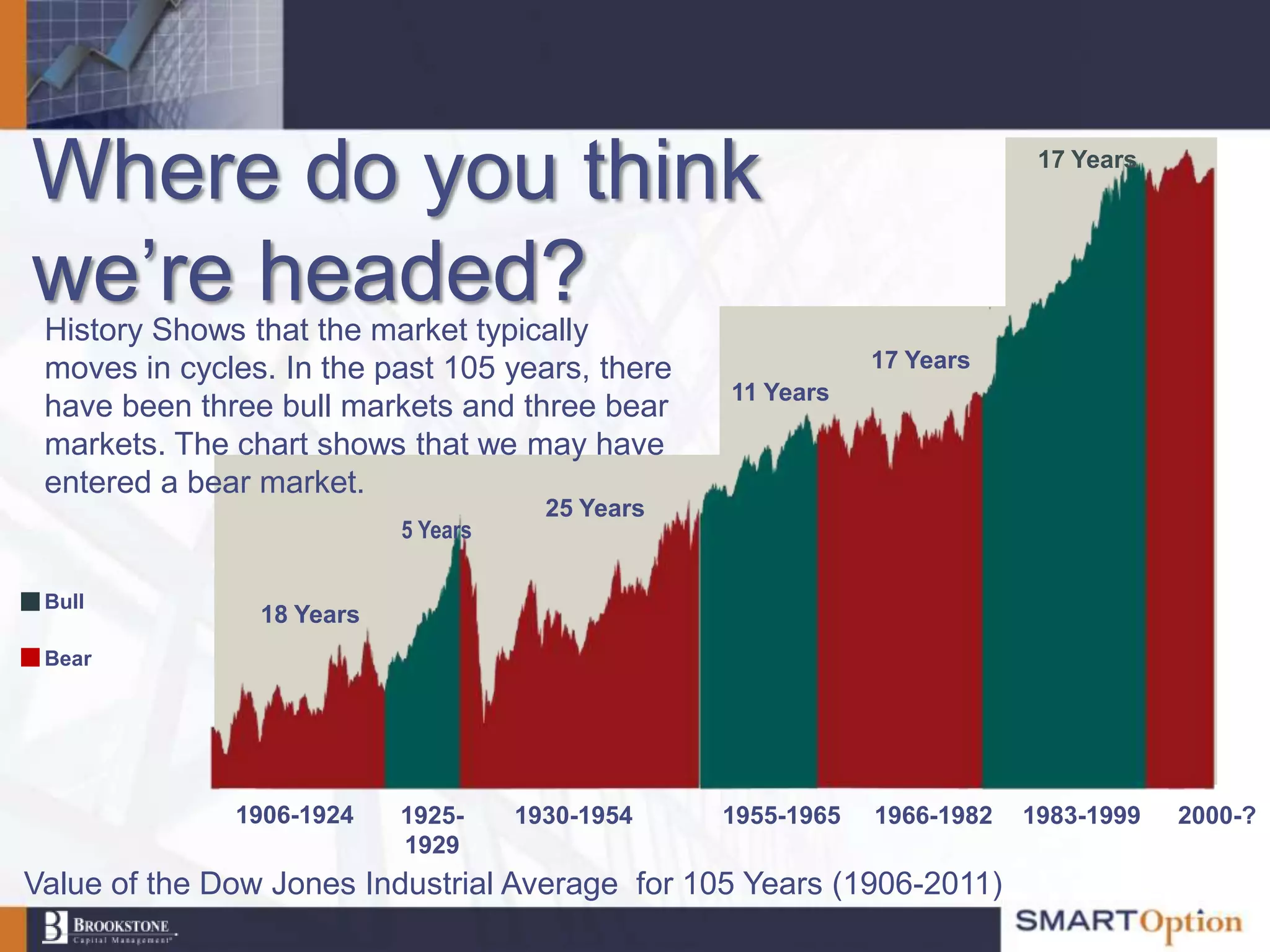

