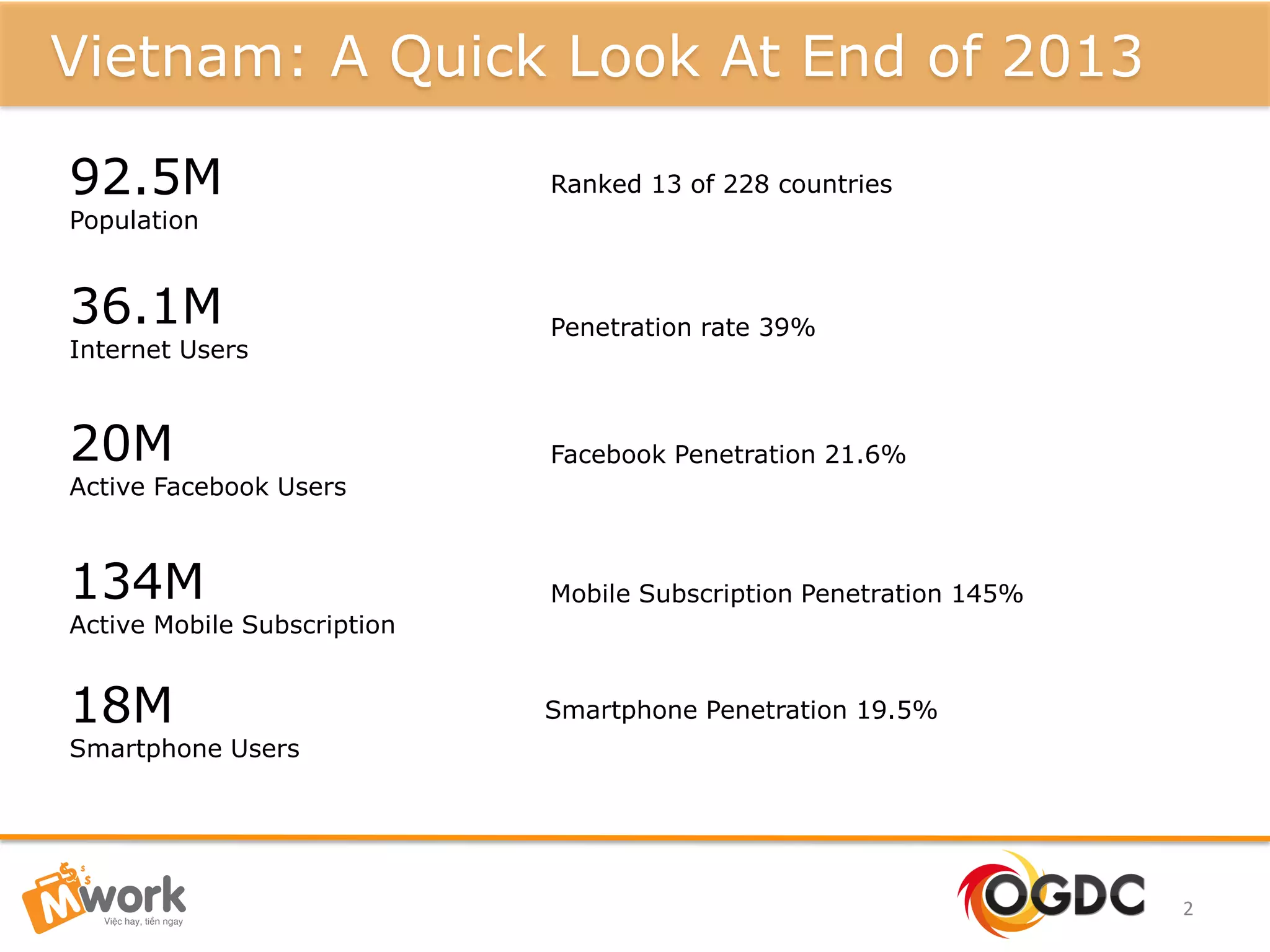

1) Vietnam's mobile internet and smartphone gaming market has grown rapidly in recent years, with smartphone users increasing almost 4-fold to 18 million between 2012 and 2014.

