The document provides an annual factsheet on the Indian tech sector in 2019. Some key highlights include:

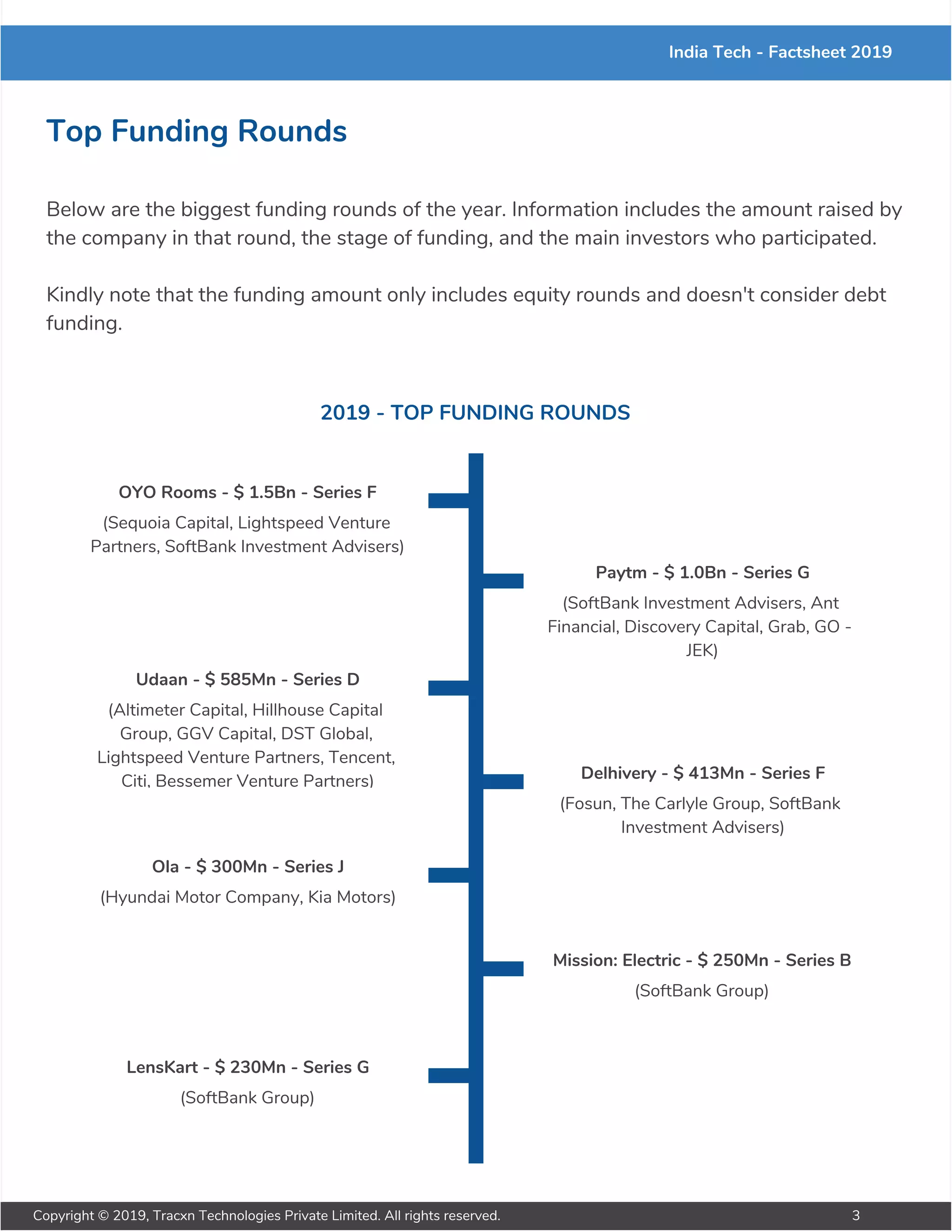

- Total funding raised by Indian startups reached $14.5 billion in 2019, with 1185 funding rounds.

- Top funded startups included OYO Rooms, Paytm, Udaan, Delhivery and Ola.

- Emerging sectors attracting funding included hotel aggregators, e-commerce logistics and online B2B marketplaces.

- Top investors were Sequoia Capital India, Accel India, Matrix India and Lightspeed Venture Partners.

- Majority of startups were founded in Delhi NCR, Bangalore and Mumbai, which also attracted most funding.