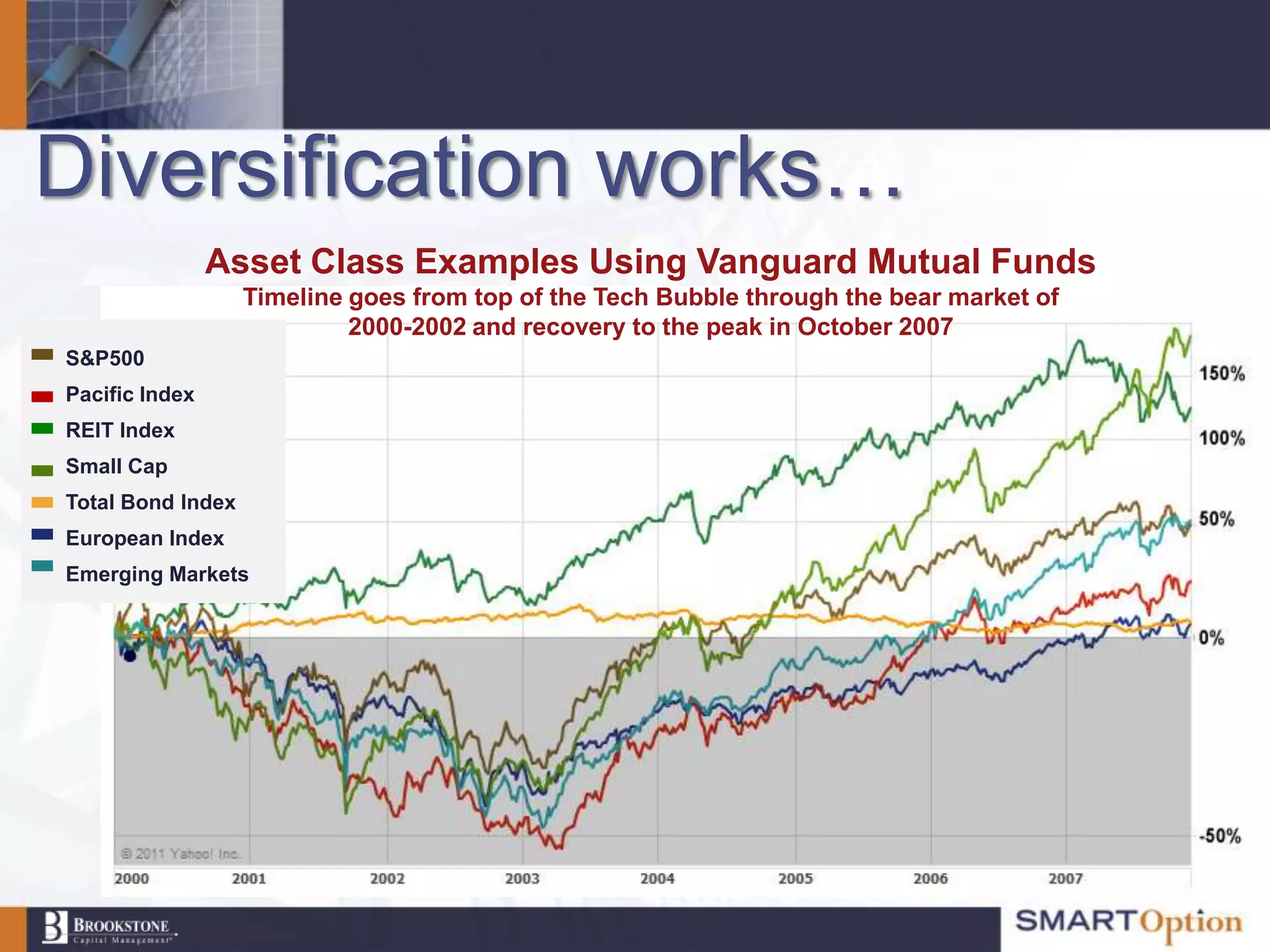

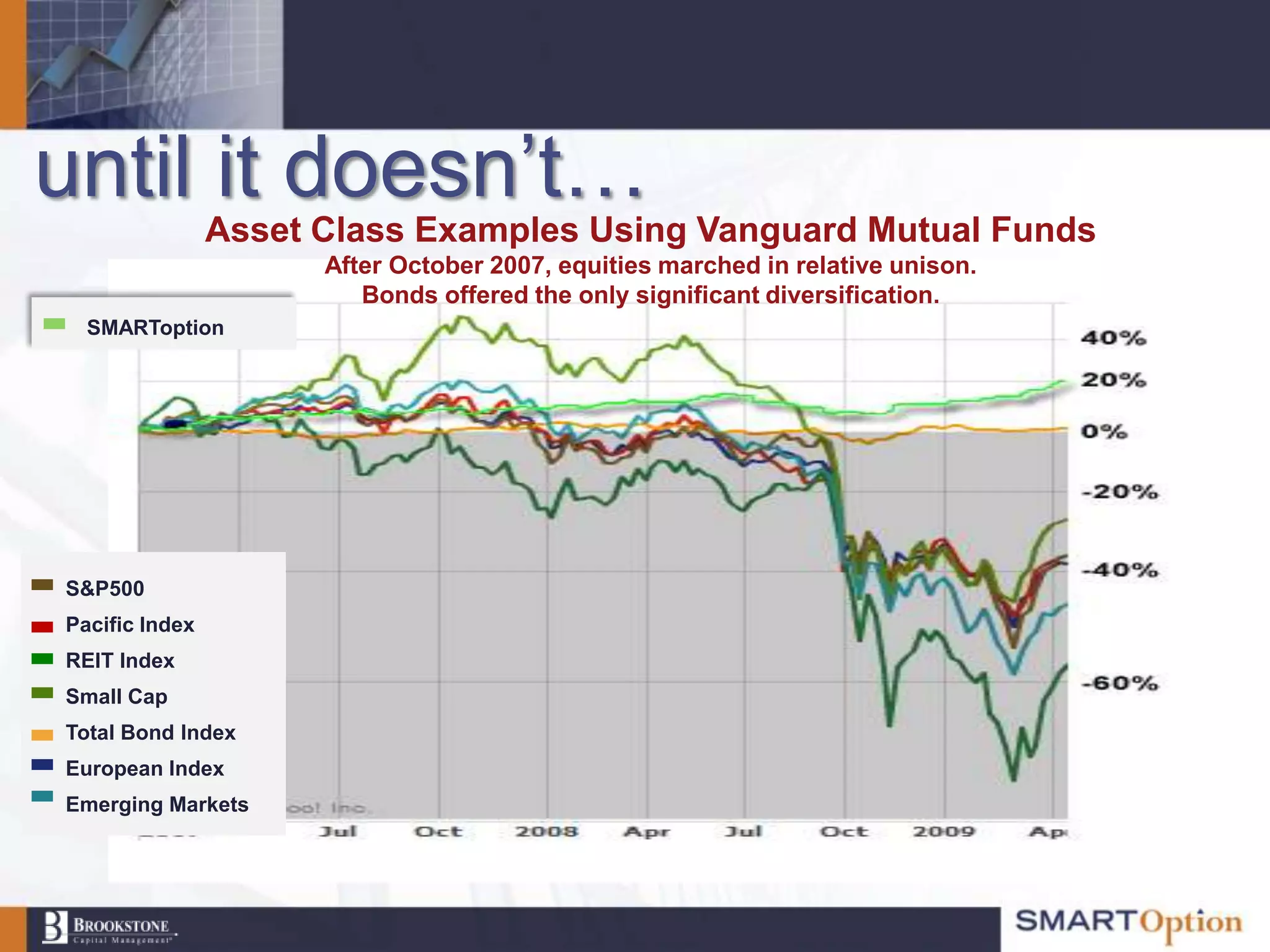