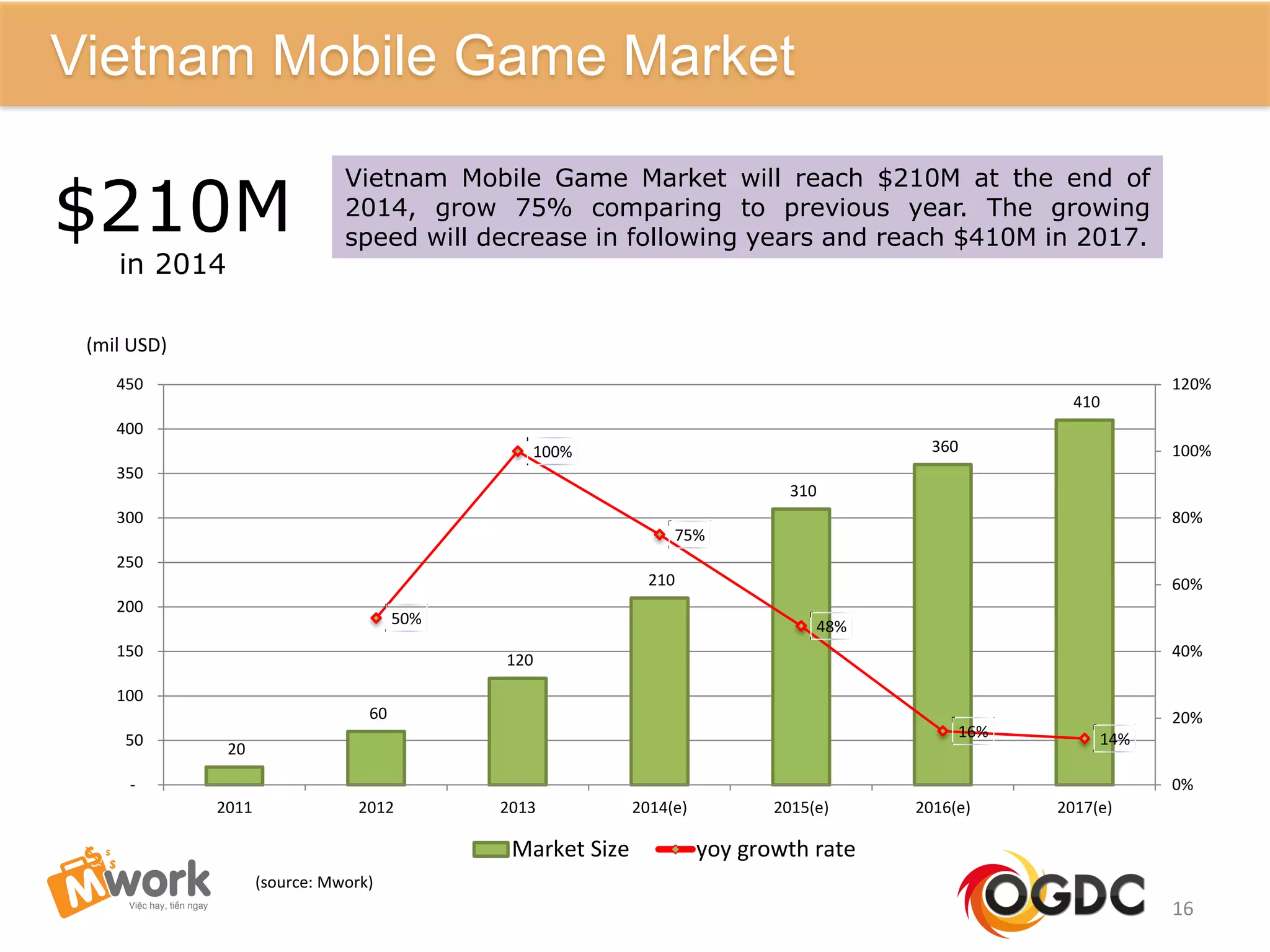

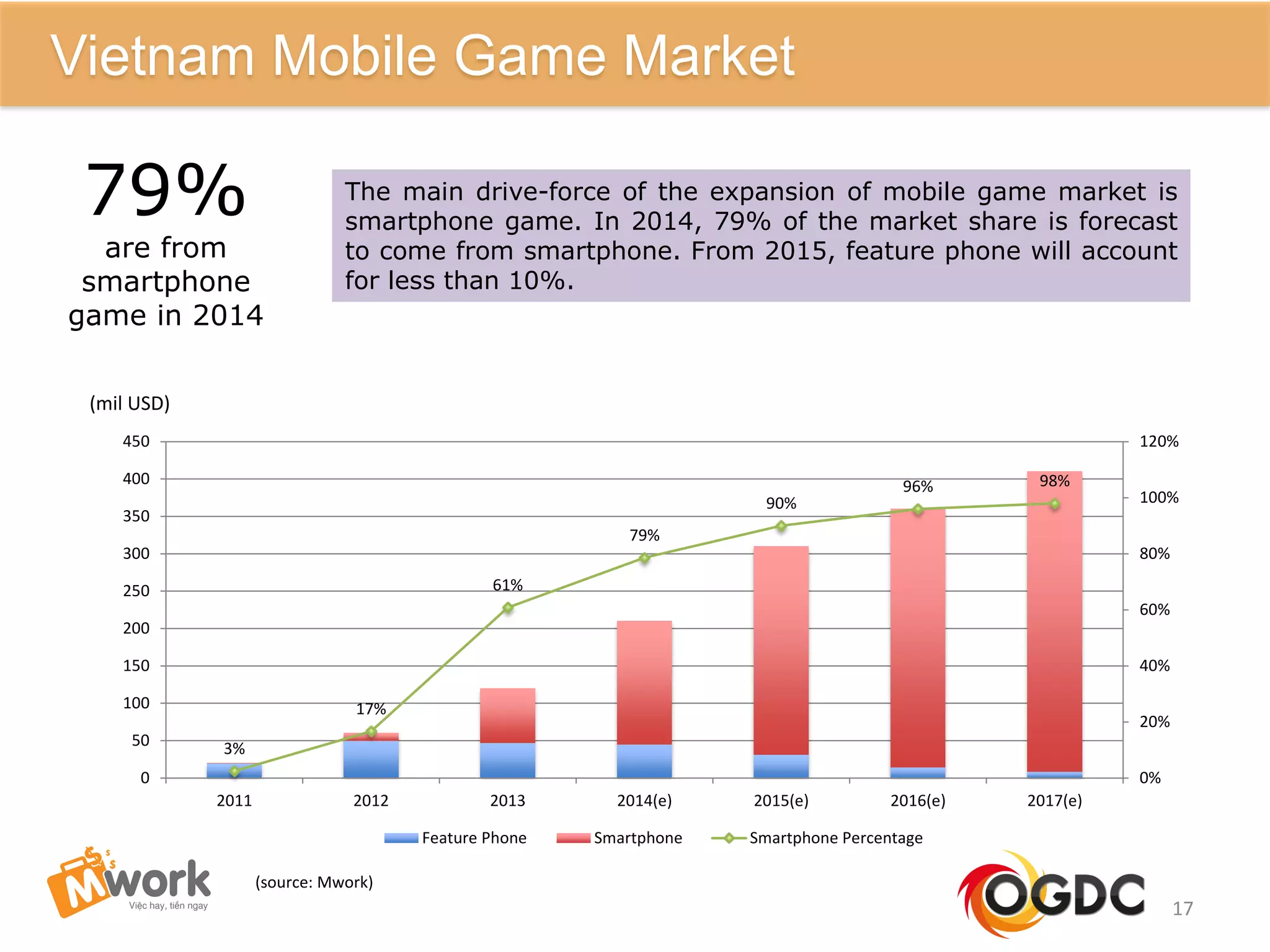

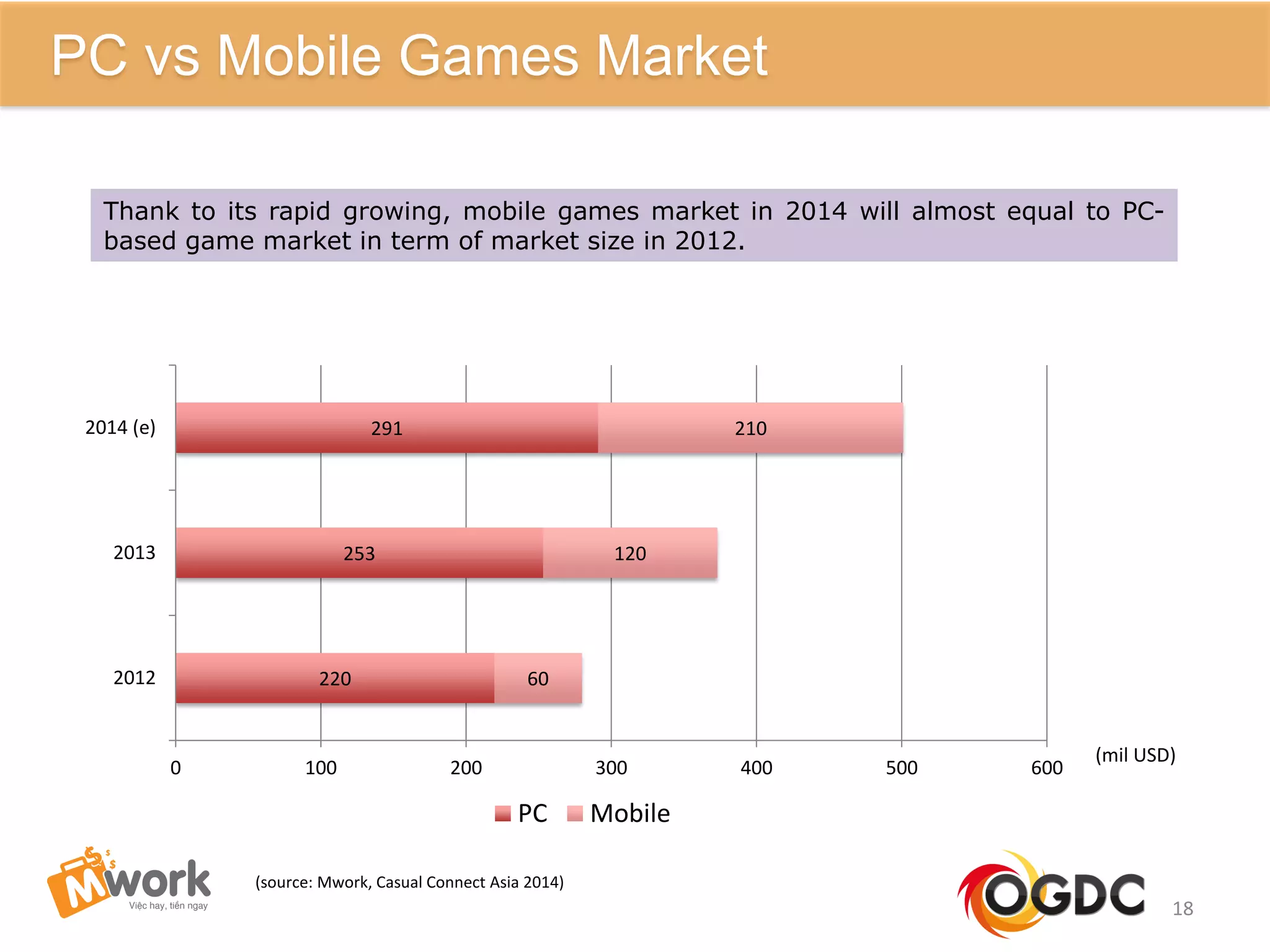

