The document summarizes a survey of 100 university students in Peshawar, Pakistan about their cellular service usage and preferences. The key findings are:

1) Ufone is the most preferred cellular provider in Peshawar, with 31% of respondents preferring it, followed by Warid (24%) and Telenor (22%).

2) Friends have the strongest influence (49%) on respondents' decisions to purchase SIM cards, followed by self (23%) and family (20%).

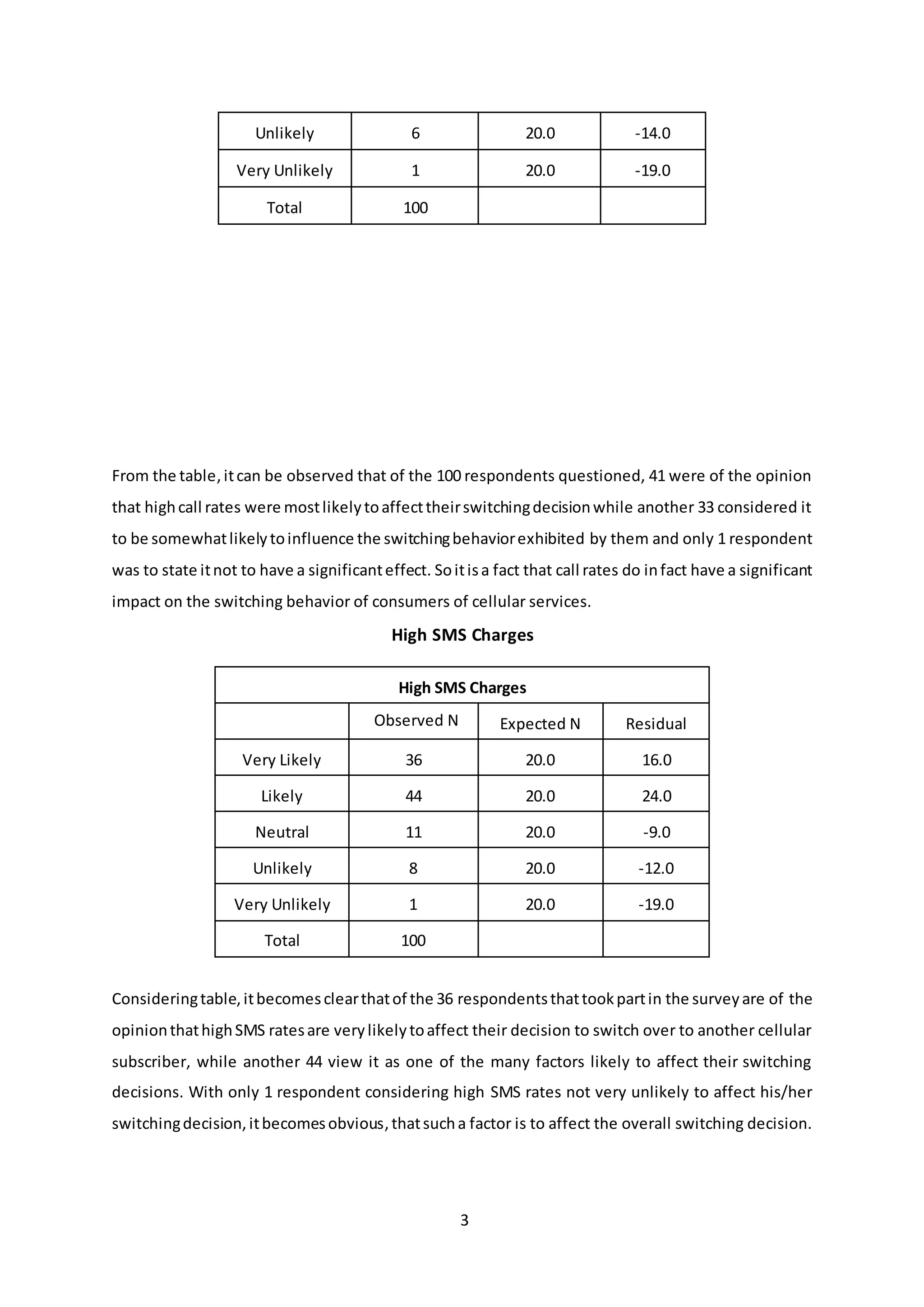