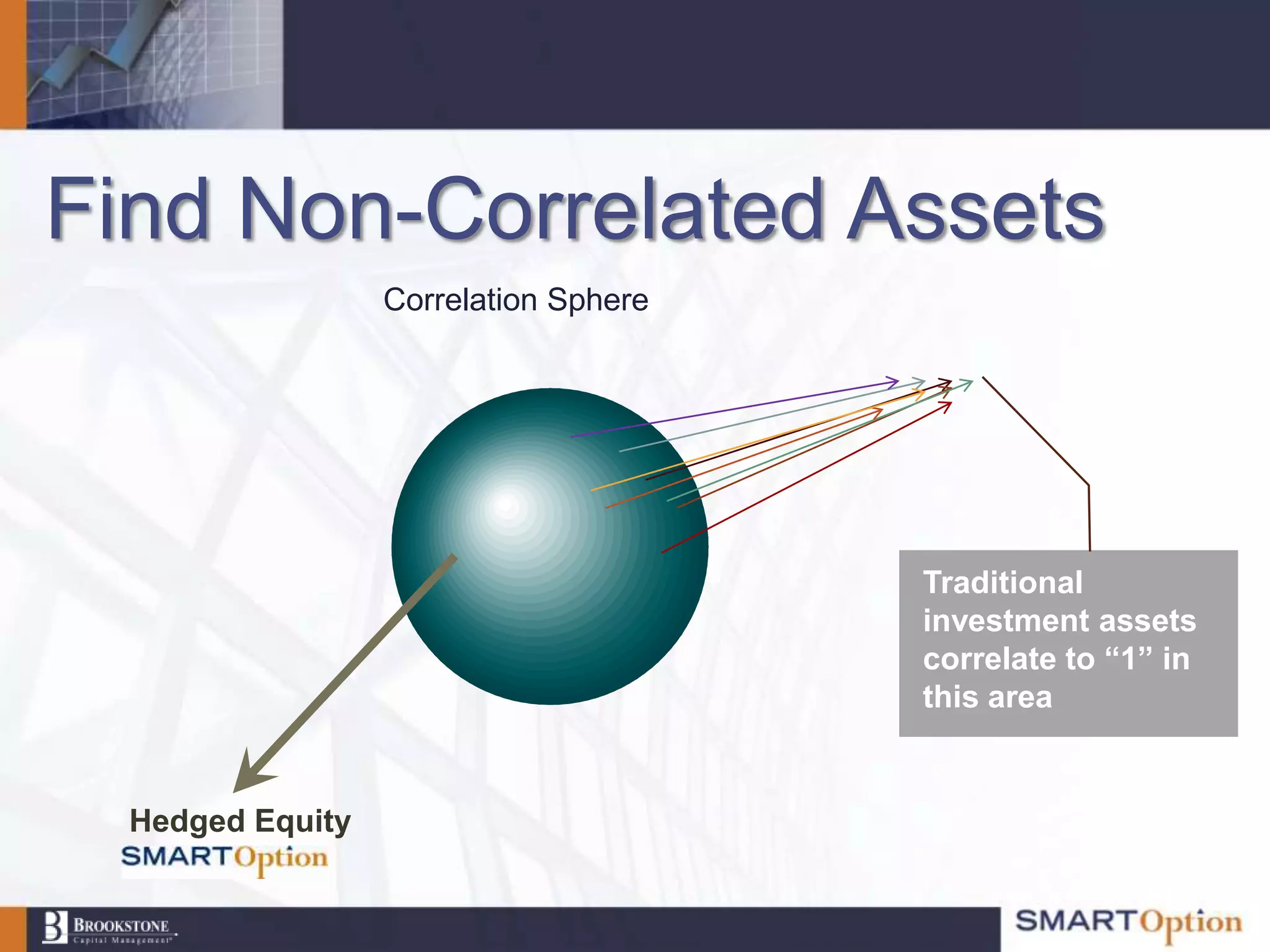

