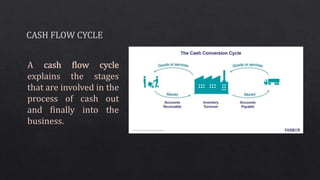

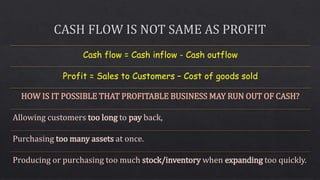

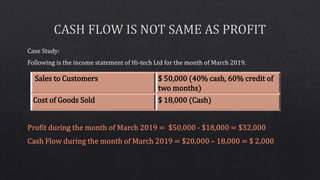

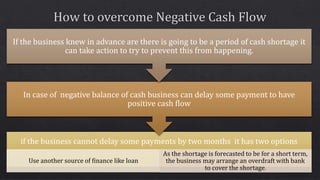

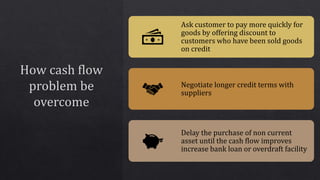

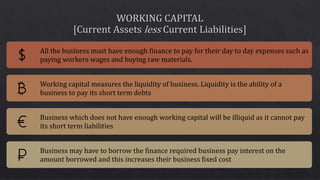

Cash flow refers to the movement of money in and out of a business over time. While a business may be profitable, it can still experience cash flow problems if it does not have enough cash on hand to cover expenses. This can occur if customers take too long to pay, assets are purchased all at once, or inventory is expanded too quickly. The document then provides an example cash flow statement that shows a business becoming overdrawn in May due to higher cash outflows than inflows that month. To remedy short-term cash flow issues, businesses can delay some payments, negotiate longer credit terms, or take out loans until cash flow improves. Maintaining adequate working capital is important for businesses to stay liquid and pay short-term debts