Embed presentation

Download to read offline

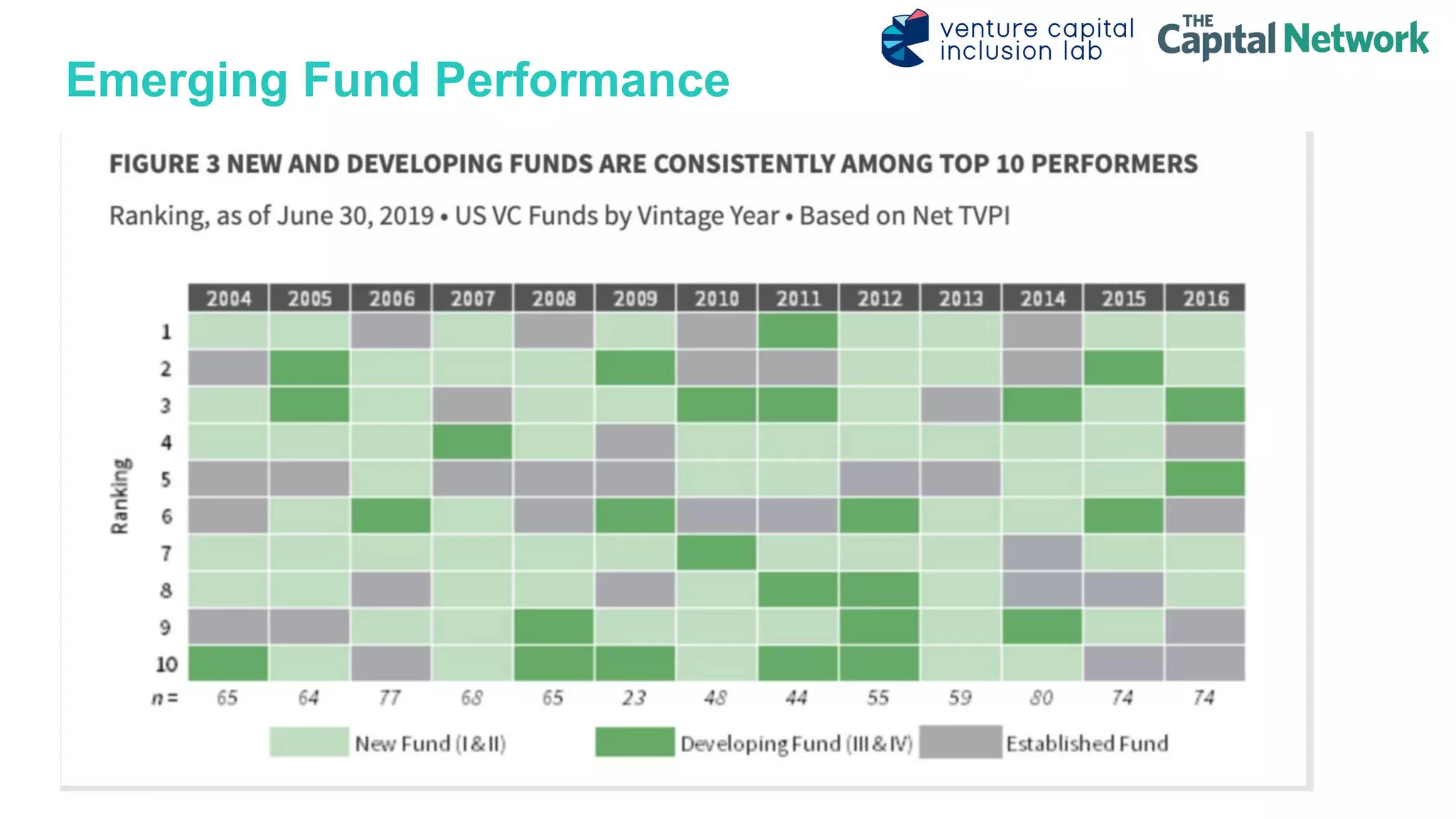

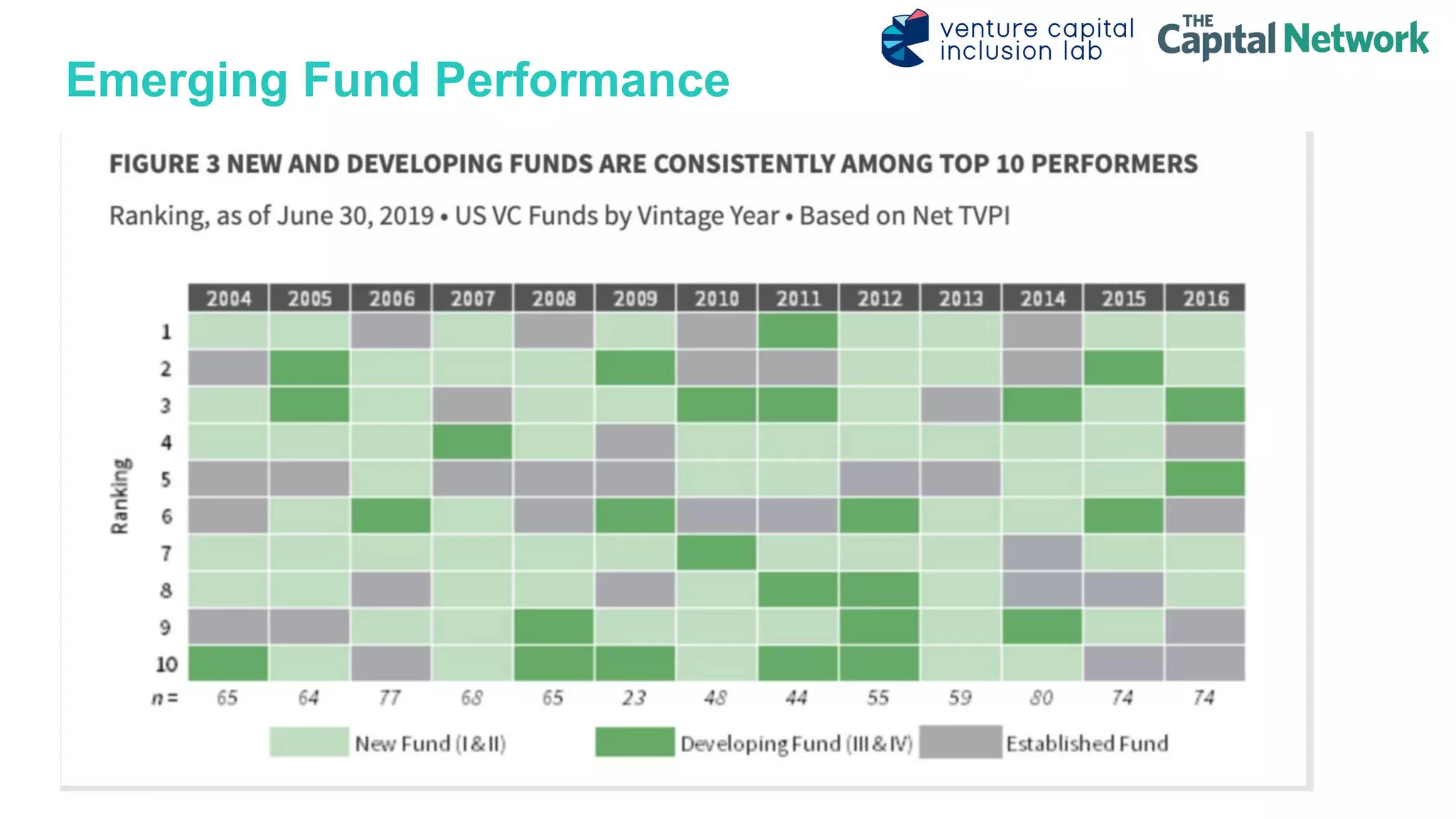

The Capital Network (TCN) supports entrepreneurs in the fundraising process through workshops, mentorship, and events. The focus is on emerging fund managers, particularly micro-VCs, who are increasingly diverse, with a significant rise in representation of women and racial minorities. TCN also shares insights on the performance of these funds and offers opportunities for engagement through webinars.