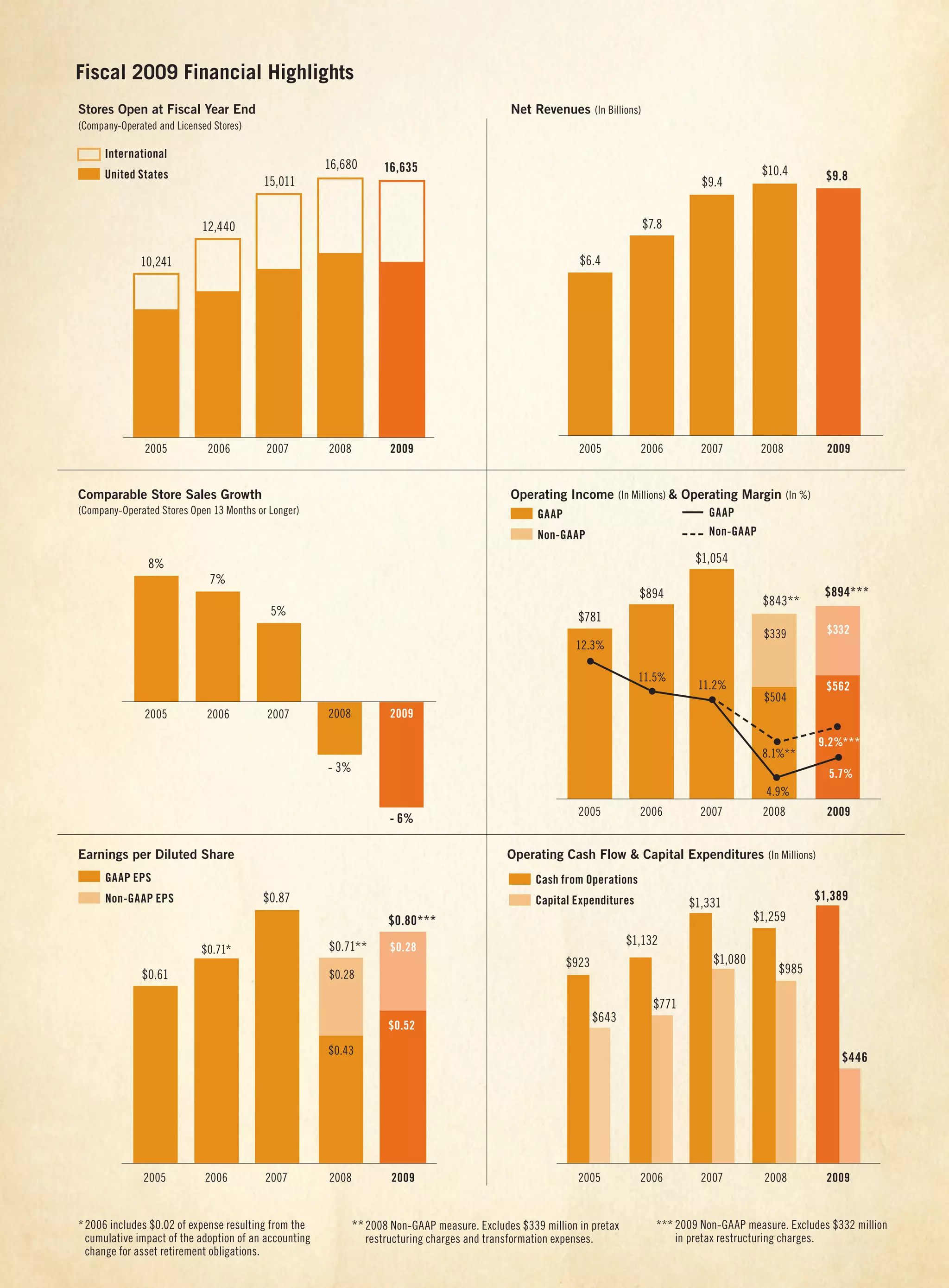

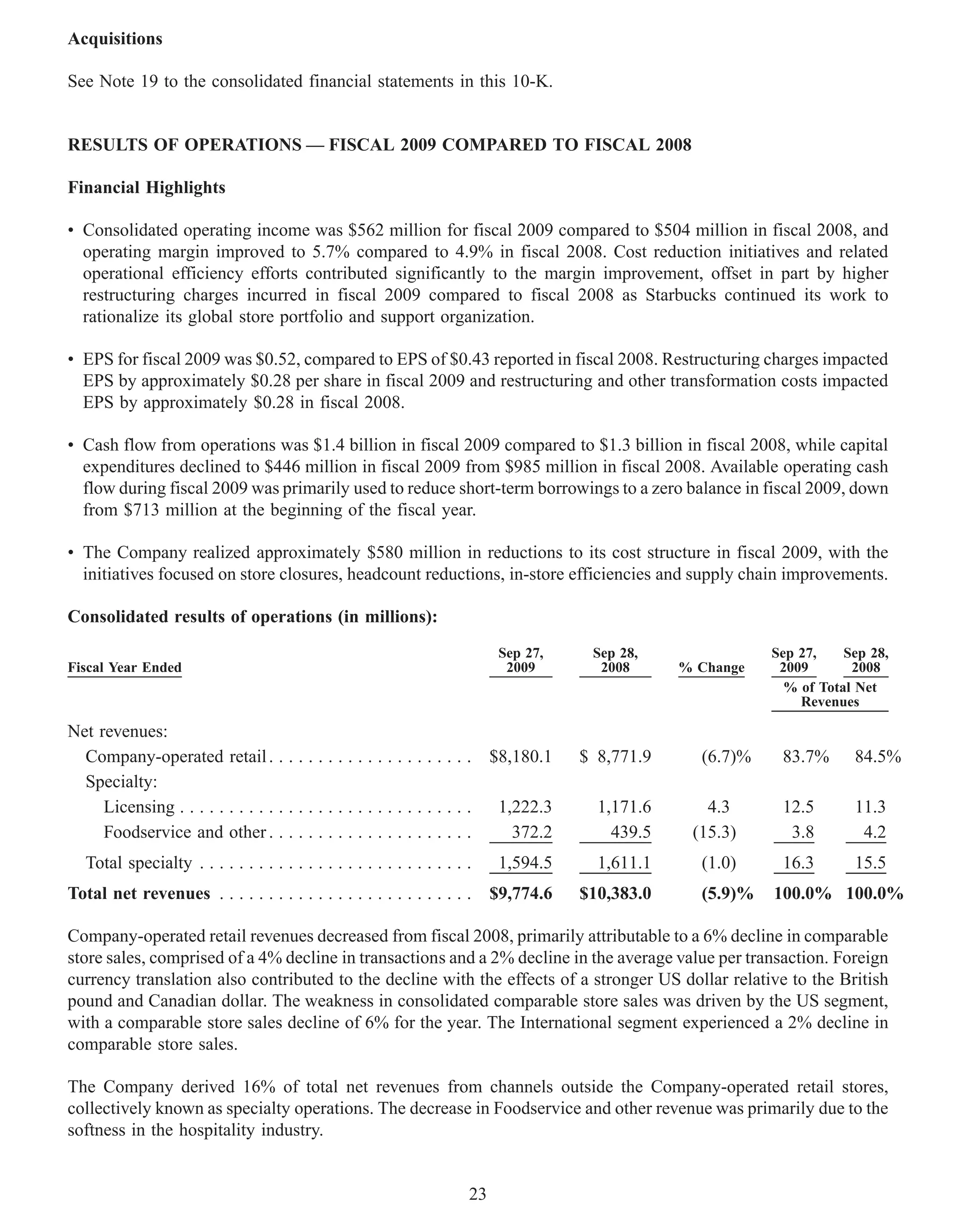

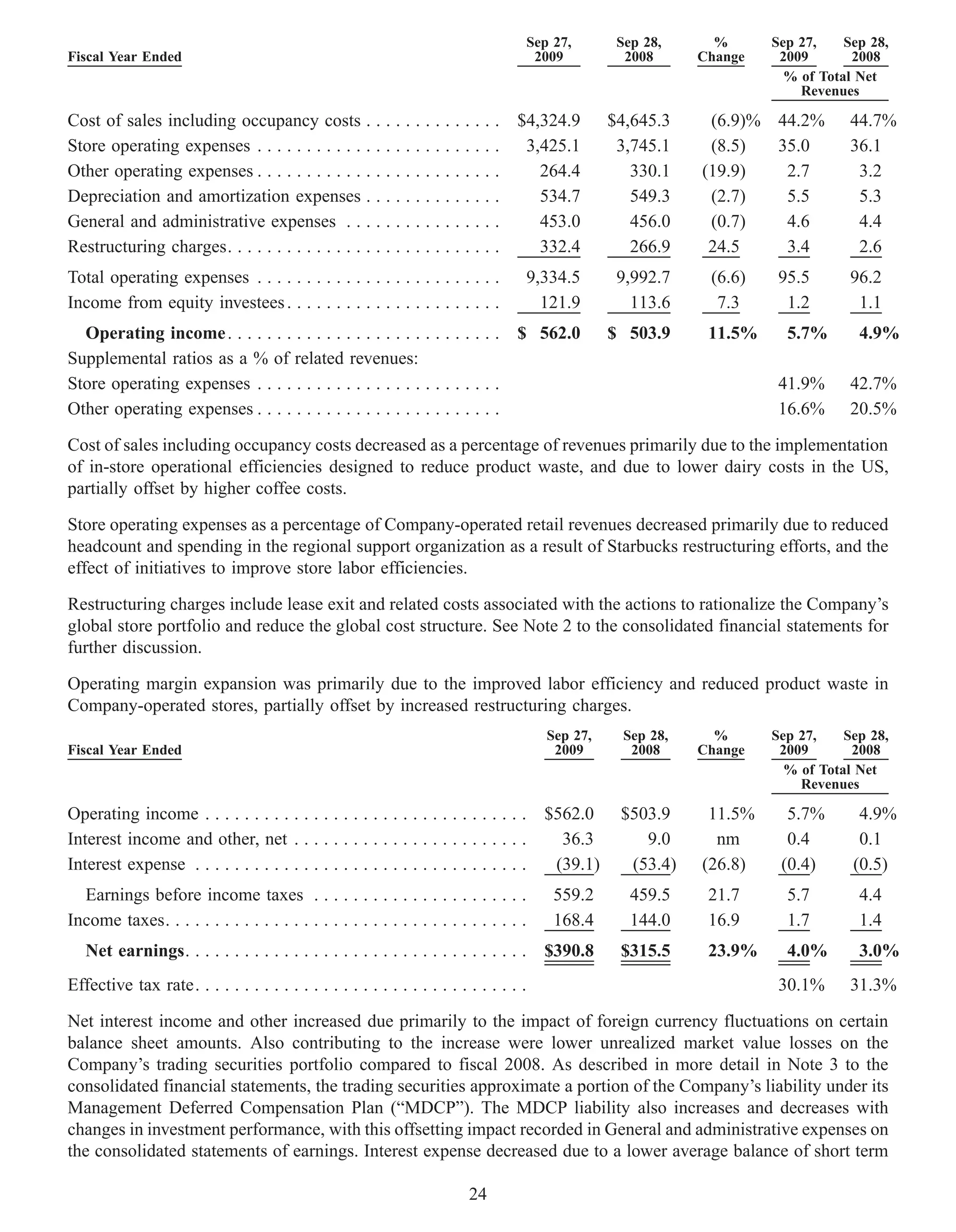

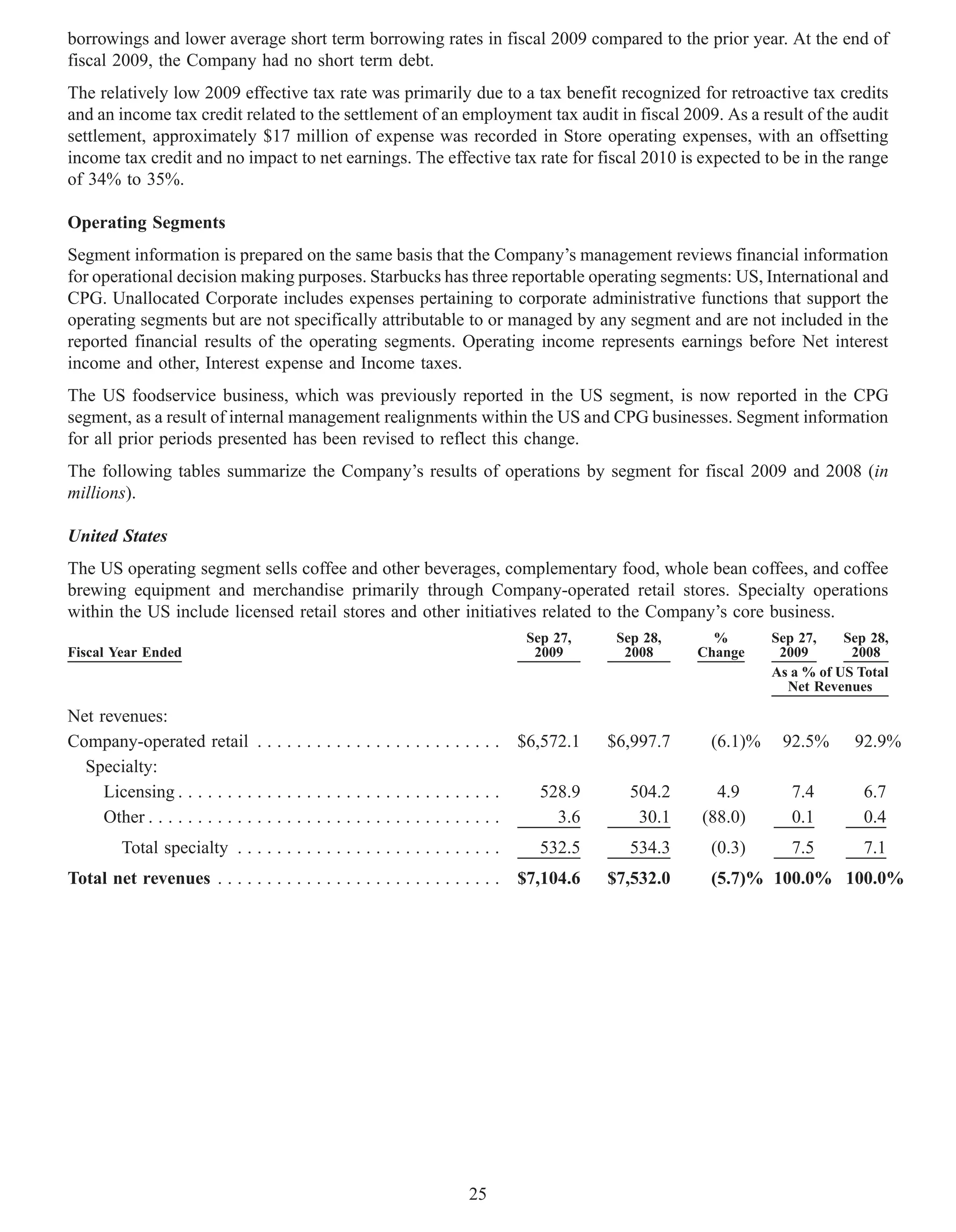

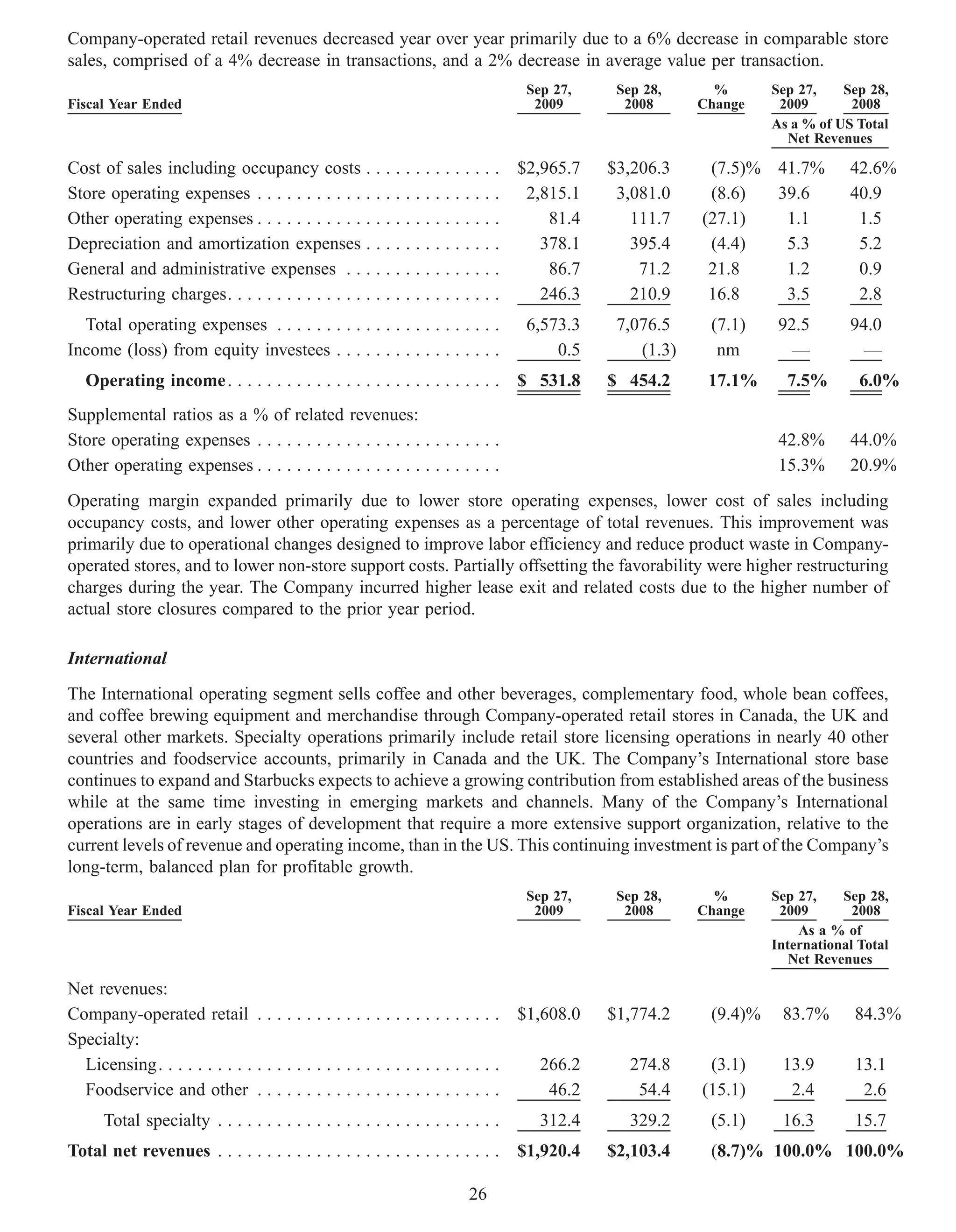

