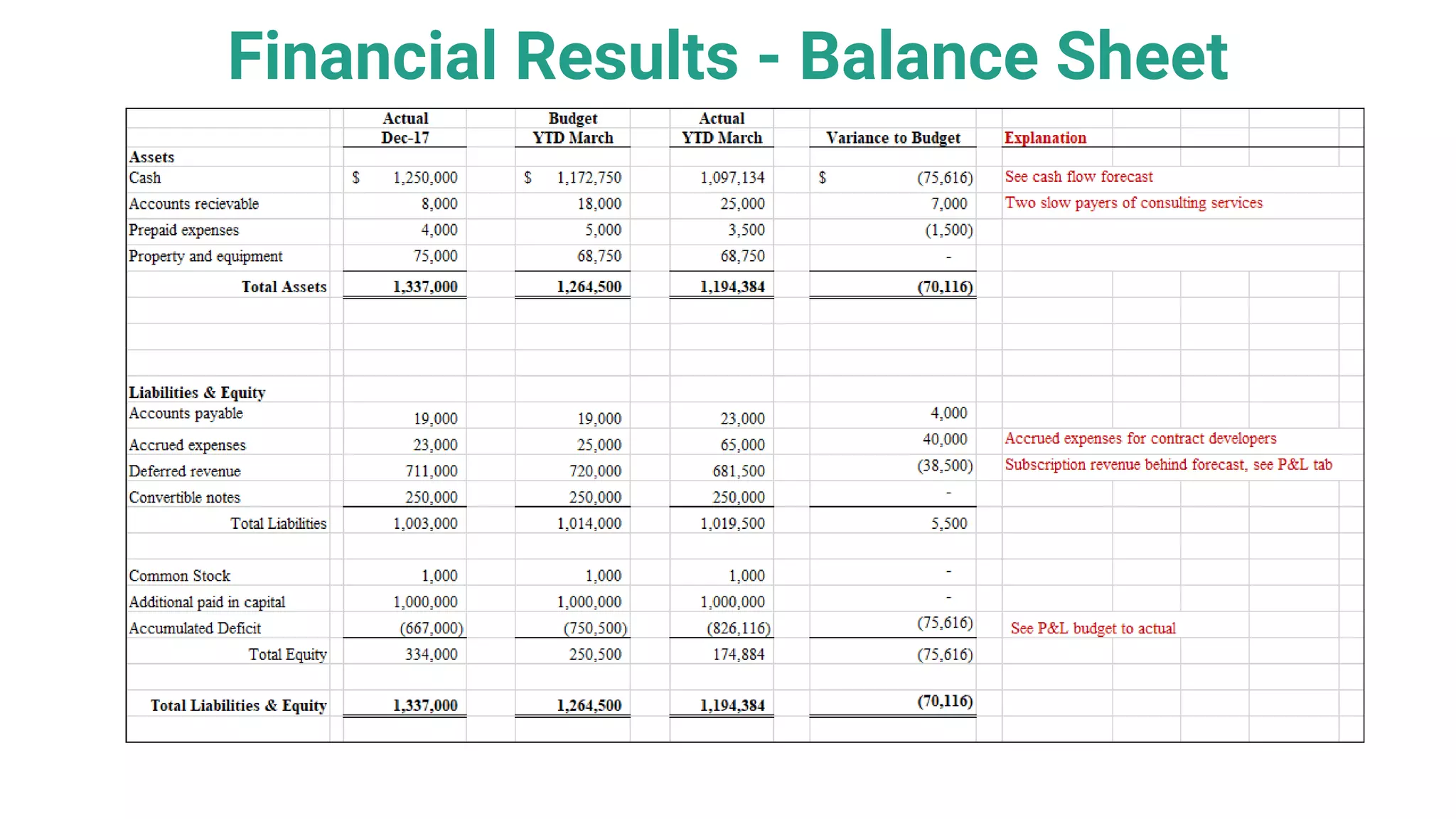

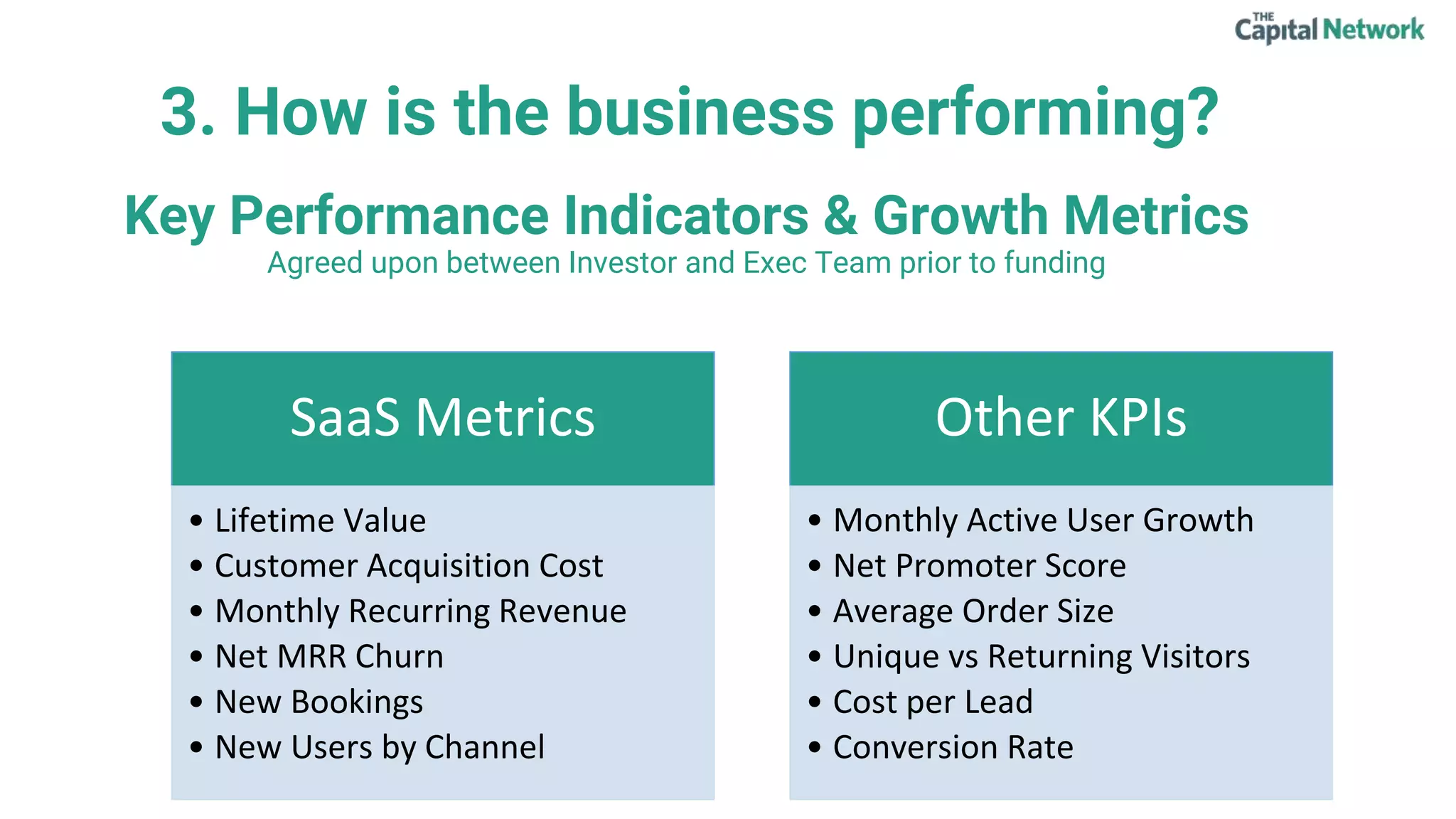

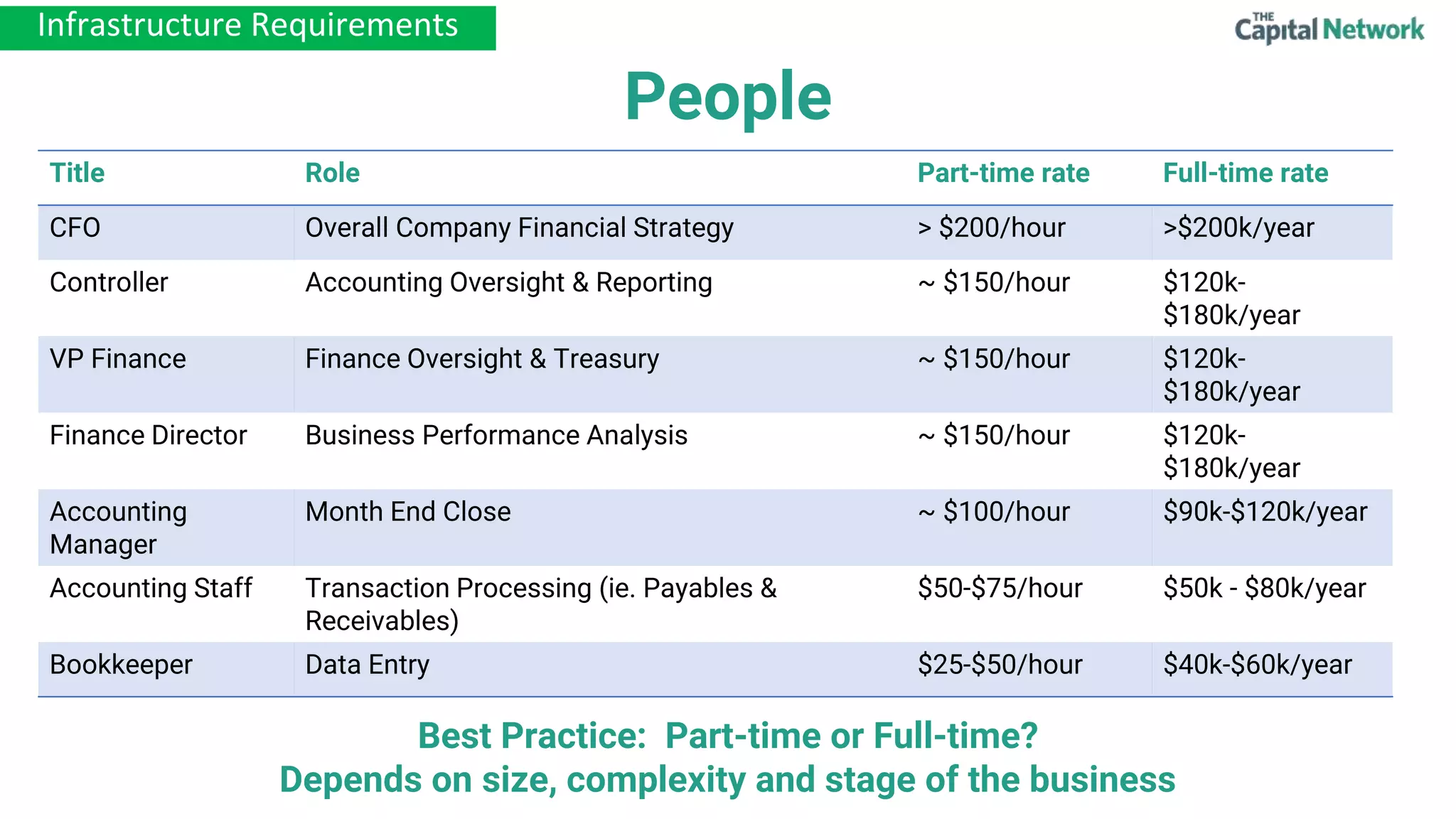

This document provides an overview of finance and accounting best practices for startups that have received funding. It discusses establishing systems and processes for tracking money flow, communicating financial information to investors, and planning budgets and cash forecasts. The presenters have extensive experience and will help founders understand new responsibilities, outline best practices, and prepare to answer investors' key questions about how funding is being used, when the money will run out, and how the business is performing.