revenue sharing among partners. Gutberlet analyzes potential mPass wallet approaches and estimates low revenues of 5 million euros based on assumptions of transaction volumes, fees, and revenue sharing. He concludes mobile wallets will eventually replace cards but short-term confusion and a lack of standardization could slow mass adoption.