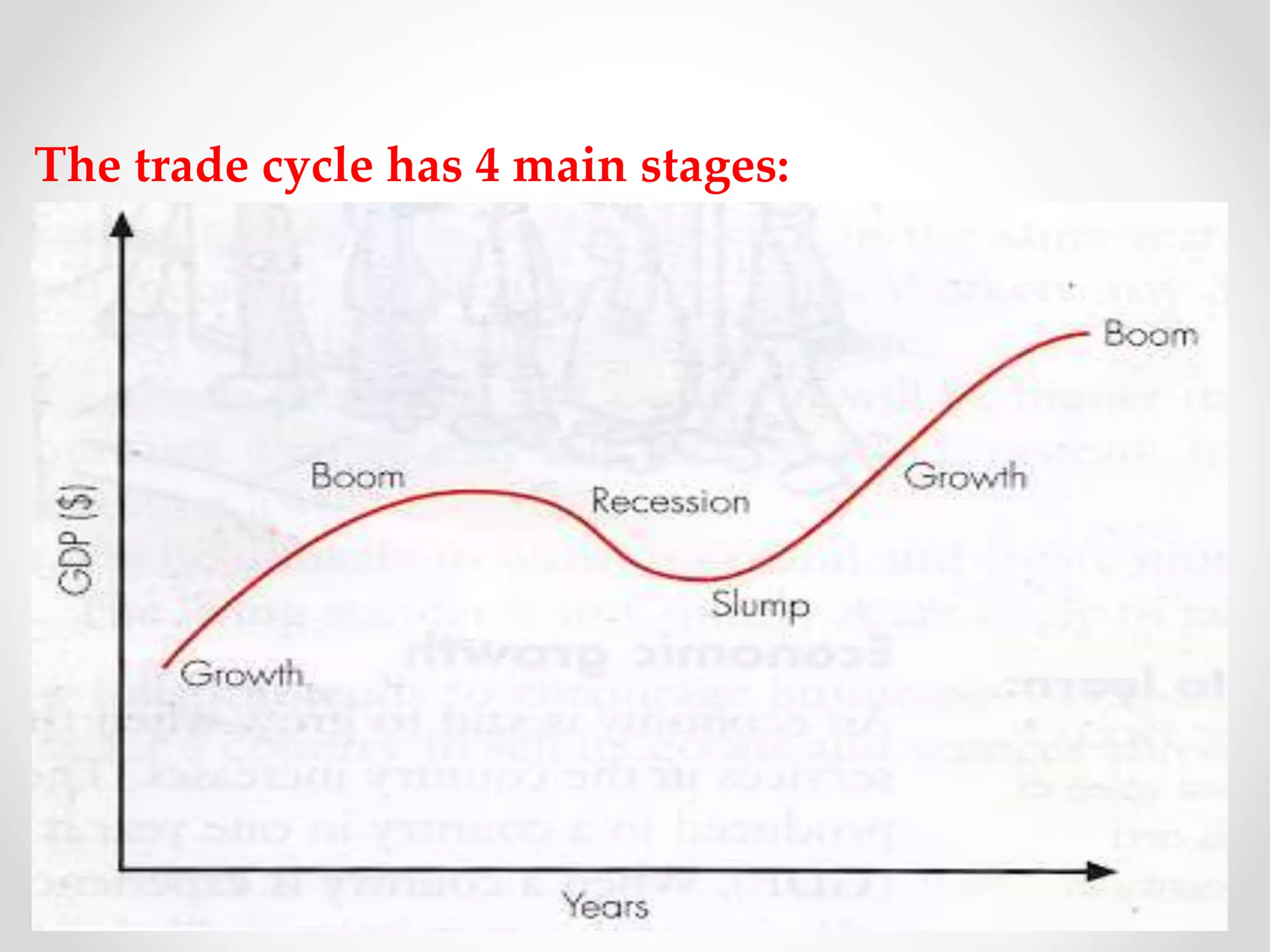

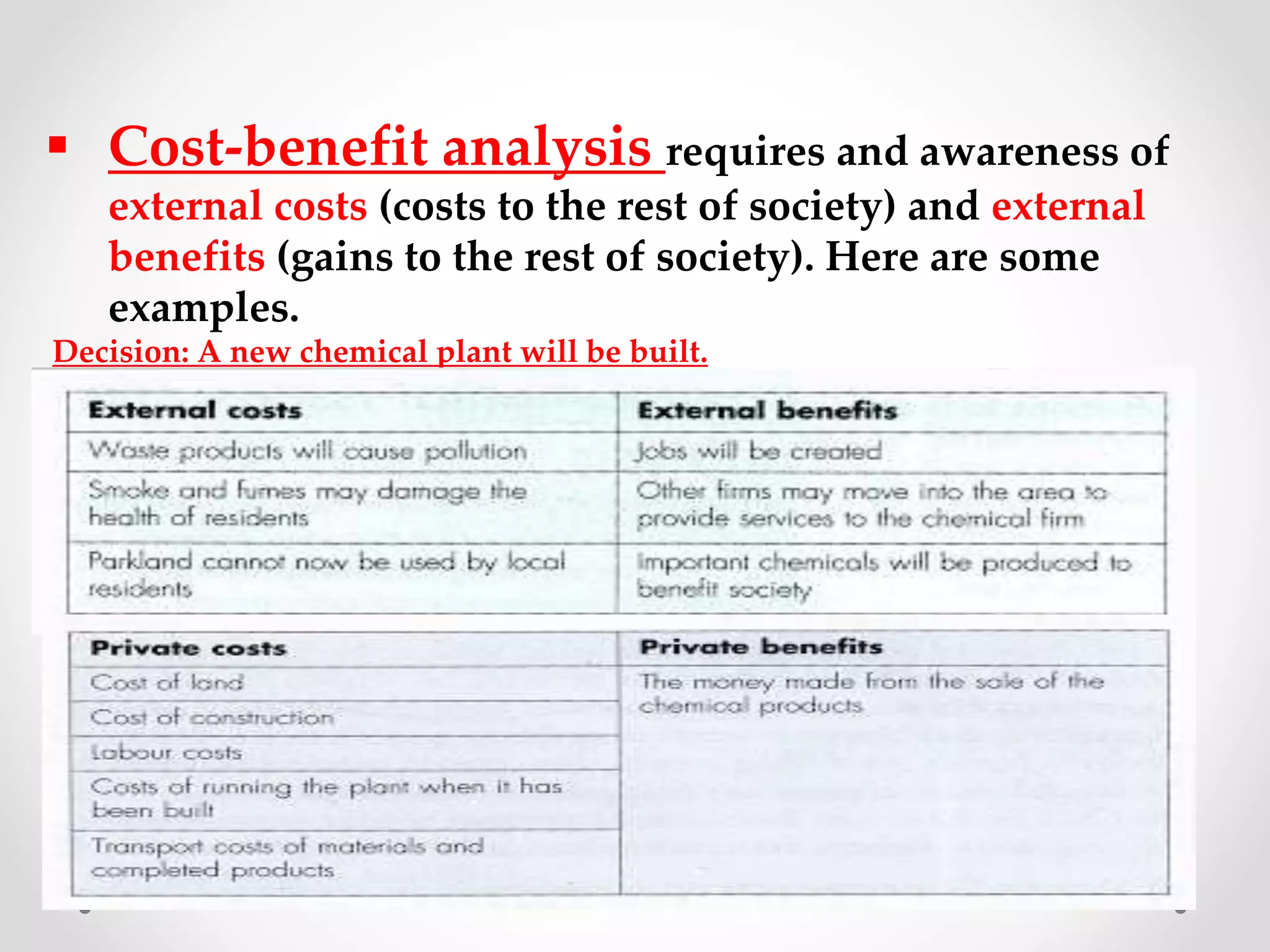

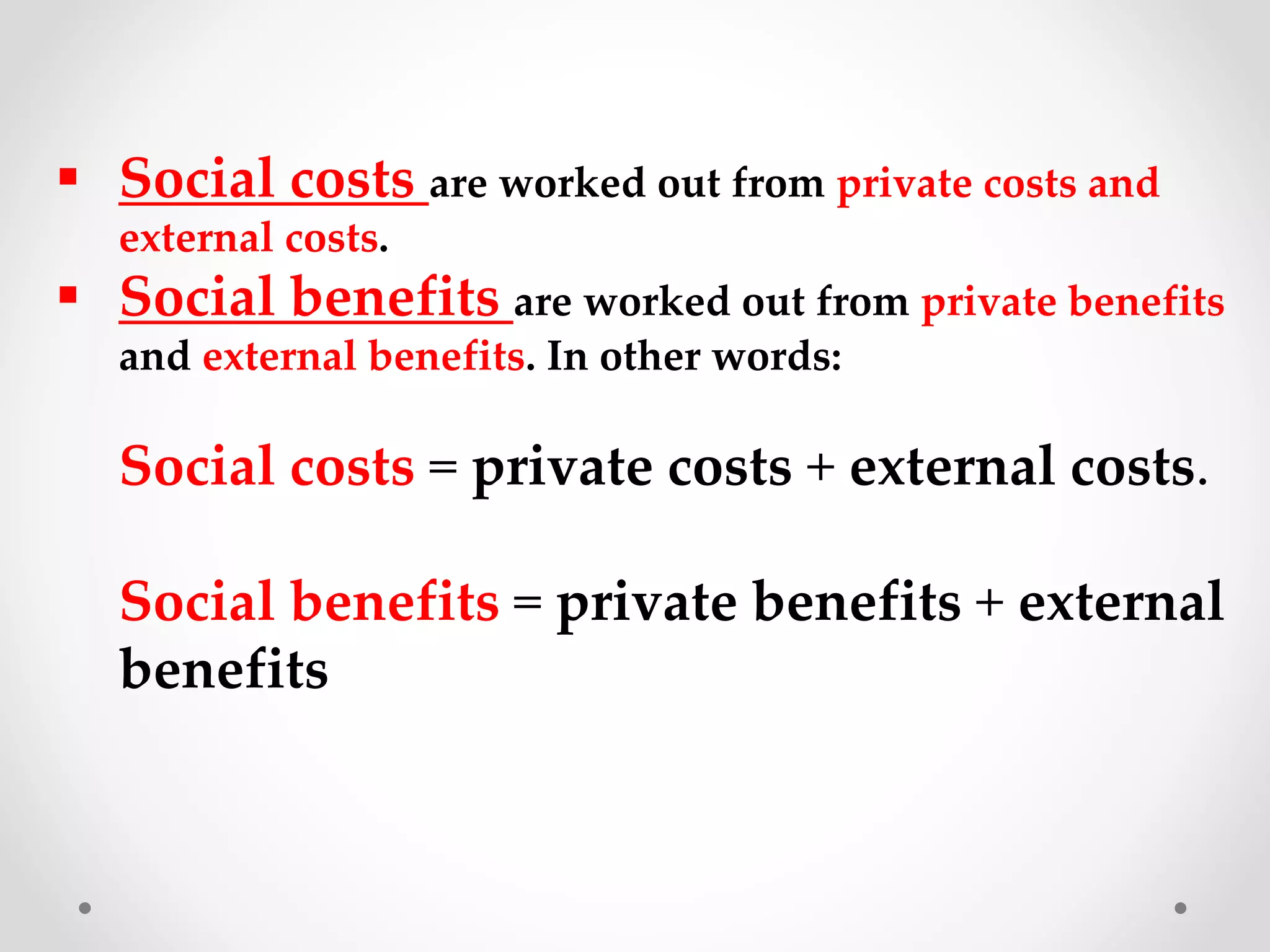

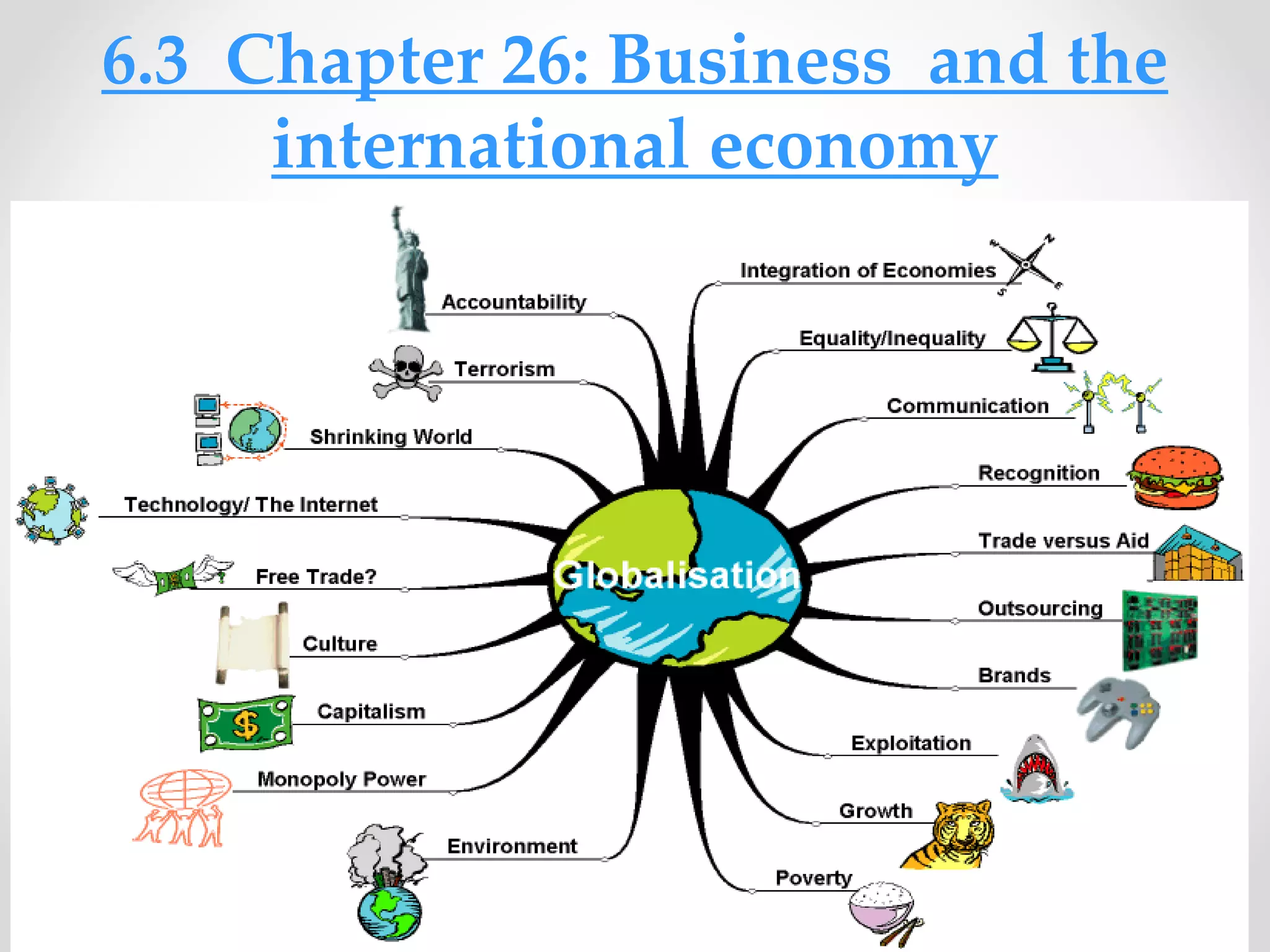

The document discusses how governments aim to influence business activity and the economy through various economic objectives and policies. The key objectives for governments are low inflation, low unemployment, economic growth, and a balanced balance of payments. Governments use fiscal policy like taxes and spending, monetary policy involving interest rates, and supply-side policies to achieve these aims. They also regulate business activity to address undesirable impacts on society and the environment.