![India Tech - Factsheet 2019

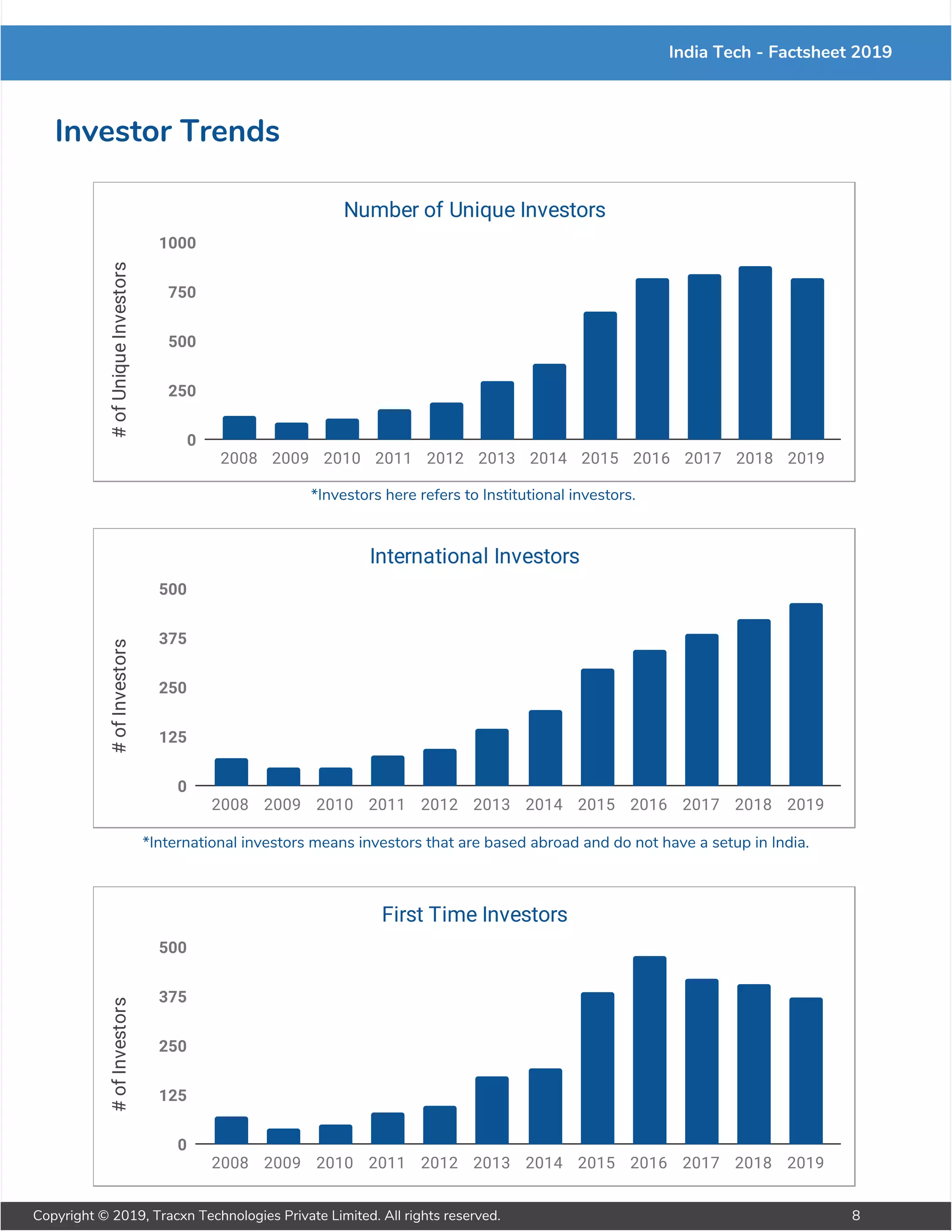

Markets in Spotlight

Here we have plotted a list of the most popular Business Models(BMs) of 2019 that gives us

an idea about the prevailing trends in the startup ecosystem.

The final list has been sorted by the total funding these BMs attracted in 2019, and also lists

the top companies, along with the total funding raised by them till date.

Top Markets

Number of

Companies

Funding Raised

in 2019

1. Hotel Aggregators

Top Companies: OYO Rooms [$3.2B], Treebo Hotels [$57M],

FabHotels [$43M]

13 $1.69 Bn

2. E Commerce Logistics

Top Companies: Delhivery [$781M], Ecom Express [$251M],

Elastic Run [$55M]

15 $641 Mn

3. Online Horizontal B2B Marketplace

Top Companies: Udaan [$870 M], Shotang [$6M], Wydr [$3M]

58 $586 Mn

4. Cab Ride-Hailing

Top Companies: Ola [$3.3B], Meru [$145M], BookMyCab [$1M]

82 $481 Mn

5. Online Comparison Platforms for Insurance

Top Companies: Policybazaar [$666M], Coverfox [59M],

Turtlemint [$34M]

42 $340 Mn

6. Second Hand Car Listings

Top Companies: CarDekho [$470M], CarTrade [$253M],

Carnation [$44M]

33 $229 Mn

Copyright © 2019, Tracxn Technologies Private Limited. All rights reserved. 4](https://image.slidesharecdn.com/indiatech-factsheet2019-200228075144/75/India-Tech-Factsheet-2019-6-2048.jpg)