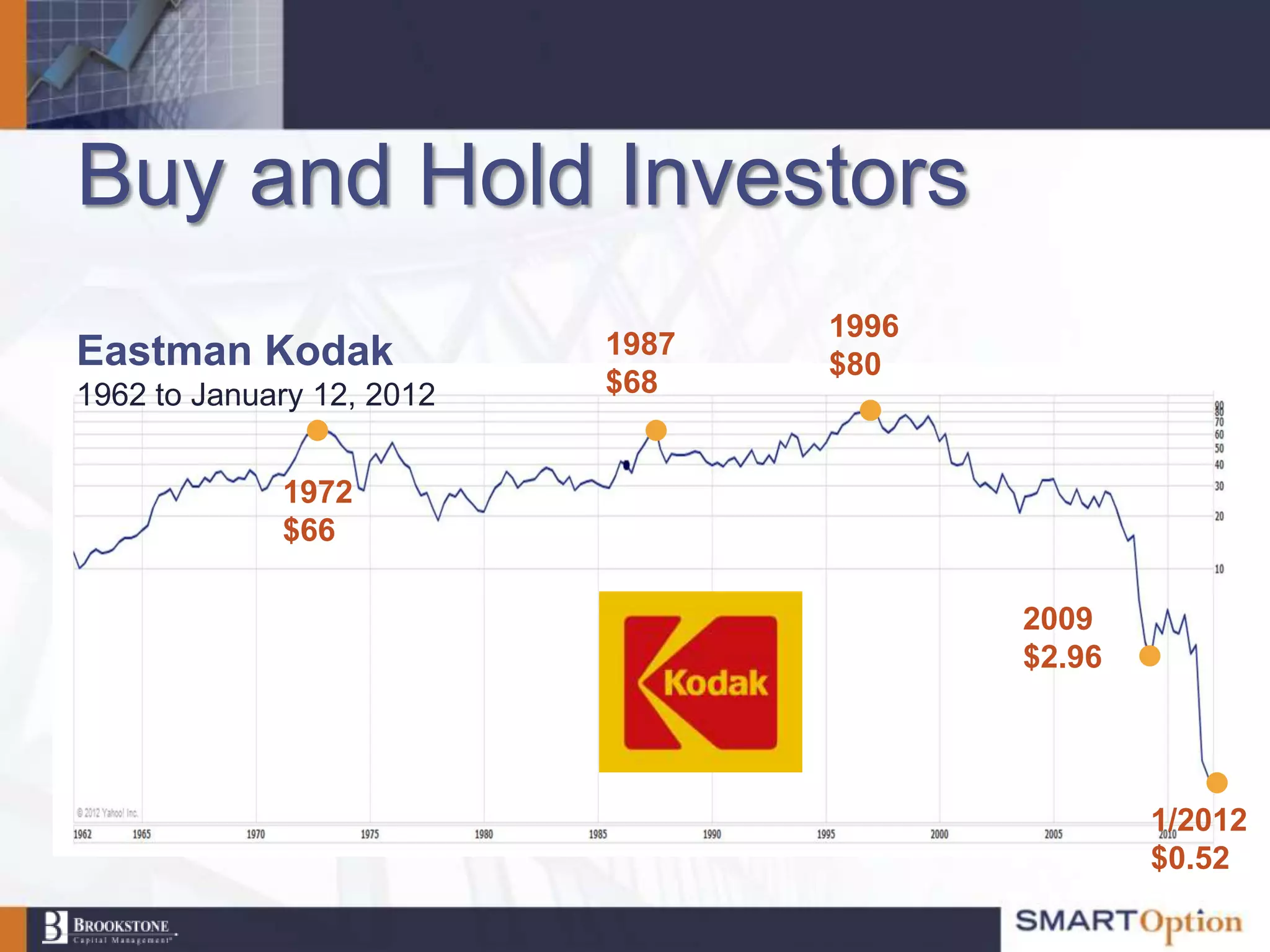

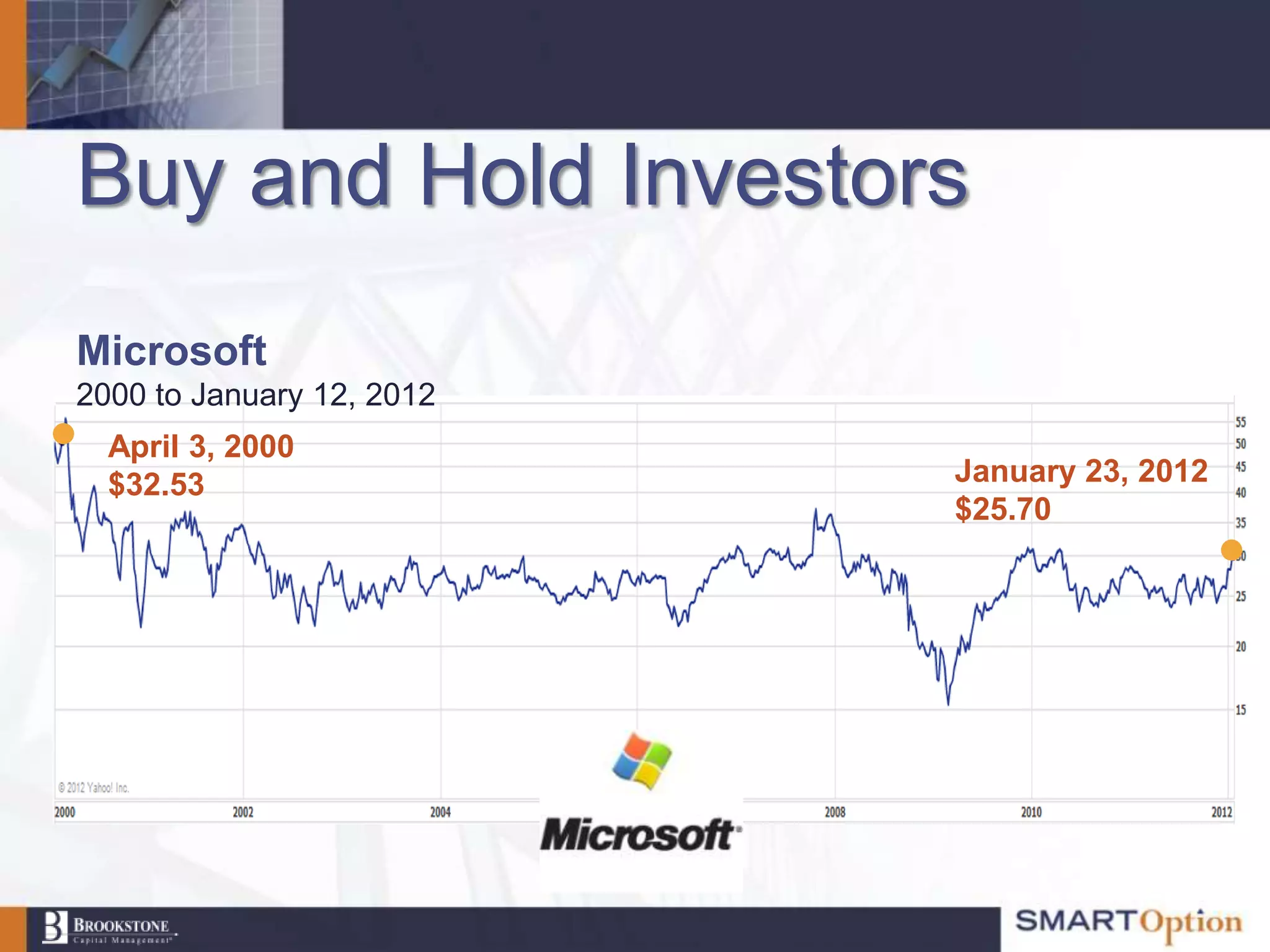

