The document discusses various aspects of employee equity at startups, including:

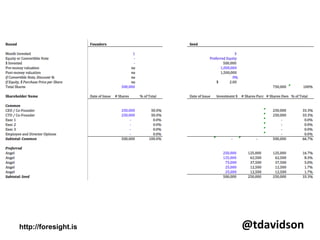

- How startups raise money from venture capital firms by selling shares of the company

- The different classes of shares (common, preferred) that founders, employees and investors hold

- The use of option pools to grant stock options to employees as part of their compensation

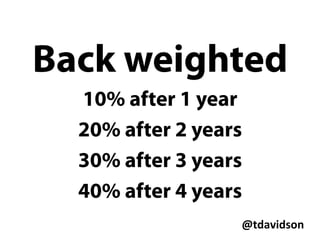

- Factors to consider when evaluating a startup job offer, such as vesting schedules and how much equity the employee would own

- How employee equity is affected by future funding rounds and exit events like acquisitions or IPOs