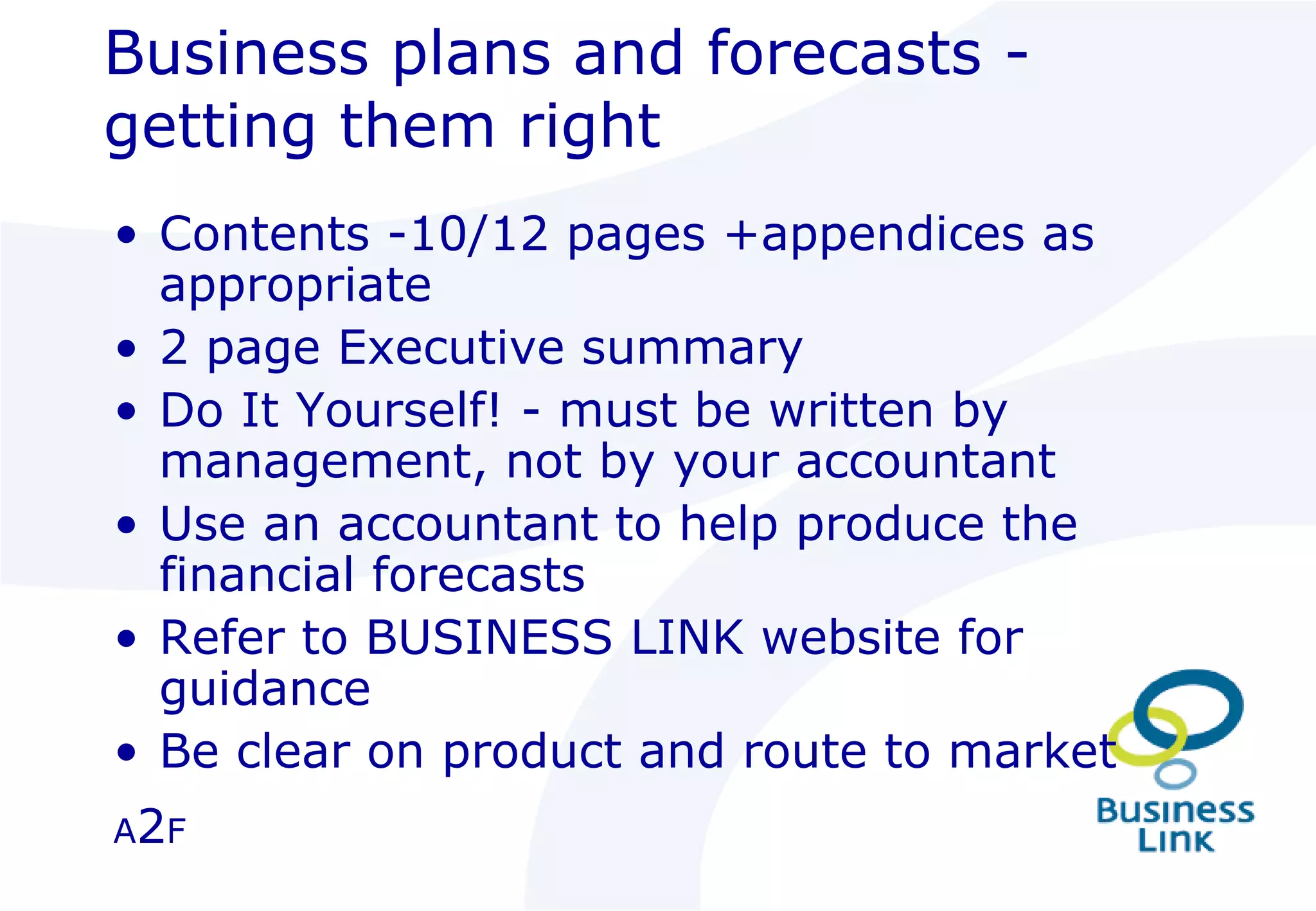

This document summarizes various business finance options for companies. It discusses the main differences between debt and equity financing. It also outlines specific financing options like bank loans, asset financing, factoring, and regional funding schemes. The document provides advice on meeting the expectations of funders for both debt and equity. It emphasizes the importance of a strong business plan and financial forecasts in preparing for and obtaining financing.