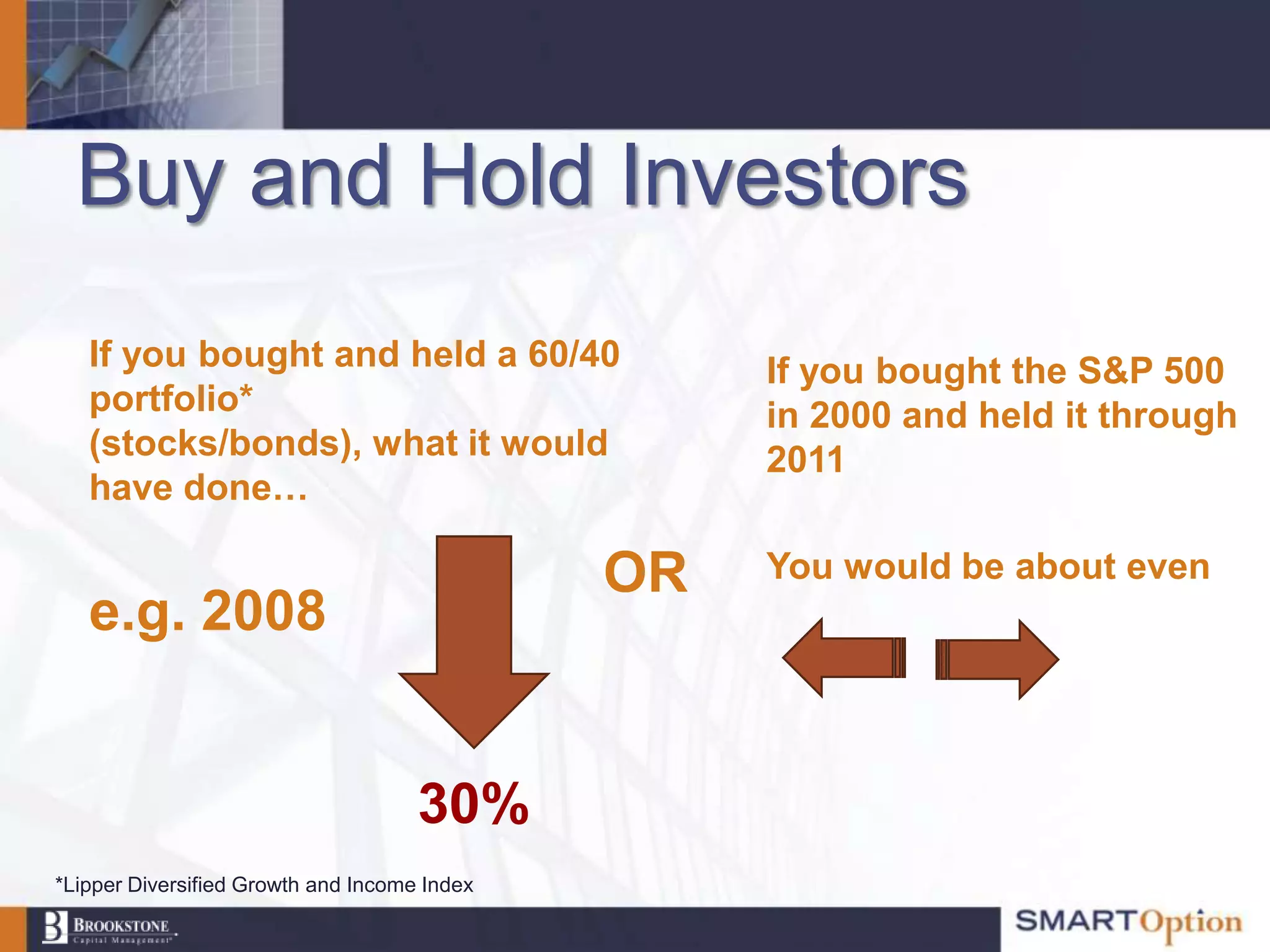

