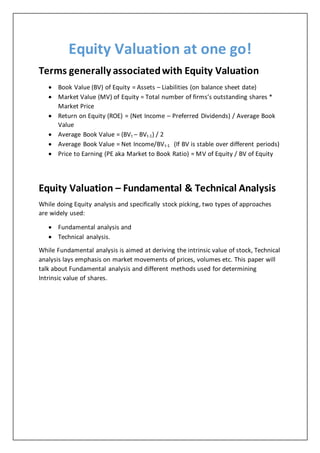

Equity valuation at one go

- 1. Equity Valuation at one go! Terms generally associatedwith Equity Valuation Book Value (BV) of Equity = Assets – Liabilities (on balance sheet date) Market Value (MV) of Equity = Total number of firms’s outstanding shares * Market Price Return on Equity (ROE) = (Net Income – Preferred Dividends) / Average Book Value Average Book Value = (BVt – BVt-1) / 2 Average Book Value = Net Income/BVt-1 (If BV is stable over different periods) Price to Earning (PE aka Market to Book Ratio) = MV of Equity / BV of Equity Equity Valuation – Fundamental & Technical Analysis While doing Equity analysis and specifically stock picking, two types of approaches are widely used: Fundamental analysis and Technical analysis. While Fundamental analysis is aimed at deriving the intrinsic value of stock, Technical analysis lays emphasis on market movements of prices, volumes etc. This paper will talk about Fundamental analysis and different methods used for determining Intrinsic value of shares.

- 2. Equity Valuation Models (for doing Fundamental analysis) Balance Sheet Methods, as the name suggestsare basedon data available inthe balance sheet. Book Value Method BookValue of Equity => NetWorth of the Company NetWorth = EquityShare Capital + Reserves&Surplus+Preference Share Capital –Miscellaneous Expenditure (inBalance Sheet) –AccumulatedLosses LiquidationValue Method LiquidationValueof Equity=NetRealizable Value of all assets –Amountpaidtoall Creditors includingPreference Shareholders ReplacementValue Method Value of Equity= Replacementcostof assets – Liabilities Discounted Cash Flow Methods, findsPresentValue of future cashflowstoderive Present Value of Equity. The followingchartshows,differentmodelsusedfordifferentperiodsof dividends and differentdividend growthassumptions. Single PeriodModel Value of firm= NetIncome / DiscountingRate Stock Price = (ExpectedDividendafteryear1) /(1+DiscountingRate) + (ExpectedPrice afteryear1) /(1+DiscountingRate) Multi PeriodModel Stock Price = {D1/(1+R)} + {D2/(1+R)2 } + {D3/(1+R)3 } +…………………+ {DN/(1+R)N } Where, D1 = Dividend after year 1 D2 = Dividend after year 2 & so on R = Expected Rate of Return or Cost of Equity

- 3. Zero GrowthModel Stock Price = Annual Dividends/RequiredRate of Return Constant Growth Model Stock Price = D1 / (K-G) Where, D1 = Dividend after year 1 K = Required Rate of Return or Discount Rate G = Expected Constant Growth Rate Two Stage Growth Model Stock Price = {D1/(1+R)} + {D2/(1+R)2 } + {D3/(1+R)3 } +…………………+ {DN/(1+R)N } +[{DN (1+G2)/(R- G2)}/(1+R)N ] Where, D1 = Dividend after year 1 R = Required Rate of Return or Discount Rate G = Growth Rate G2 = Growth Rate at stage 2 N = Number of years H Model Stock Price = {D (1+G2)}/(R-G2)+{(D*H*(G1-G2)}/(R-G2) Where, D = Current year Dividend R = Required Rate of Return or Discount Rate G = Initial Growth Rate G2 = Terminal Growth Rate H = Half of anticipated transition Free Cash Flow Model Calculationandapproachissimilartothe DividendDiscountmodelsthe onlymajordifference being that insteadof Dividends, Free CashFlows are used forequityvaluation. Free CashFlows= OperatingCashFlow – CAPEX Relative Valuation Methods, are alsoknownas Comparable methodsbecause theyuse peers or competitorsvalue toderive atthe value of equity. P/E or Price to Earnings Ratio = Market Value PerShare /Earningsper share Price to Book Value aka Price Equity Ratio = Stock Price / Book Value of Share Price to Sales= Price pershare / Annual Salespershare