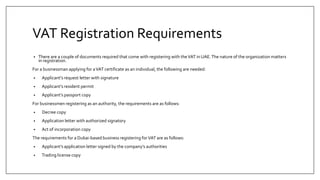

The United Arab Emirates implemented Value Added Tax (VAT) at a rate of 5% in 2018, which affects most goods and services, exempting necessities like food, healthcare, and education. Businesses exceeding AED 375,000 in supplies must register, ensuring their financial records comply with updated regulations. The VAT registration process is online via the Federal Tax Authority's website, requiring specific documentation based on the nature of the business.