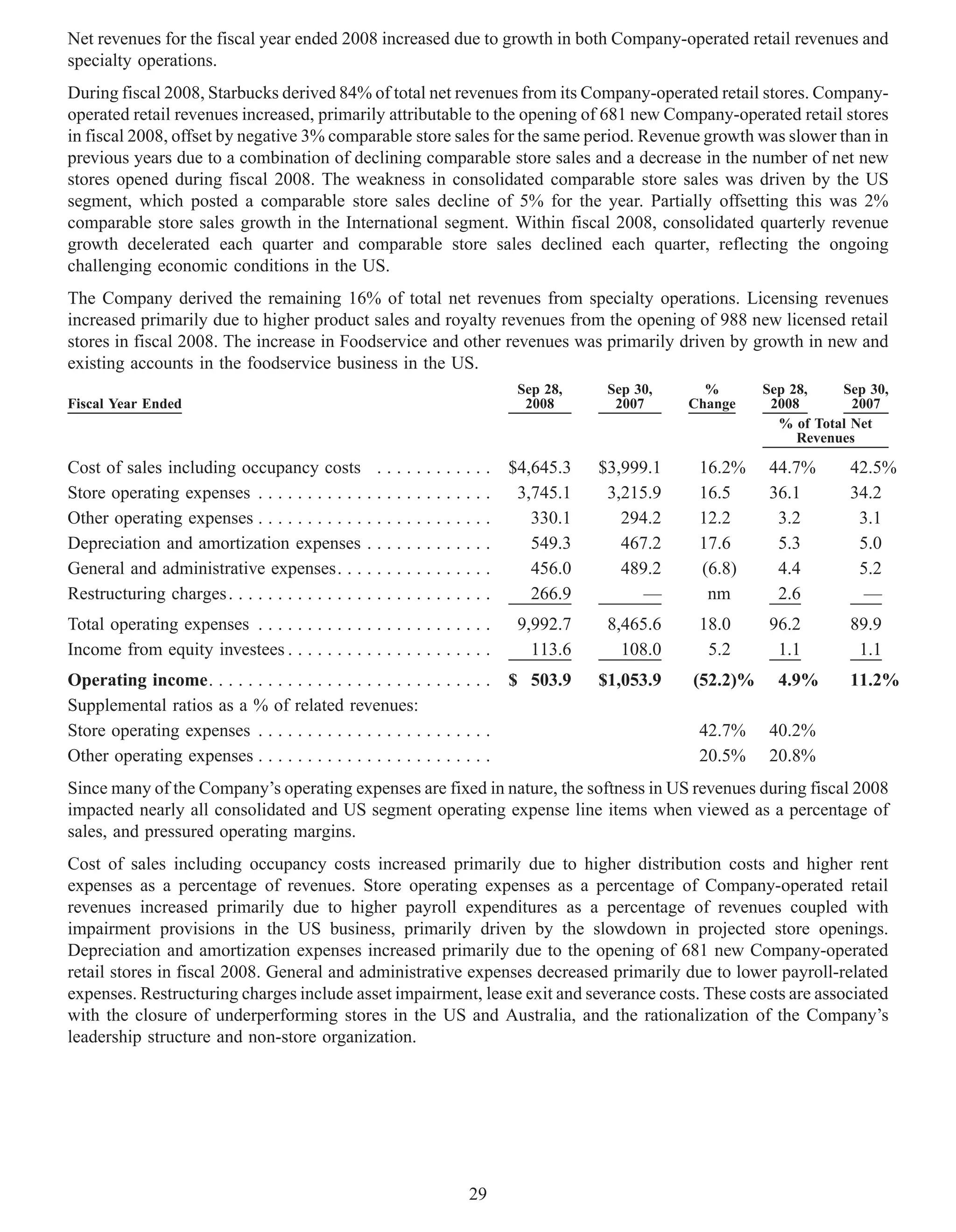

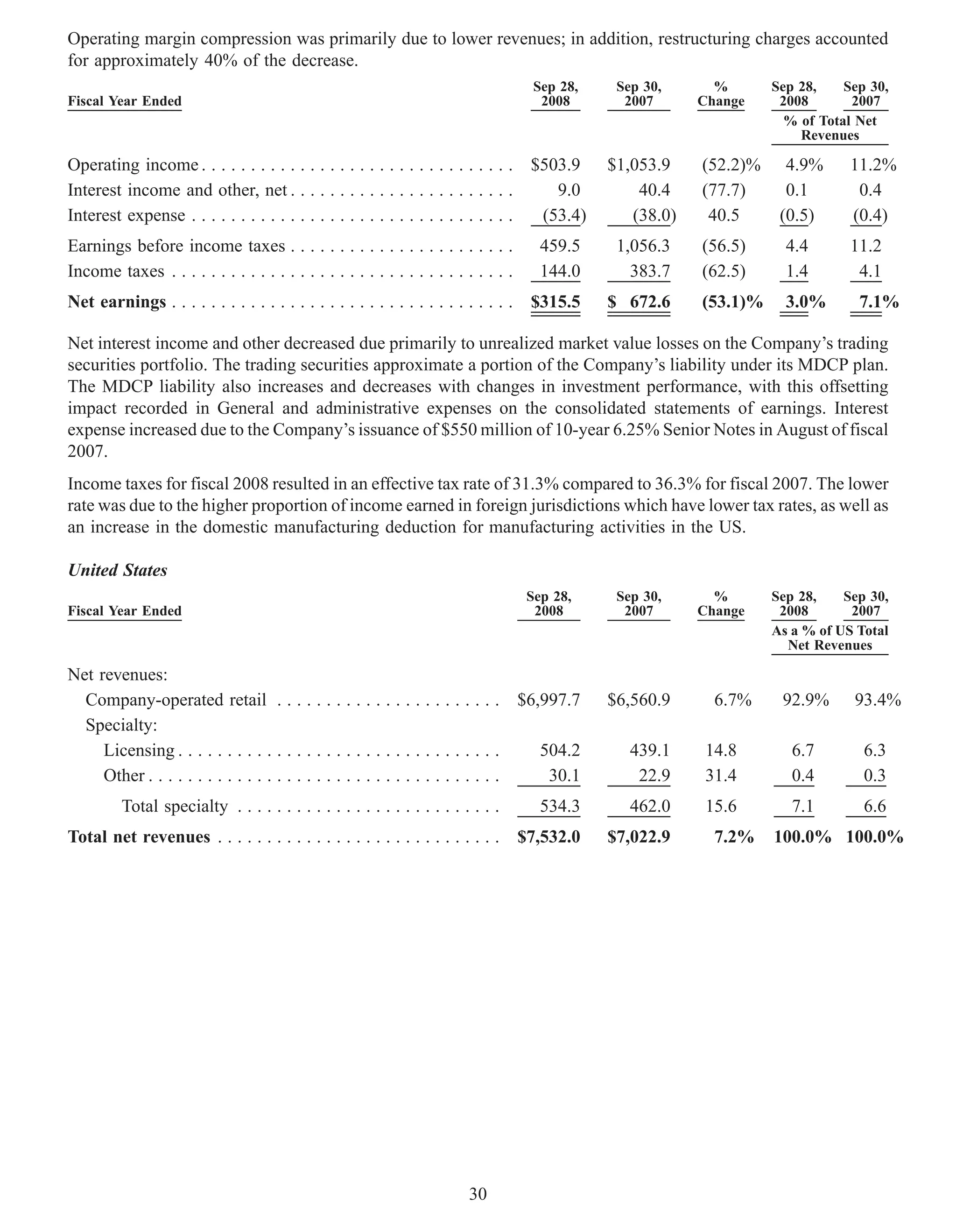

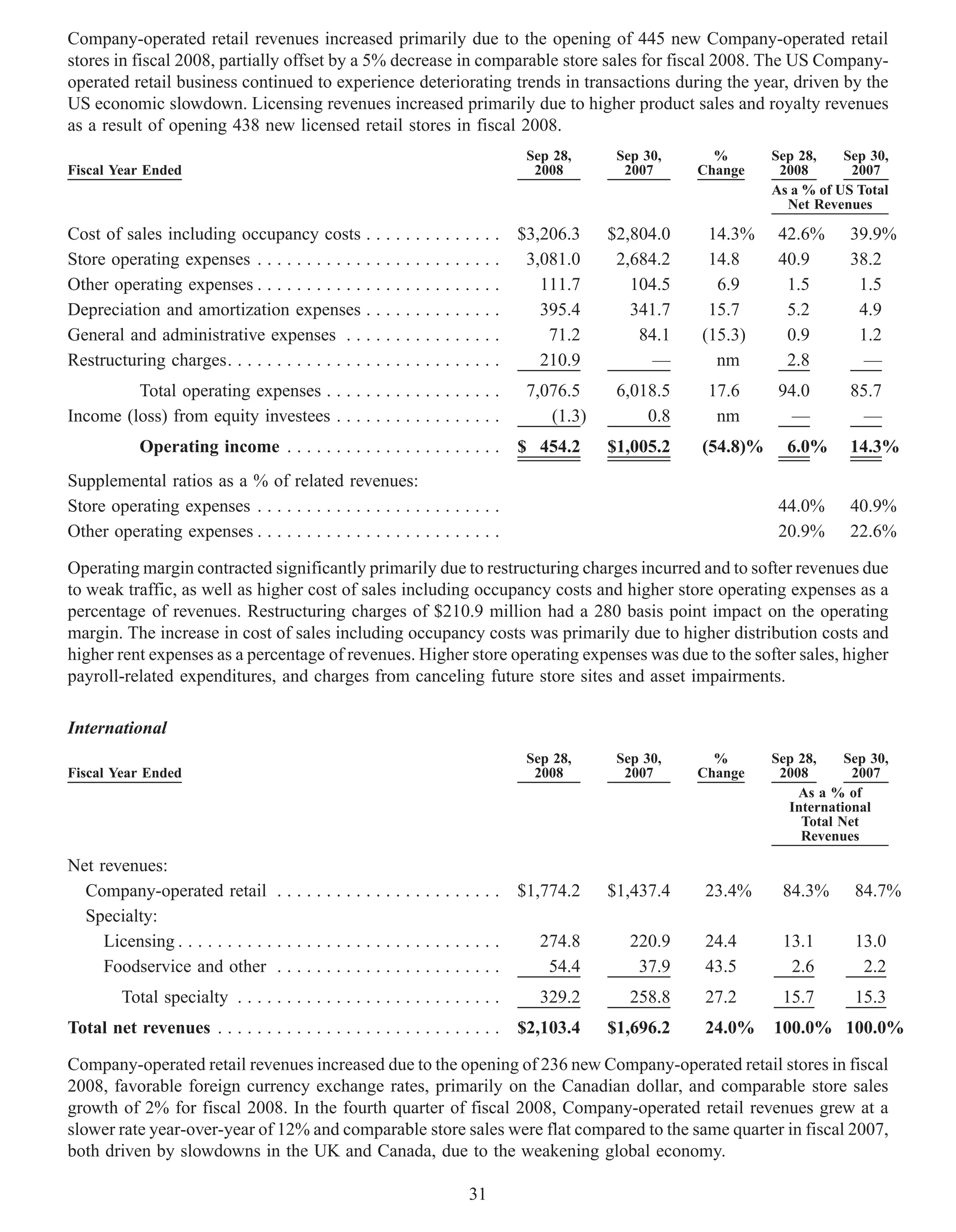

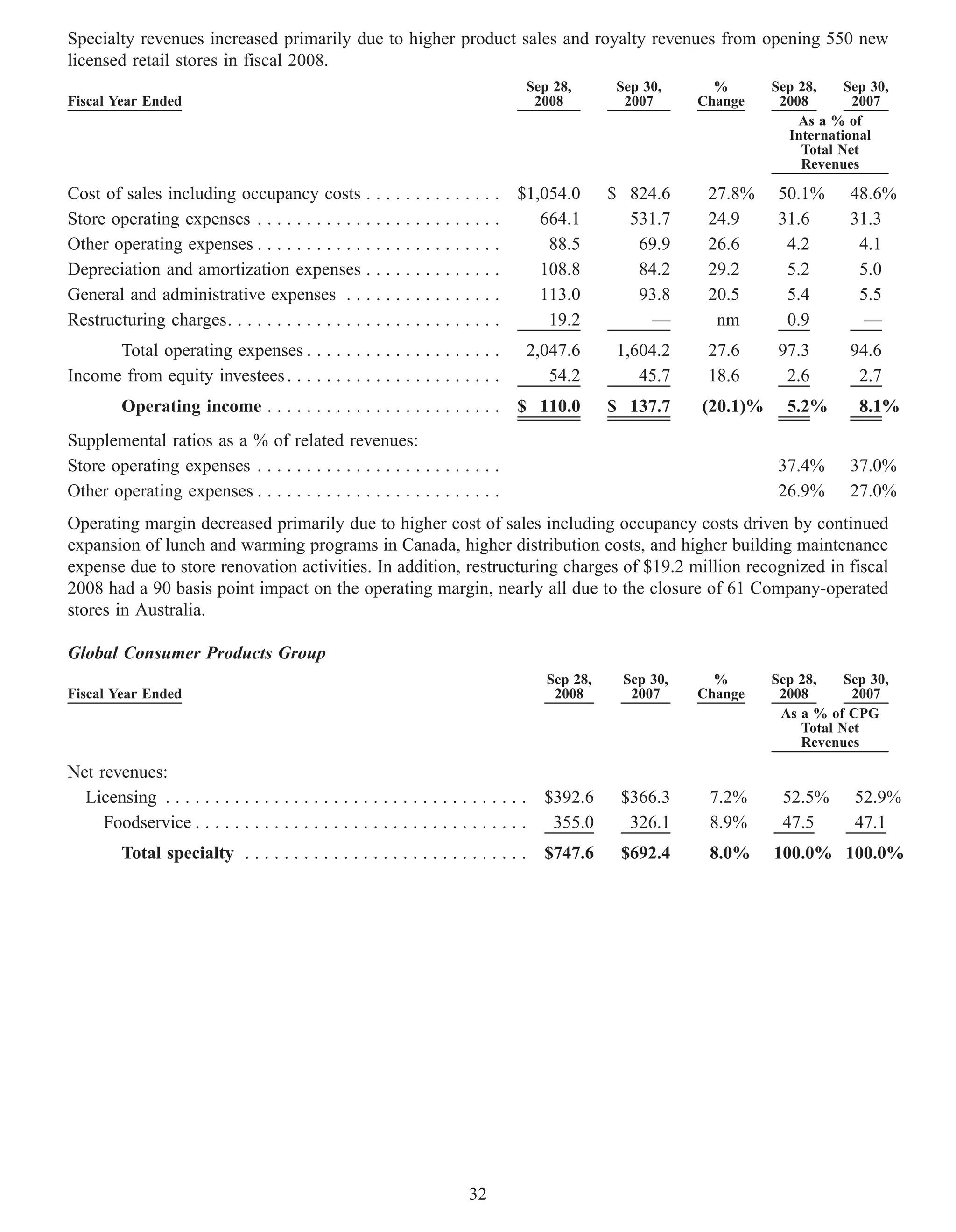

