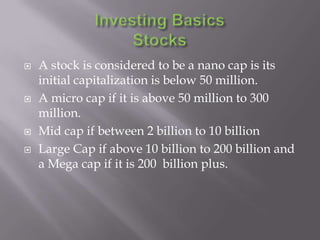

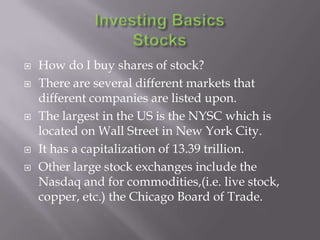

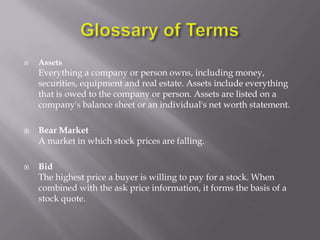

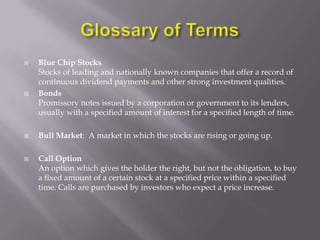

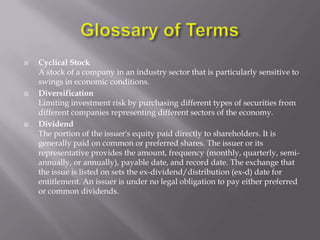

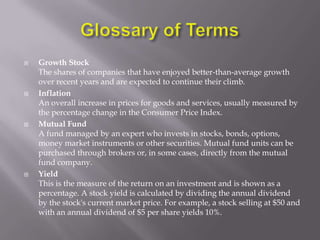

The document provides an overview of basic investing topics including stocks, mutual funds, DRIPs, and common investing terms. It defines what stocks are, how buying shares entitles the owner to potential price appreciation and dividend payouts. It also explains mutual funds and DRIPs as ways to invest without picking individual stocks. Finally, it includes definitions for several important investing terms.