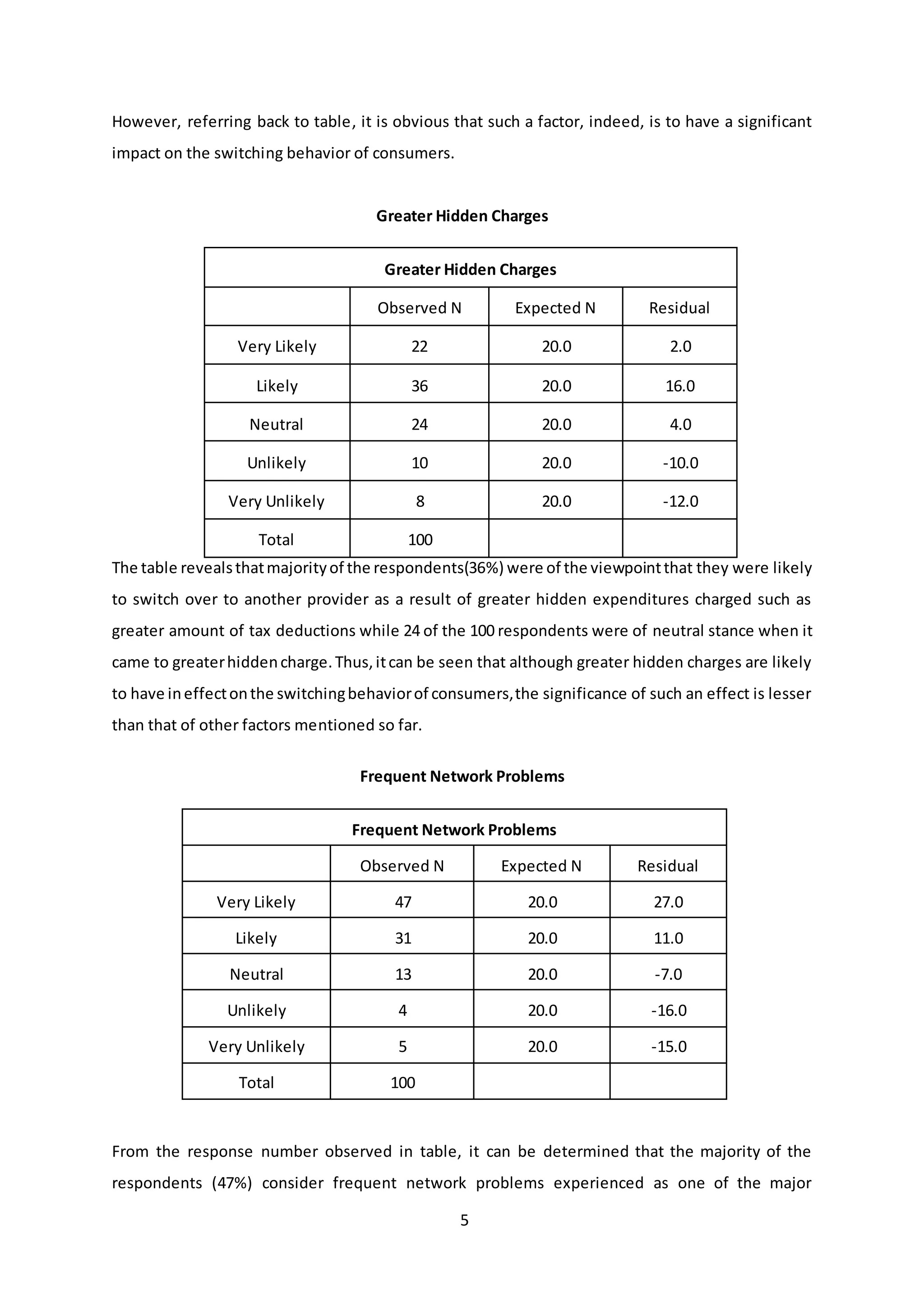

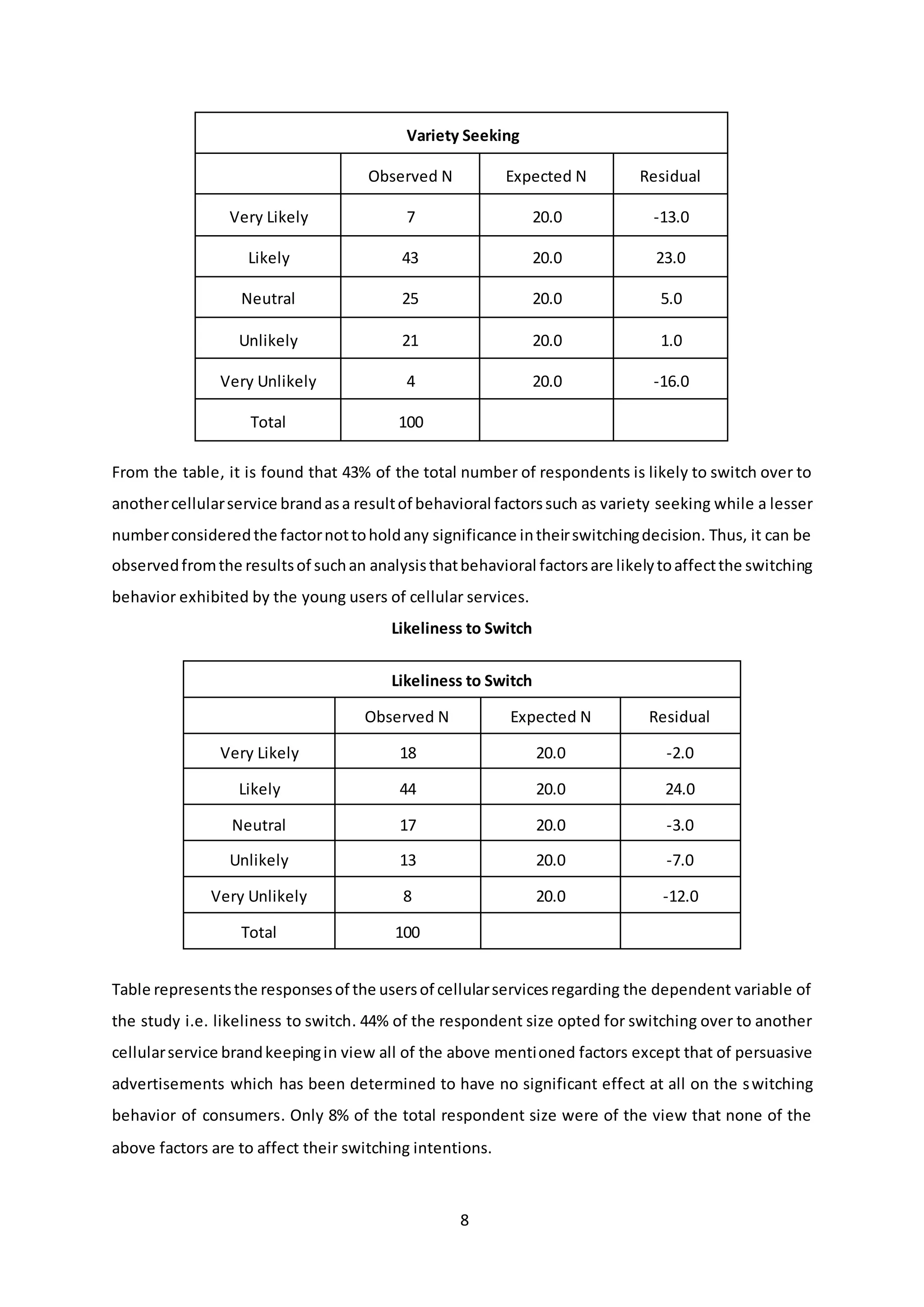

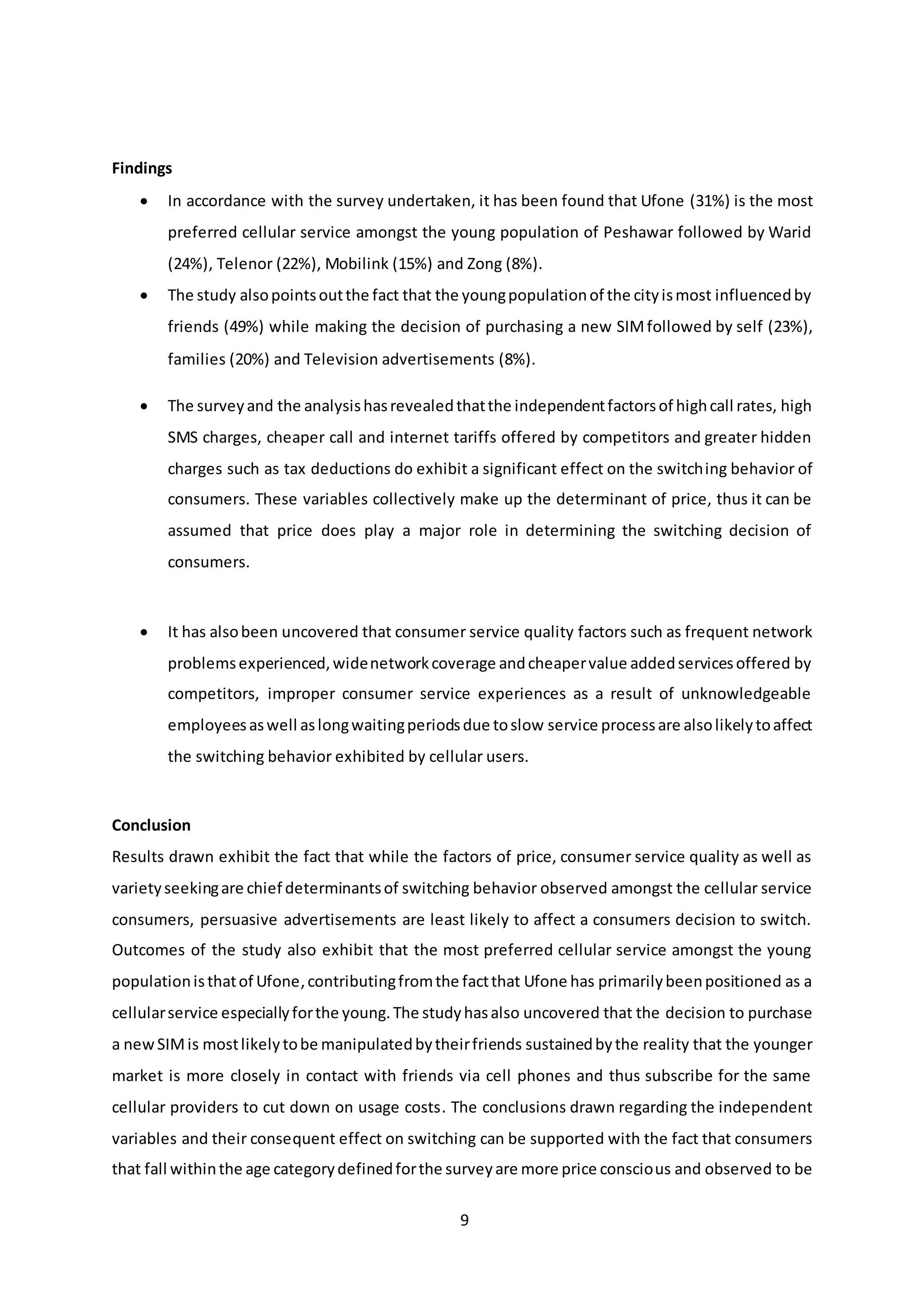

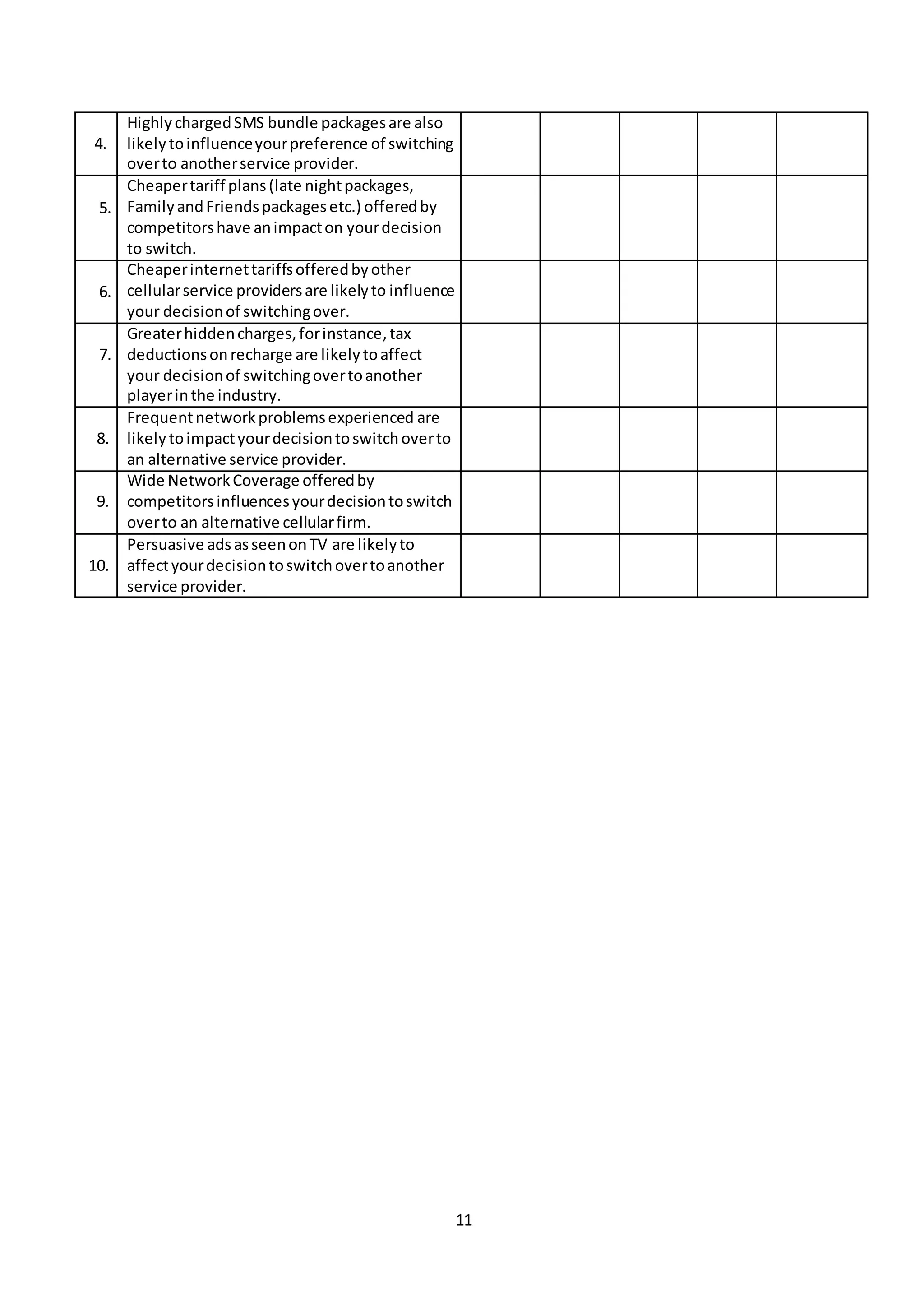

3) High call rates, frequent network problems, and cheaper tariff plans offered by competitors are the factors most likely to influence respondents to switch cellular providers.