2) The mobile game market is expected to reach $210 million in 2014, growing 75% over the previous year. Smartphone games will account for 79% of this market.

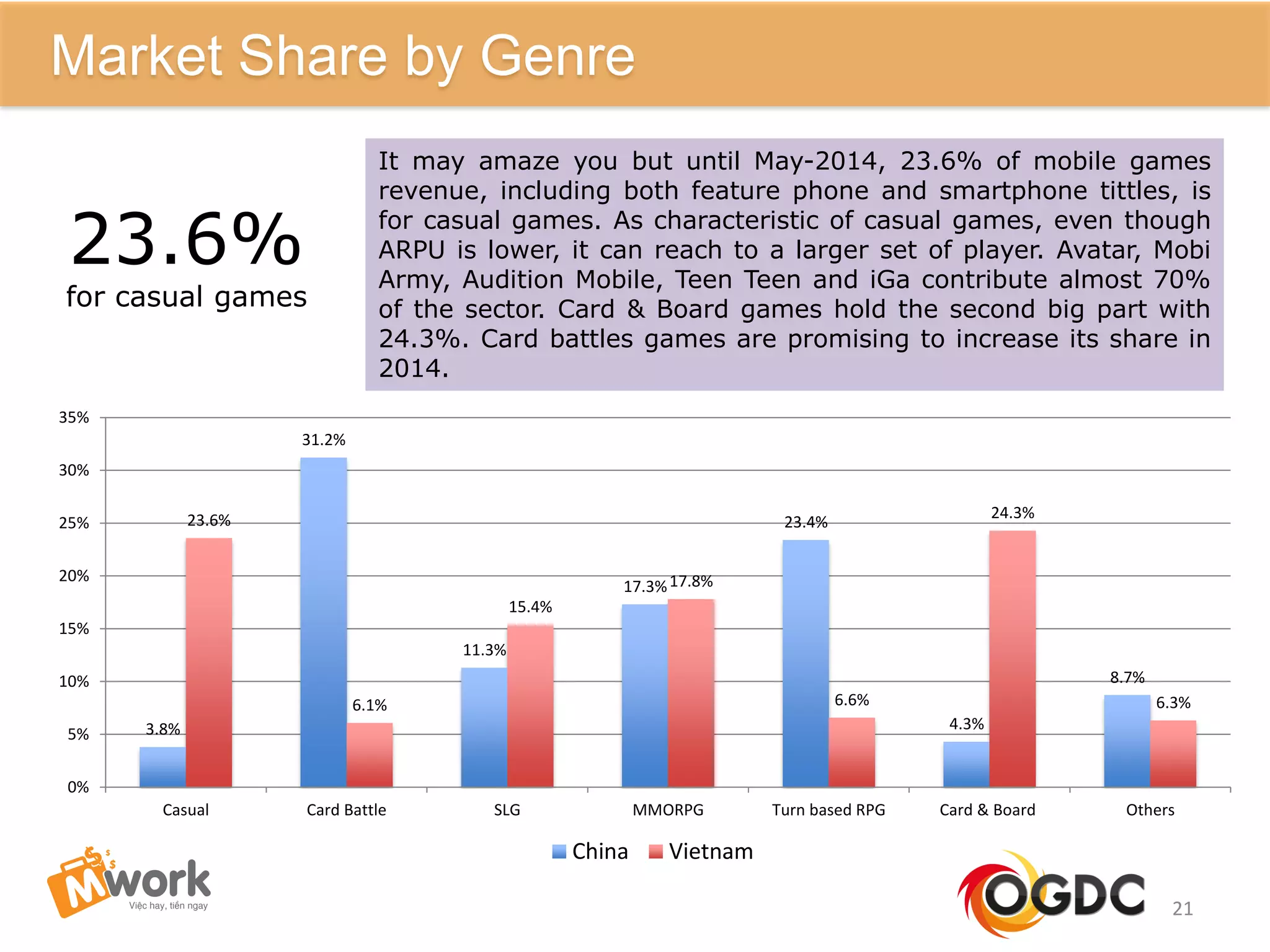

3) Casual games