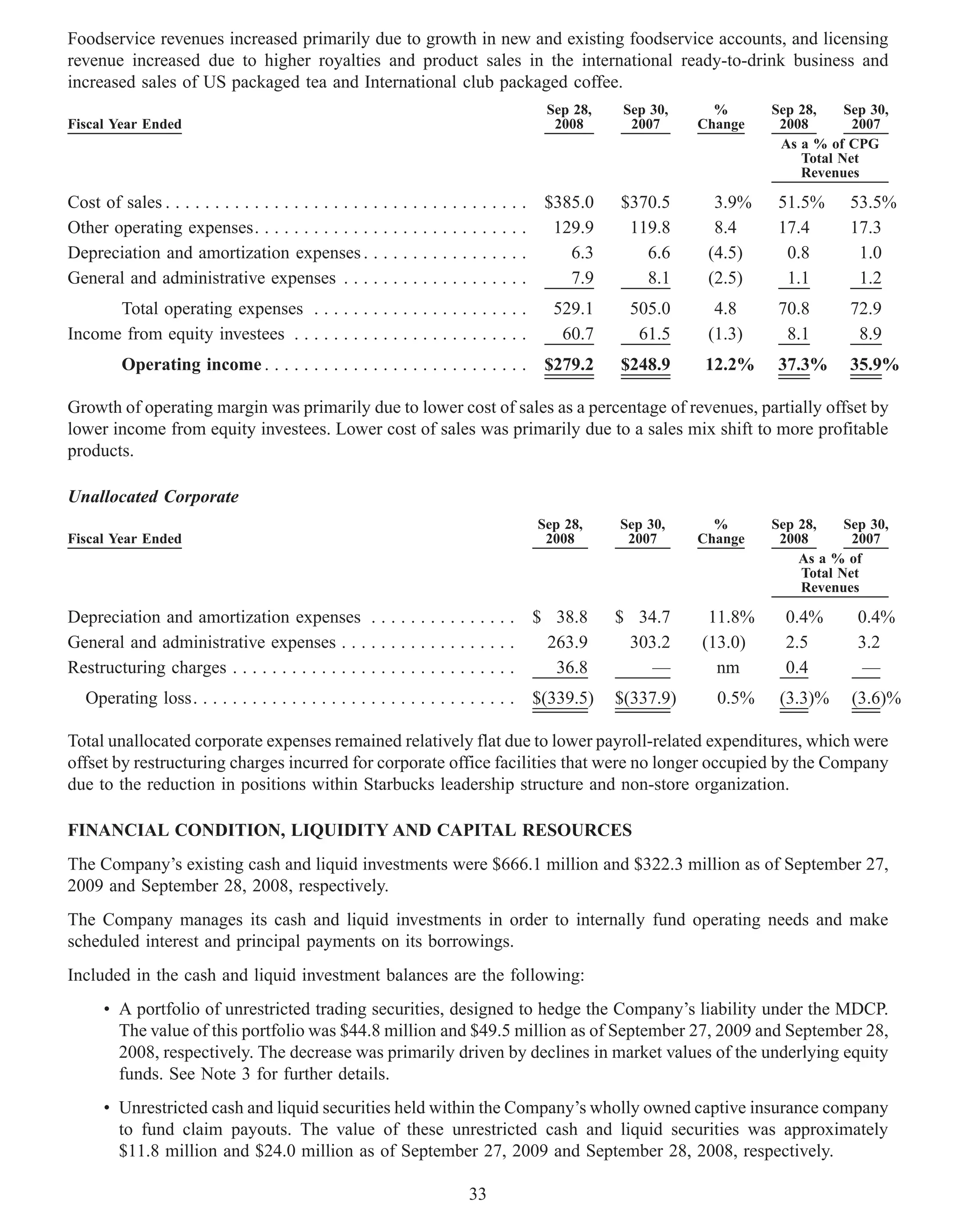

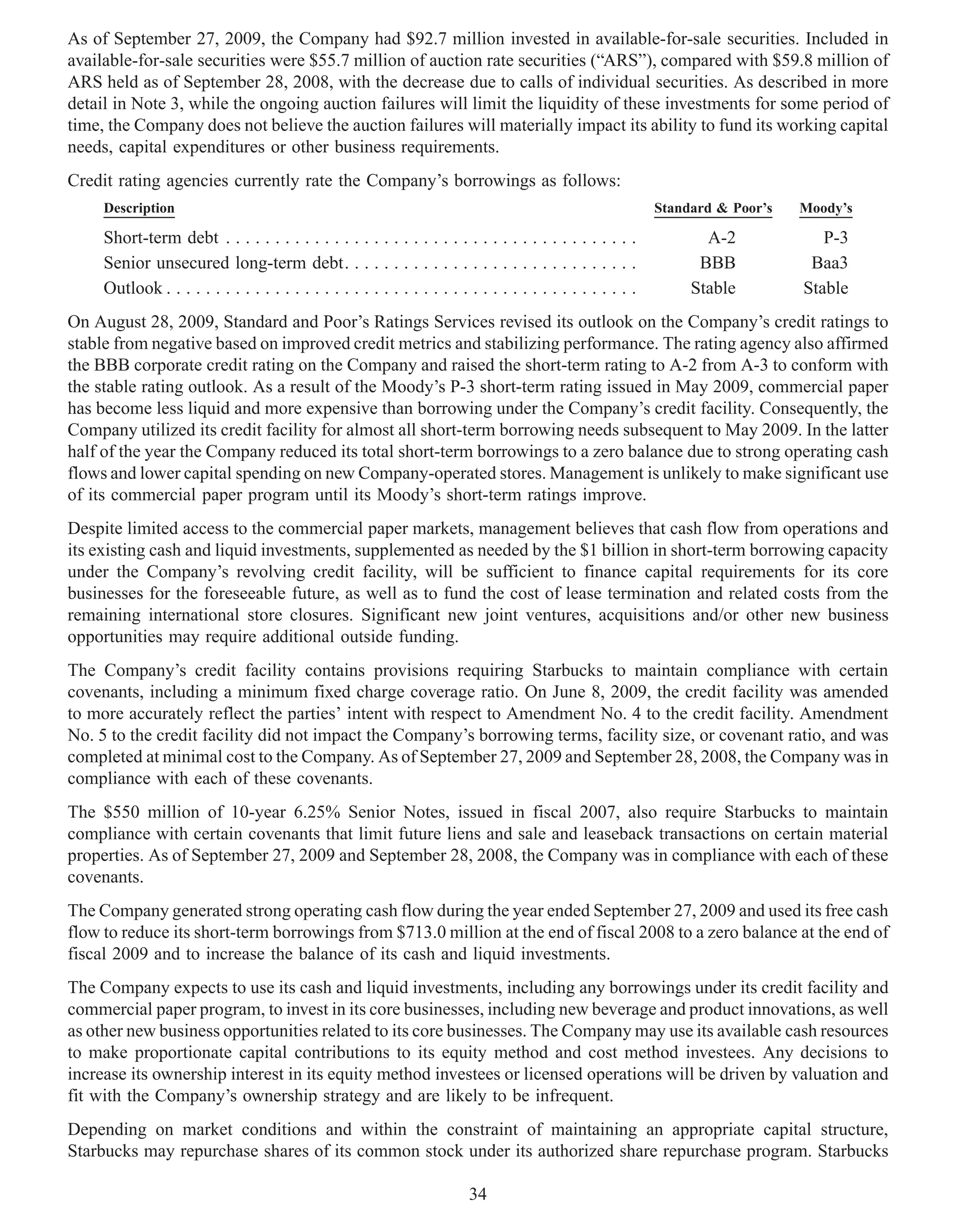

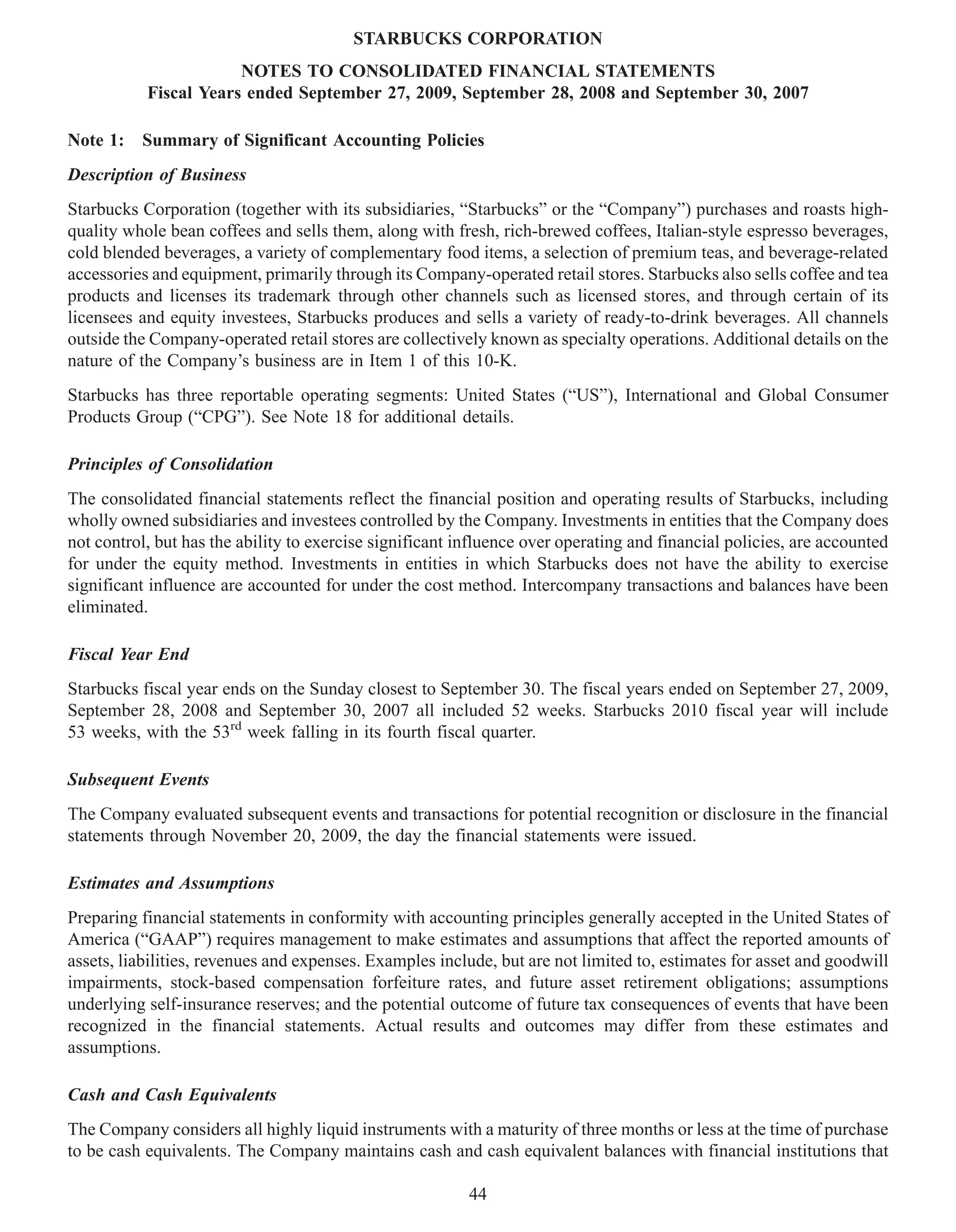

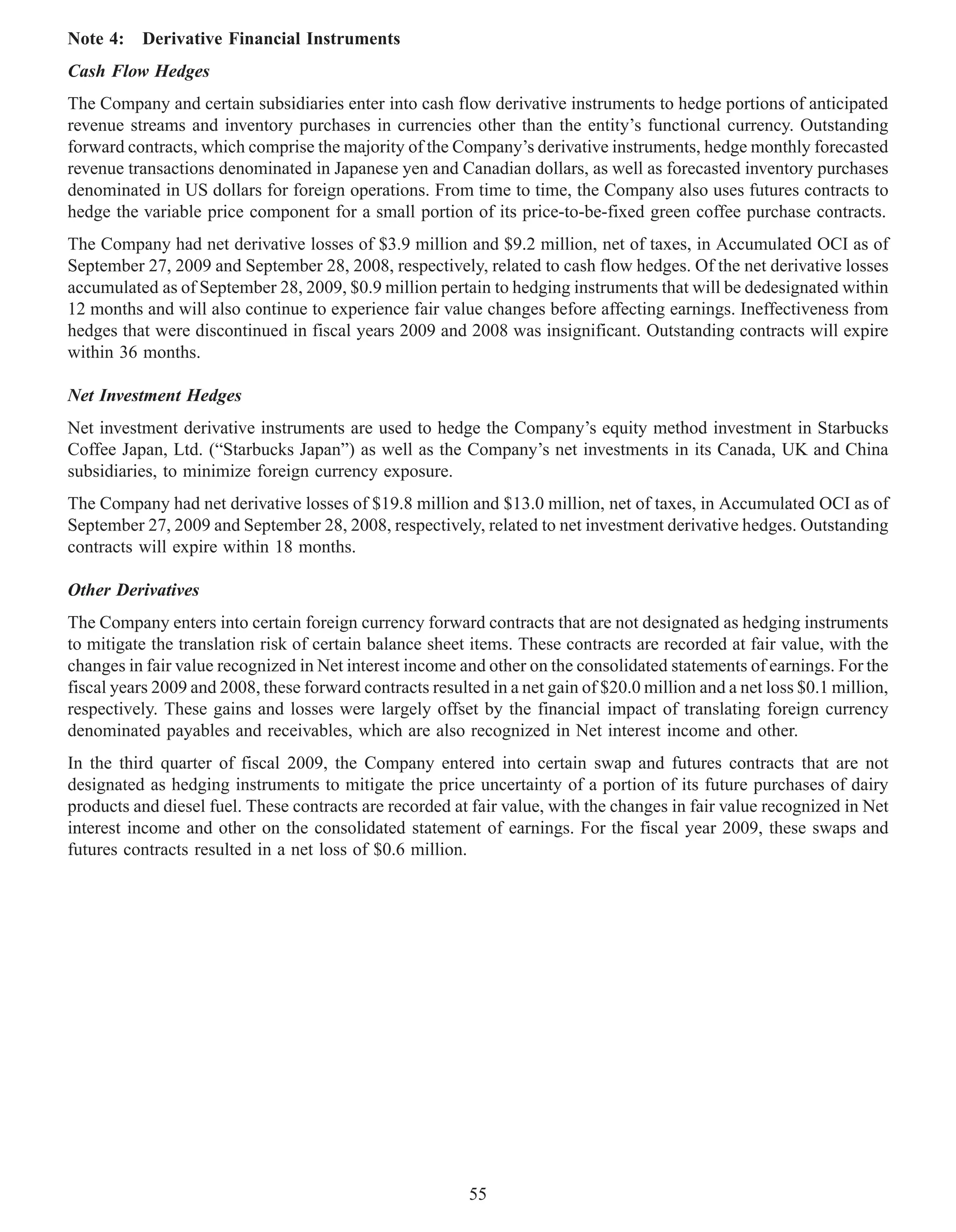

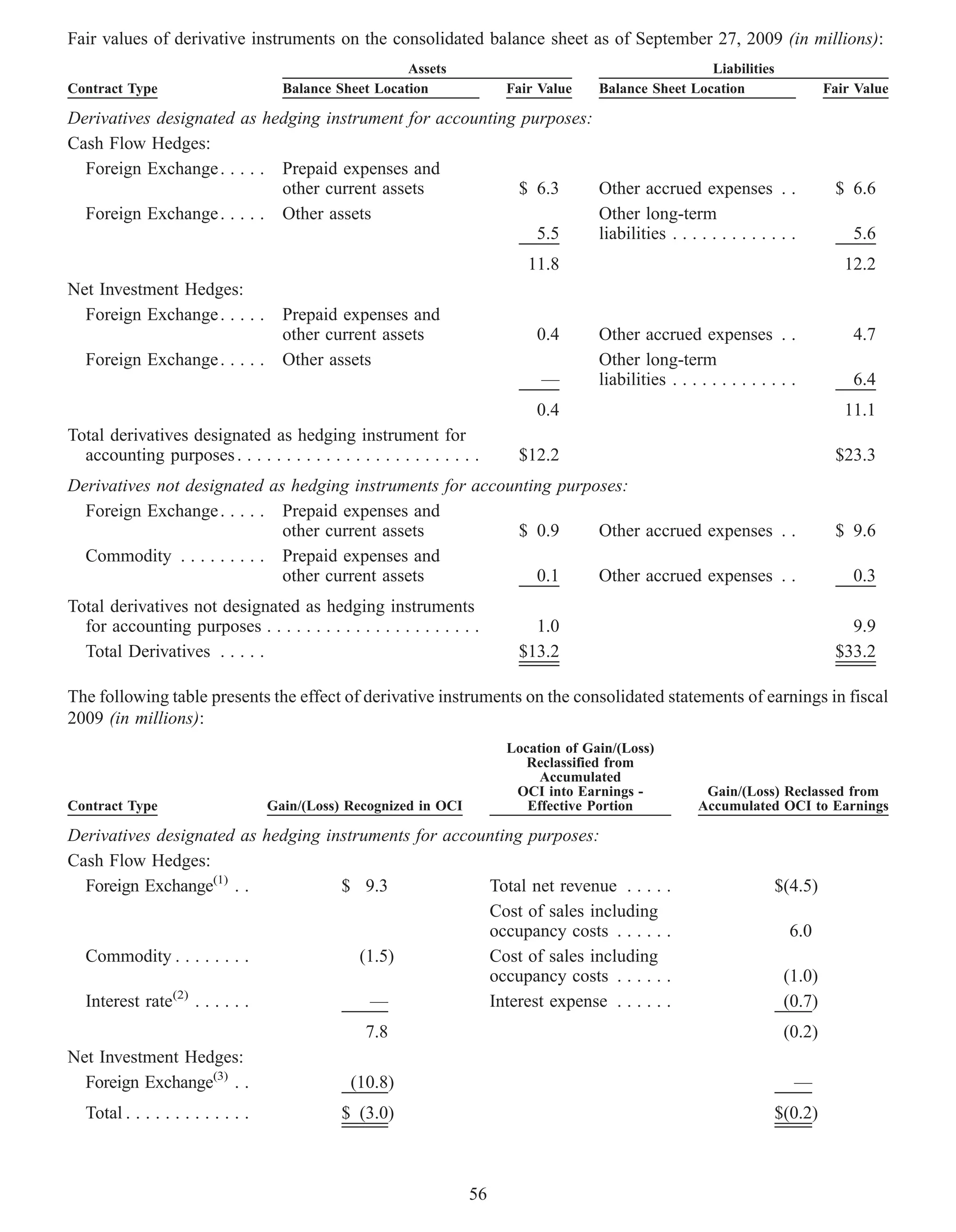

