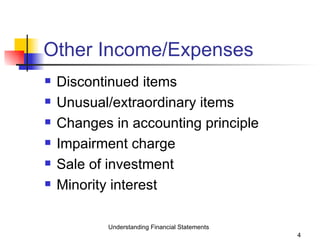

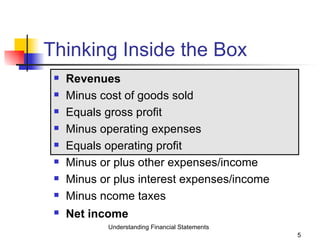

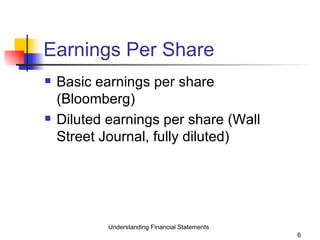

The document outlines key concepts for understanding financial statements, including income statements, balance sheets, and cash flow analysis. It emphasizes the calculation of various financial metrics such as gross profit, operating profit, and earnings per share, along with analysis techniques like common size analysis and ratio analysis to evaluate company performance. The seminar encourages identifying trends and significant changes in financial metrics to better understand a company's financial health.