currently make up the largest share of the mobile gaming market in Vietnam at 23.6% as of May 2014. Card and board games are the second largest genre.

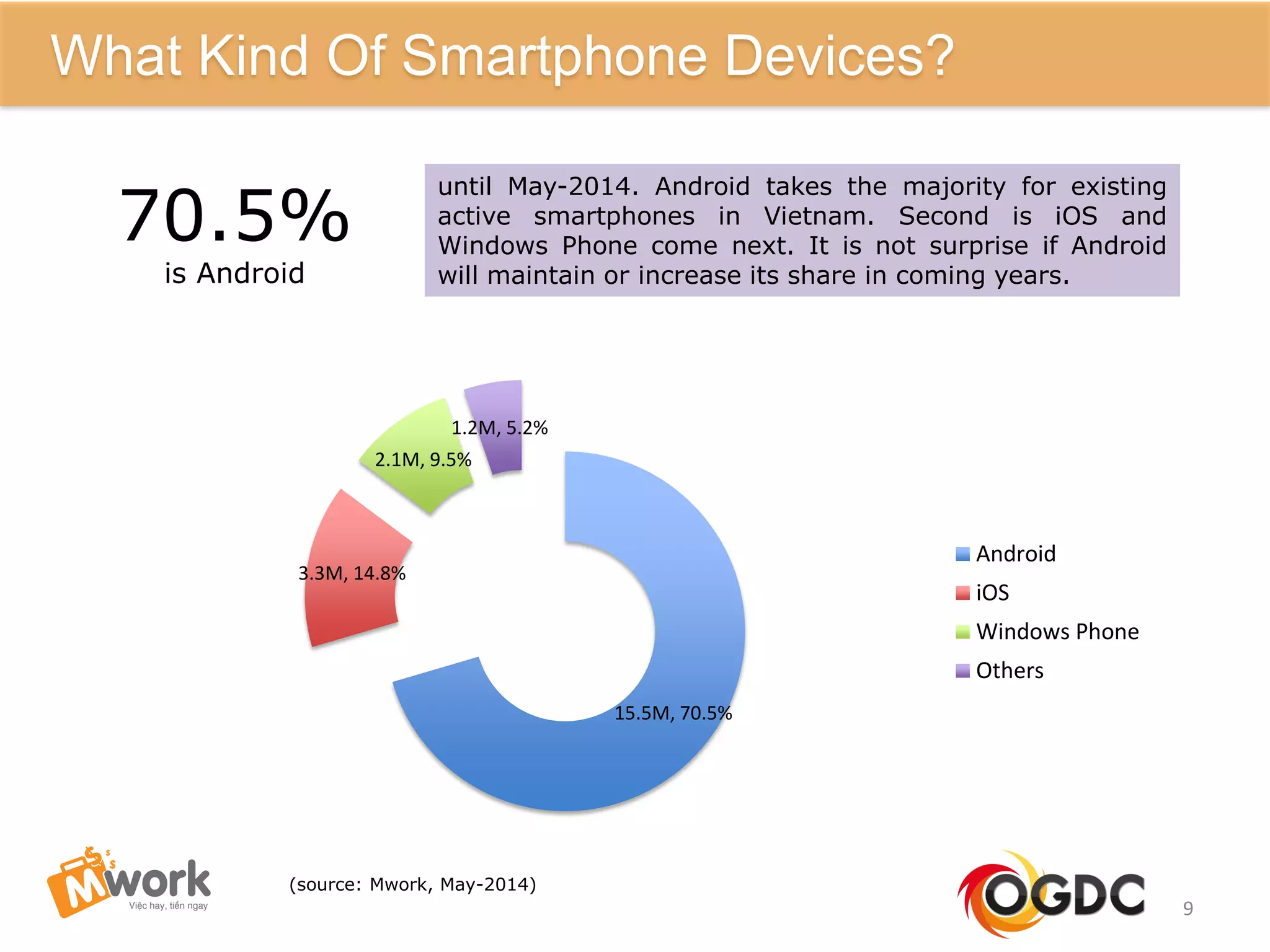

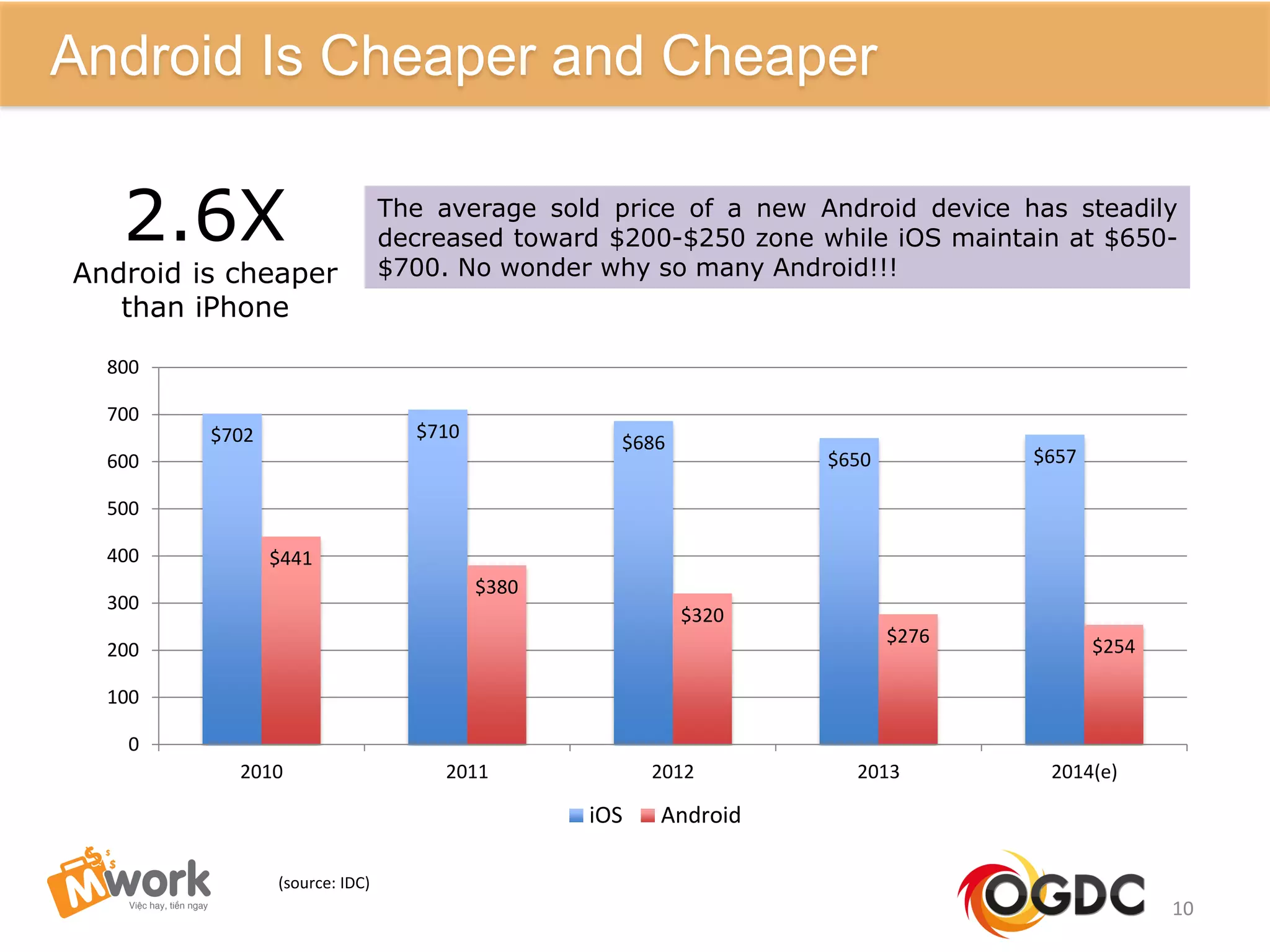