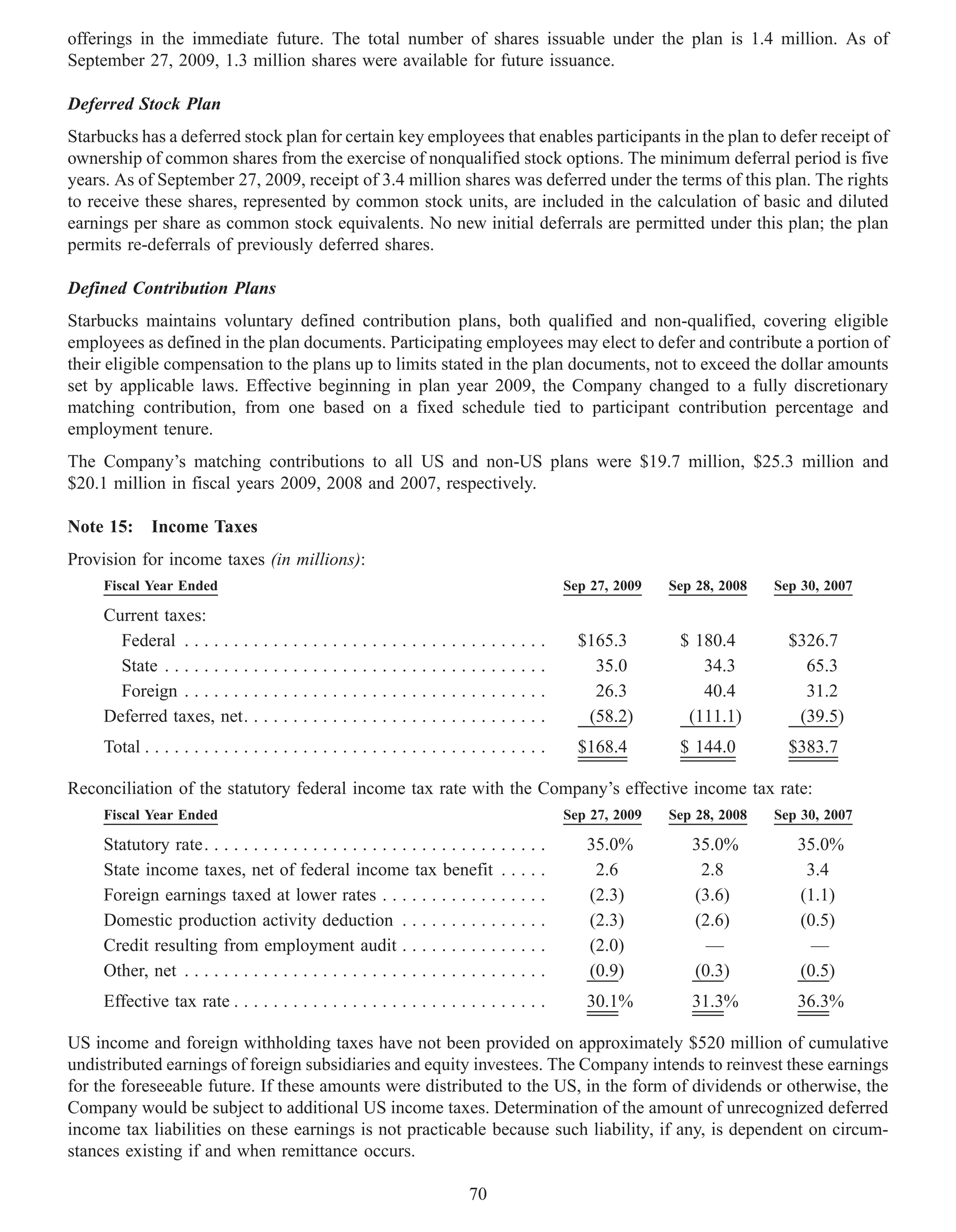

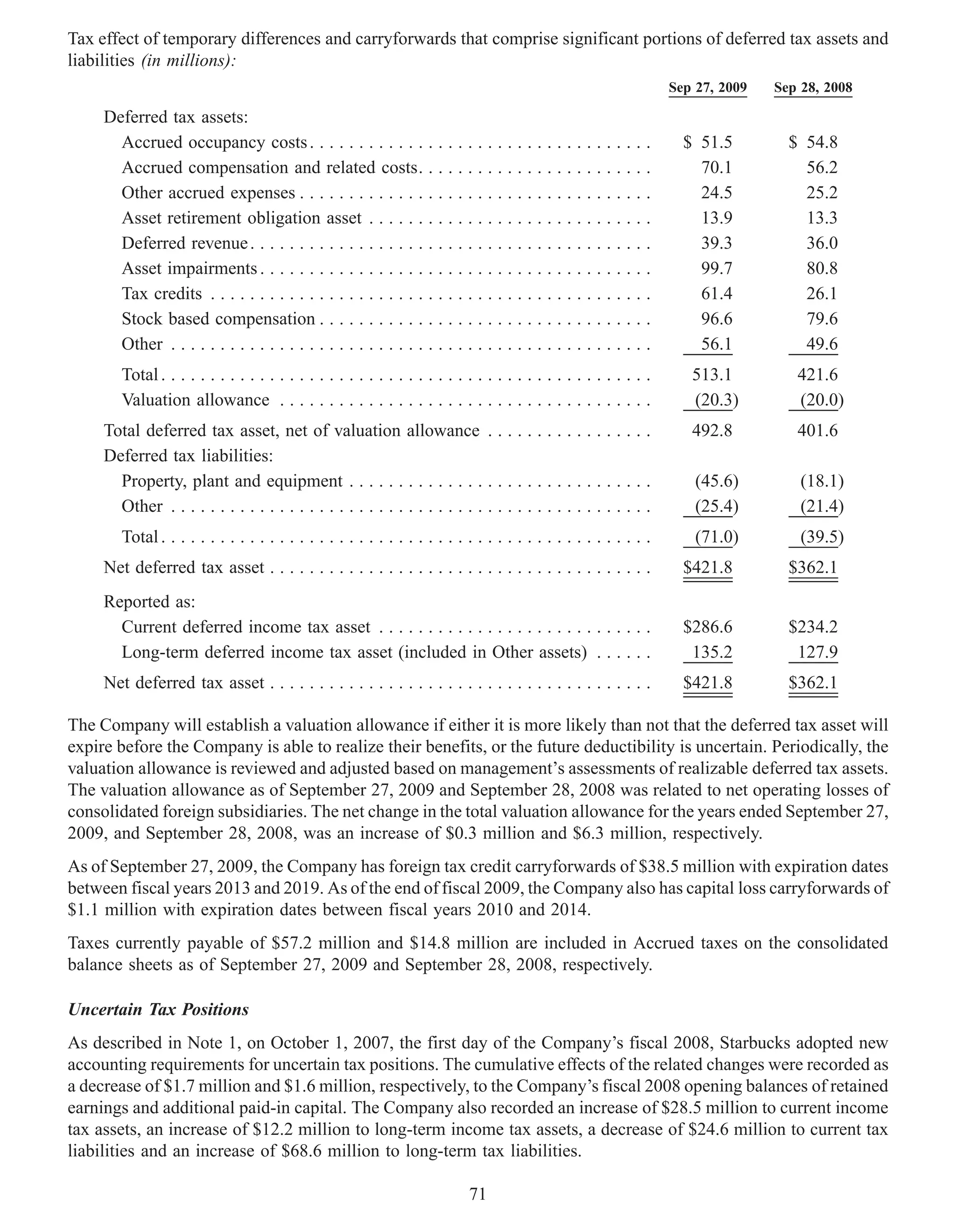

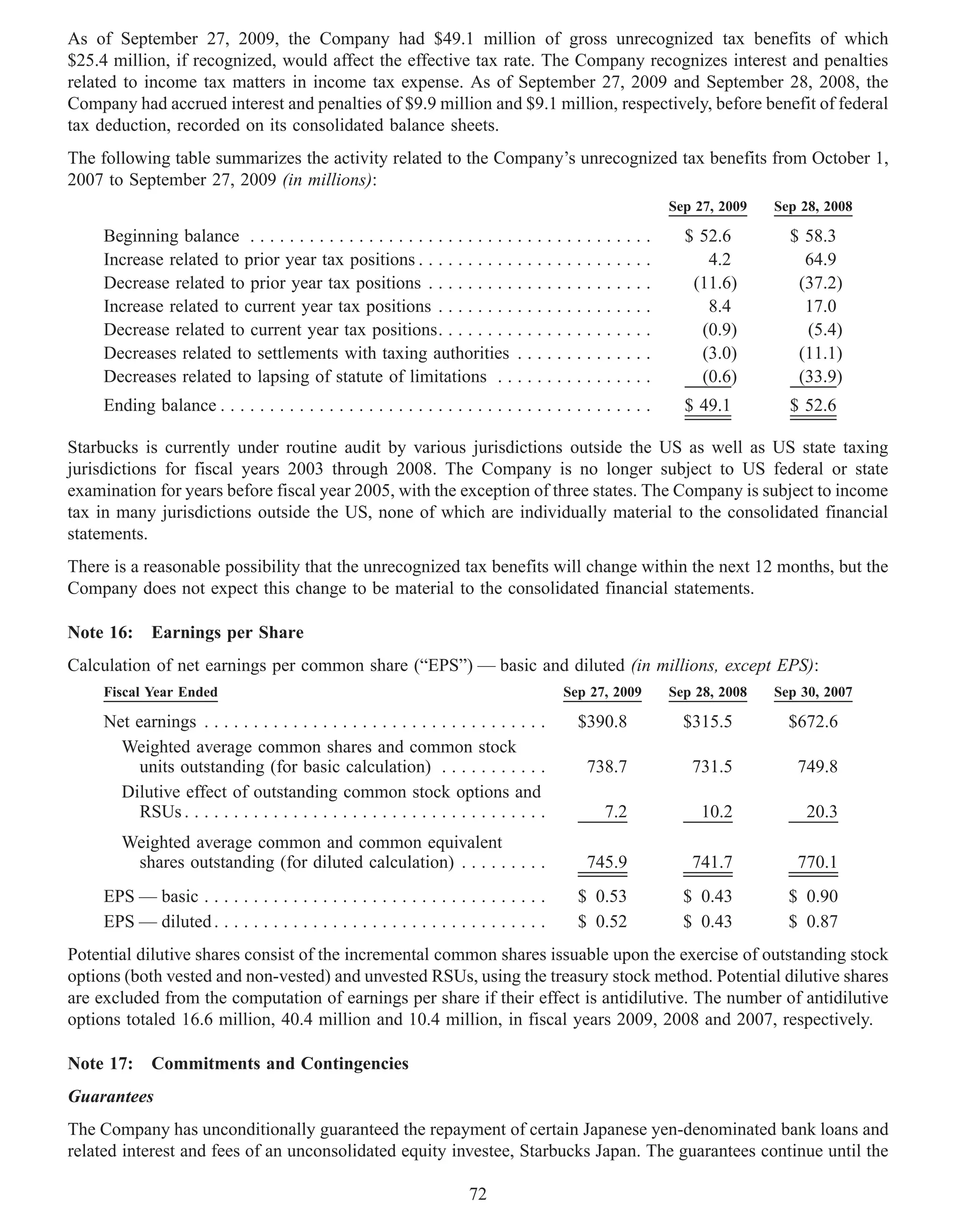

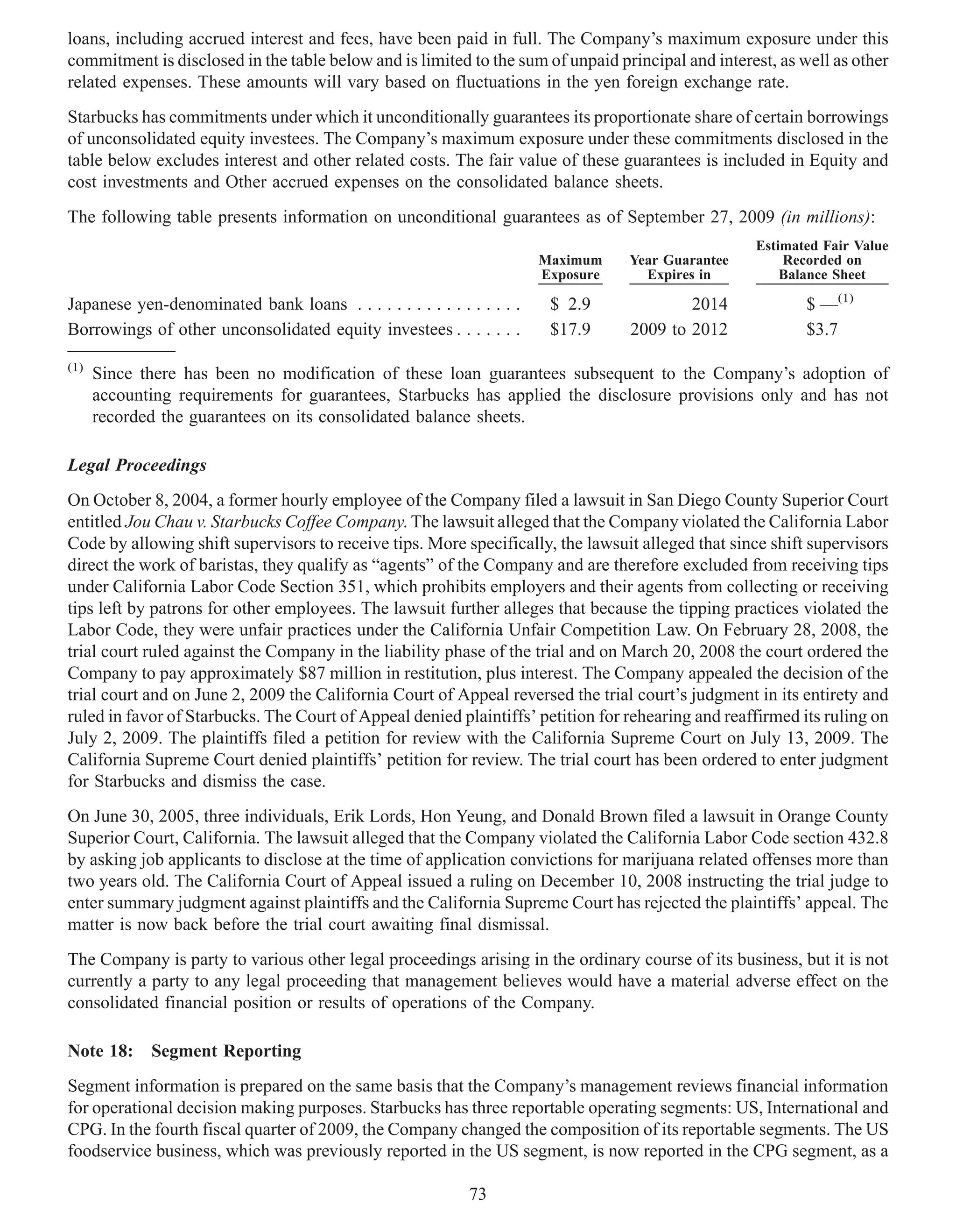