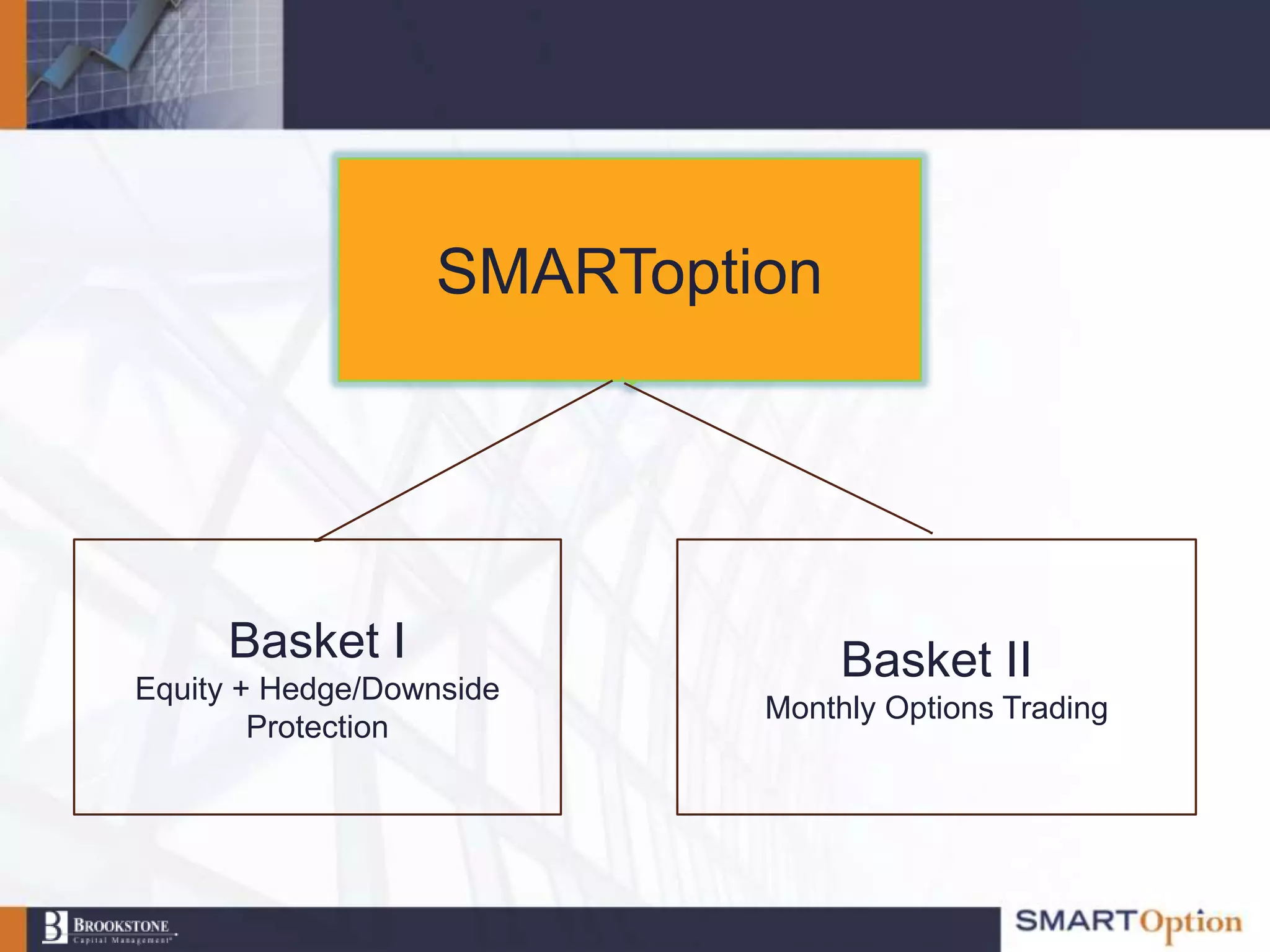