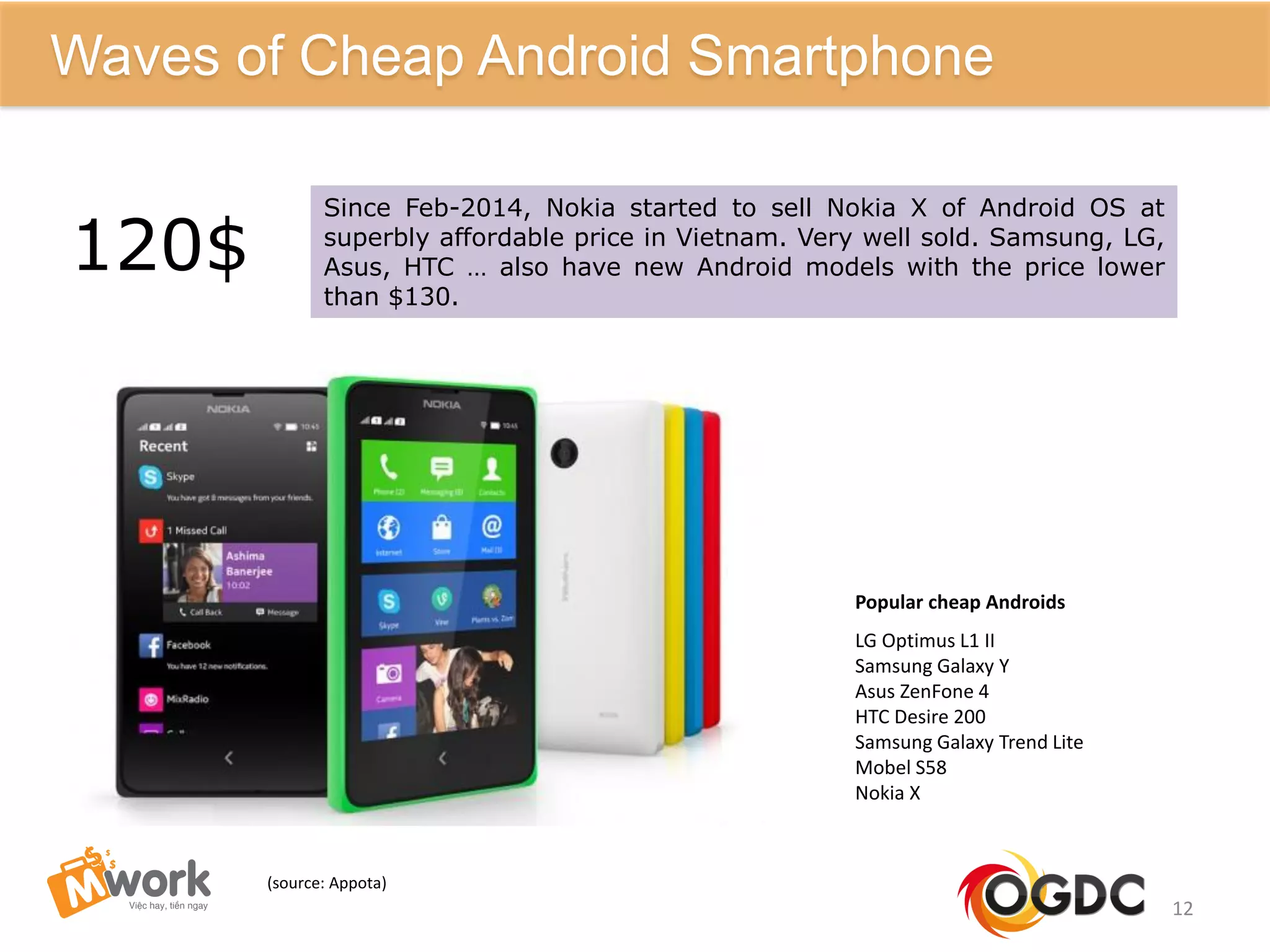

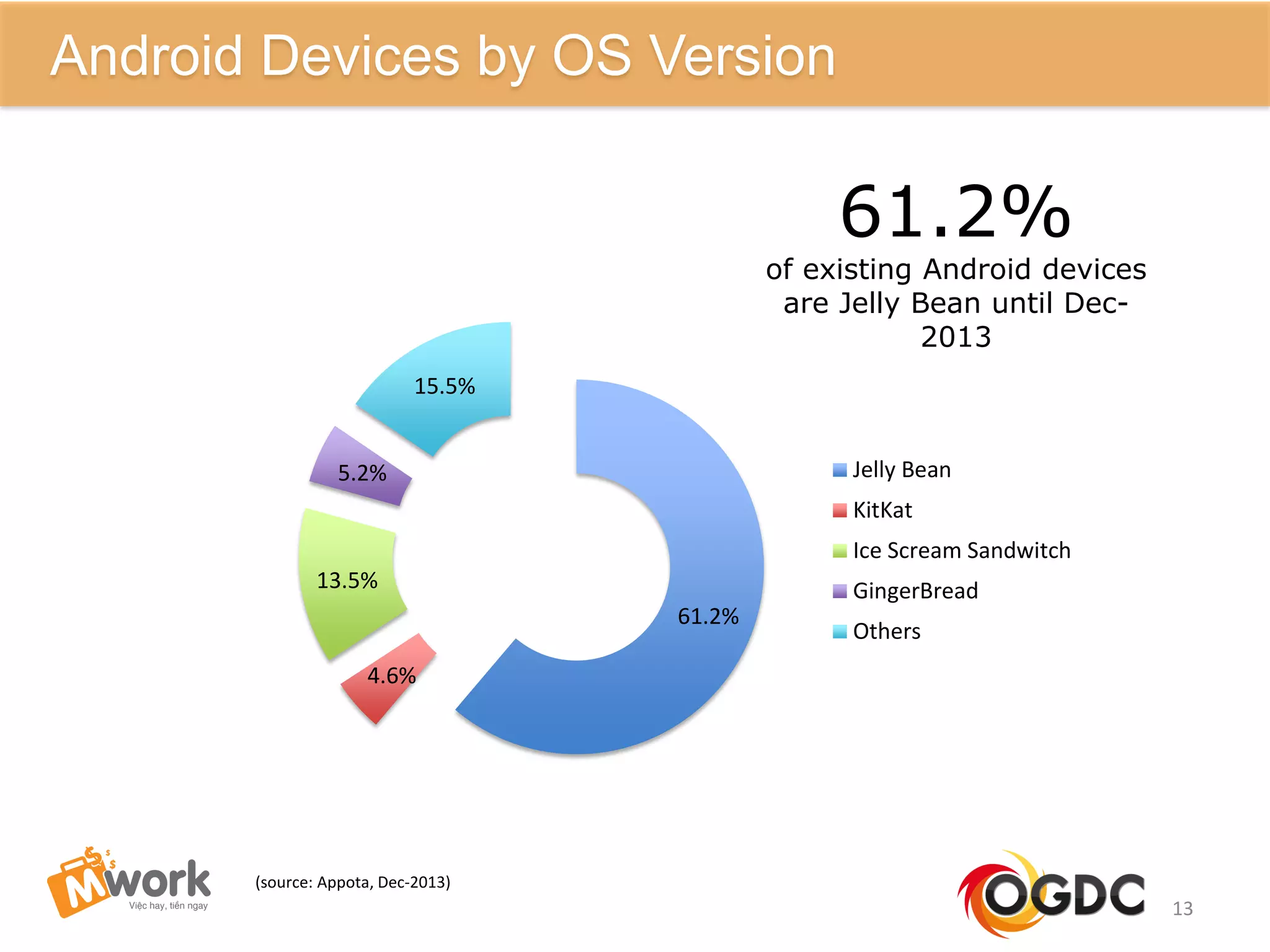

4) Cheap Android devices starting at $120 have driven adoption of smartphones in Vietnam, with Android making up over 70% of devices as of May 2014.