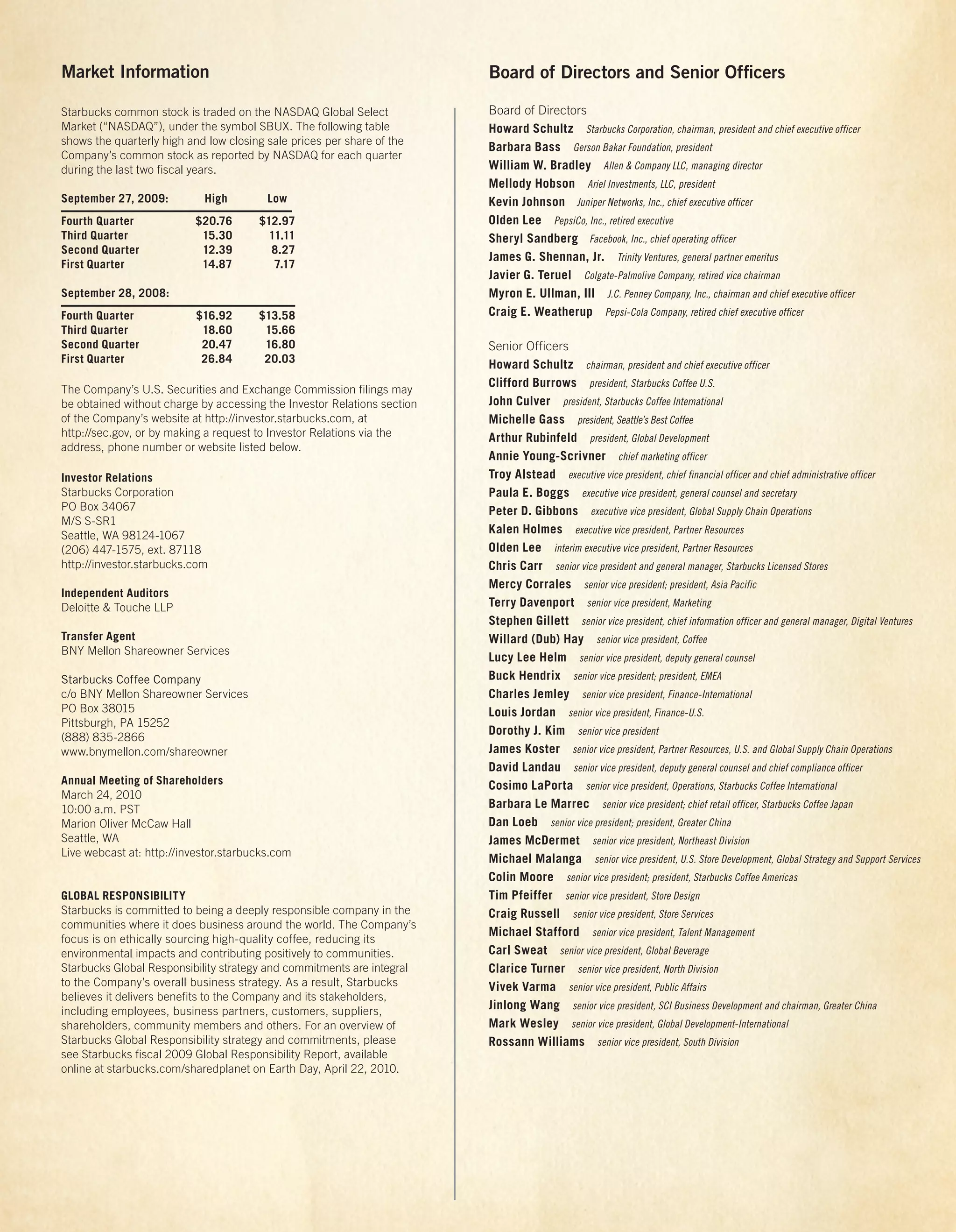

Starbucks Corporation's 2009 Annual Report summarizes the company's financial performance and transformation efforts during fiscal year 2009. Key highlights include generating $10.4 billion in net revenues, opening over 1,000 new stores internationally and in the United States, and implementing a transformation agenda focused on improving operations, renewing the customer experience, and realigning the organization for long-term growth. As part of the transformation, Starbucks reduced costs by $580 million, improved employee training and store operations, increased customer satisfaction scores by 10 percentage points, and launched new products and value offerings to attract customers during the economic downturn.