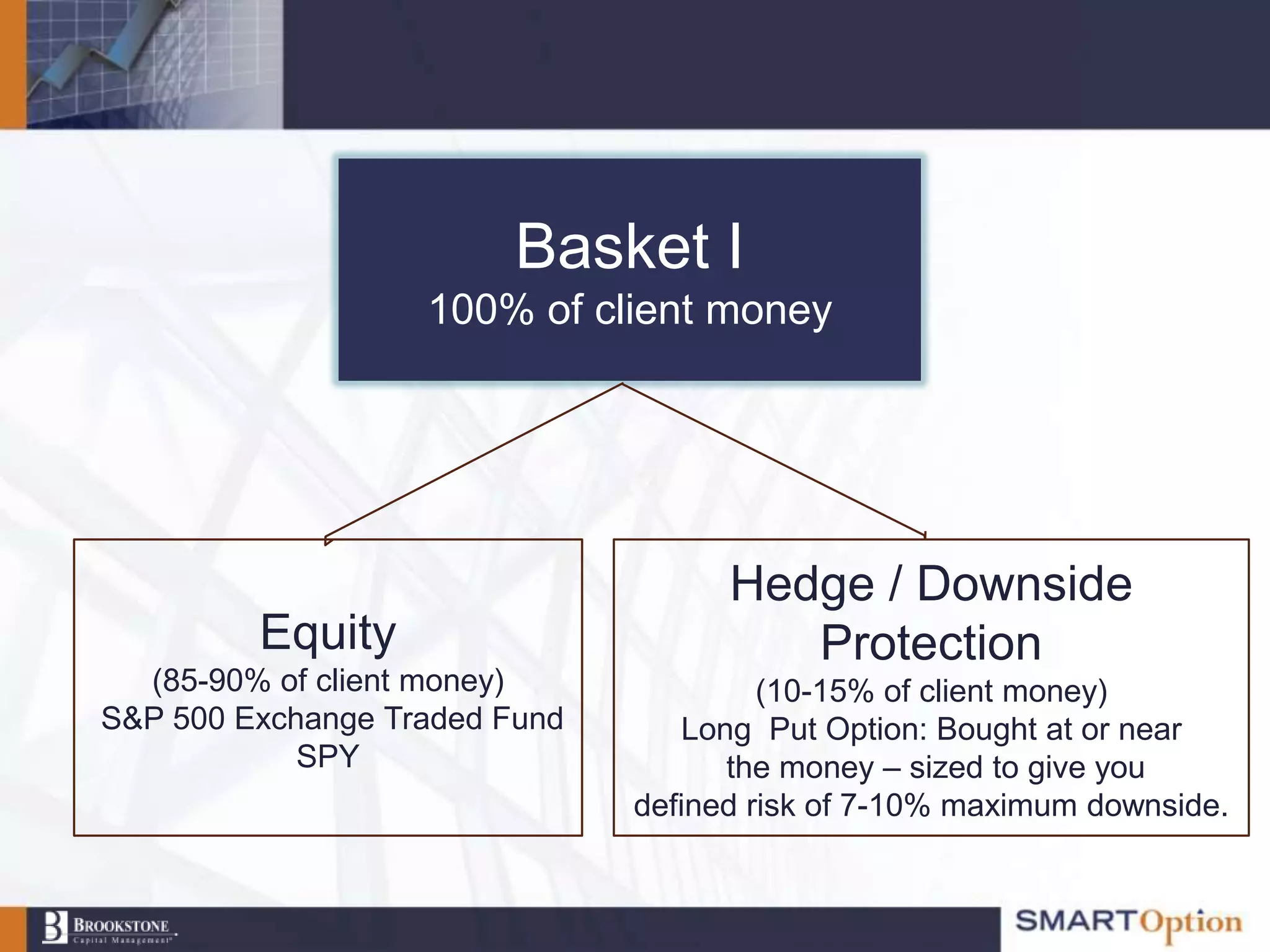

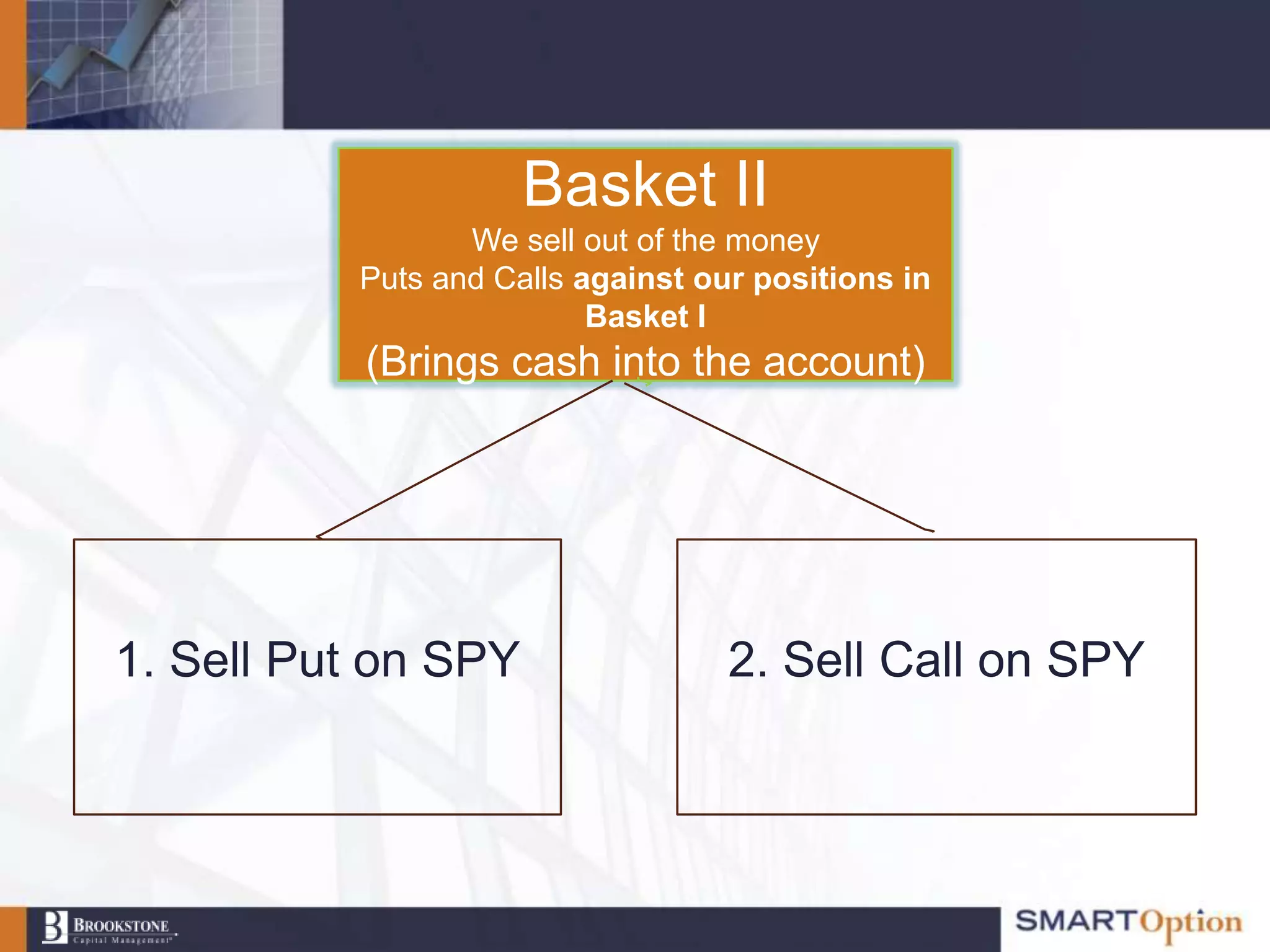