![India Tech - Factsheet 2019

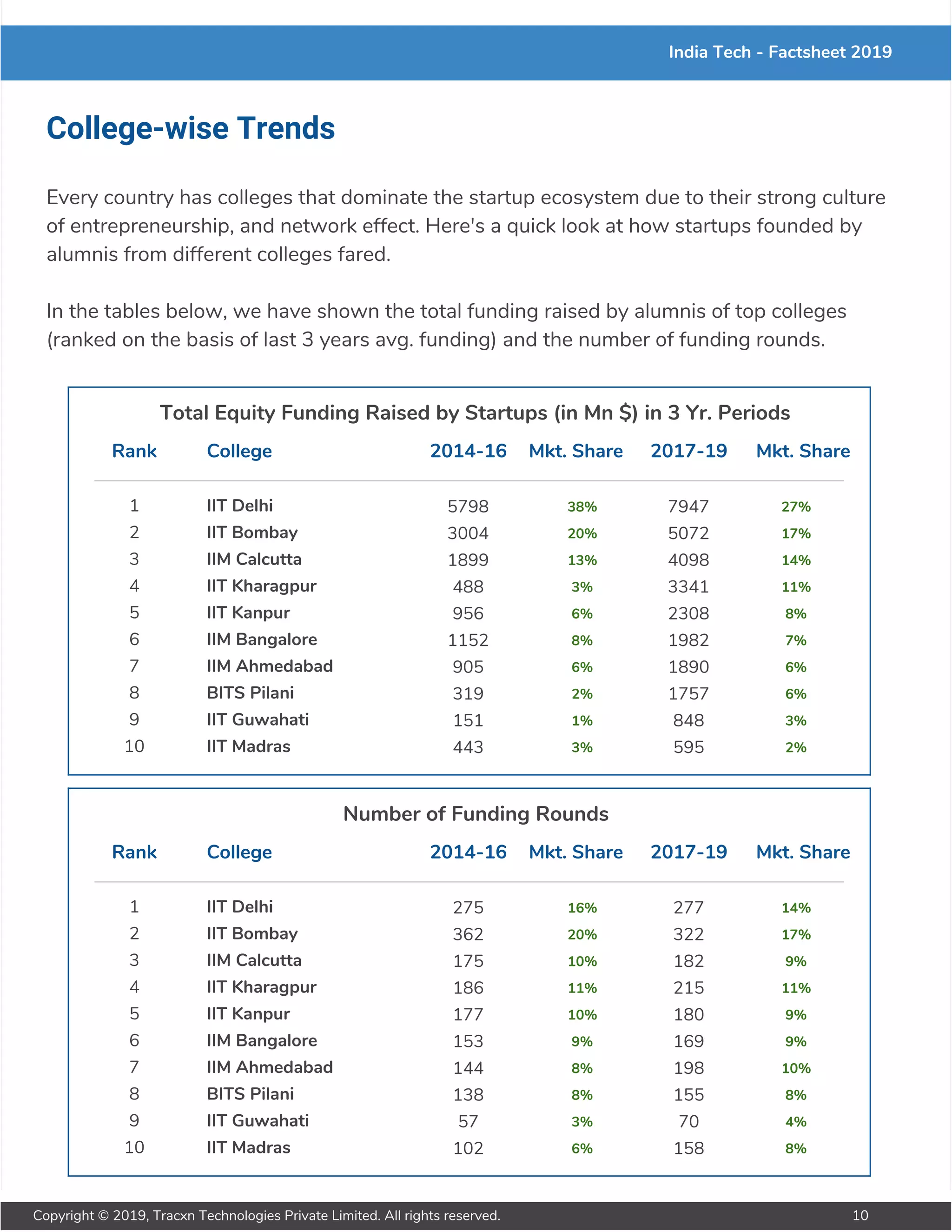

Top Markets

Number of

Companies

Funding Raised

in 2019

7. Online Self-paced Test Preparation Courses

Top Companies: Byju's Classes [$971M], Toppr [$55M],

Extramarks [$43M]

154 $199 Mn

8. Internet-First Restaurant Chains

Top Companies: Rebel Foods [$244M]

1 $173 Mn

9. Long Haul Trucking Marketplace

Top Companies: BlackBuck [$291M], 4Tigo [$12M], FreightTiger

[$12M]

125 $168 Mn

10. Direct Lender Working Capital Loans

Top Companies: Lendingkart [$188M], Capital Float [$124M],

OfBusiness [$91M]

13 $168 Mn

11. Online Horizontal Marketplace

Top Companies: Flipkart [$7.1B], Snapdeal [$1.8B], Paytm Mall

[$816M]

176 $164 Mn

12. Customer Service Software

Top Companies: Freshworks [$400M], [24]7.ai [$22M]

7 $150 Mn

13. Backup and Disaster Recovery

Top Companies: Druv [$330M]

12 $130 Mn

14. Consumer and SME Loans

Top Companies: InCred Finance [$212M], Shiksha Finance

[$11M]

2 $119 Mn

15. Ad-Supported Video On Demand

Top Companies: MX Player [$111M], TVFPlay [$27M]

12 $116 Mn

Copyright © 2019, Tracxn Technologies Private Limited. All rights reserved. 5](https://image.slidesharecdn.com/indiatech-factsheet2019-200228075144/75/India-Tech-Factsheet-2019-7-2048.jpg)