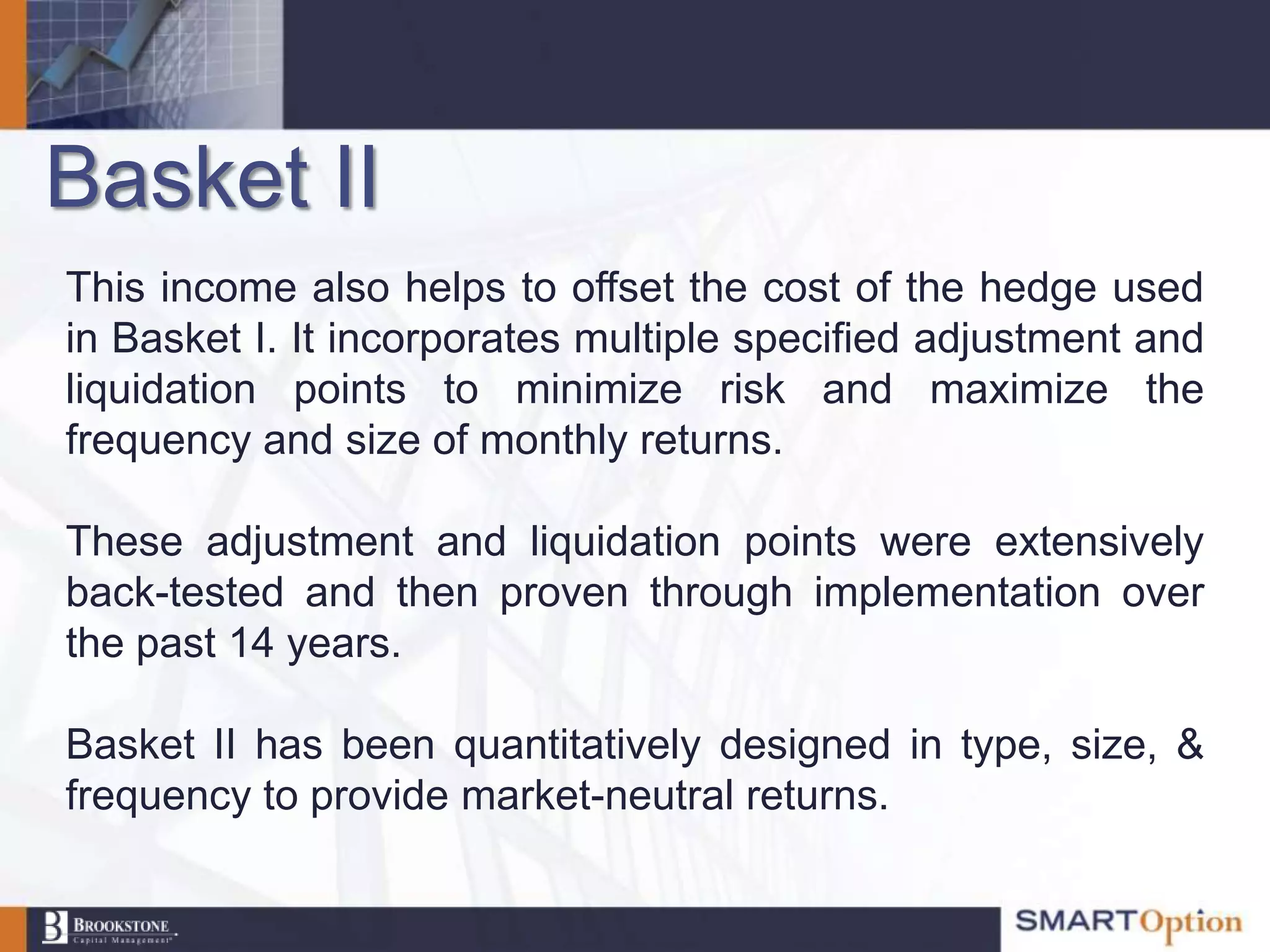

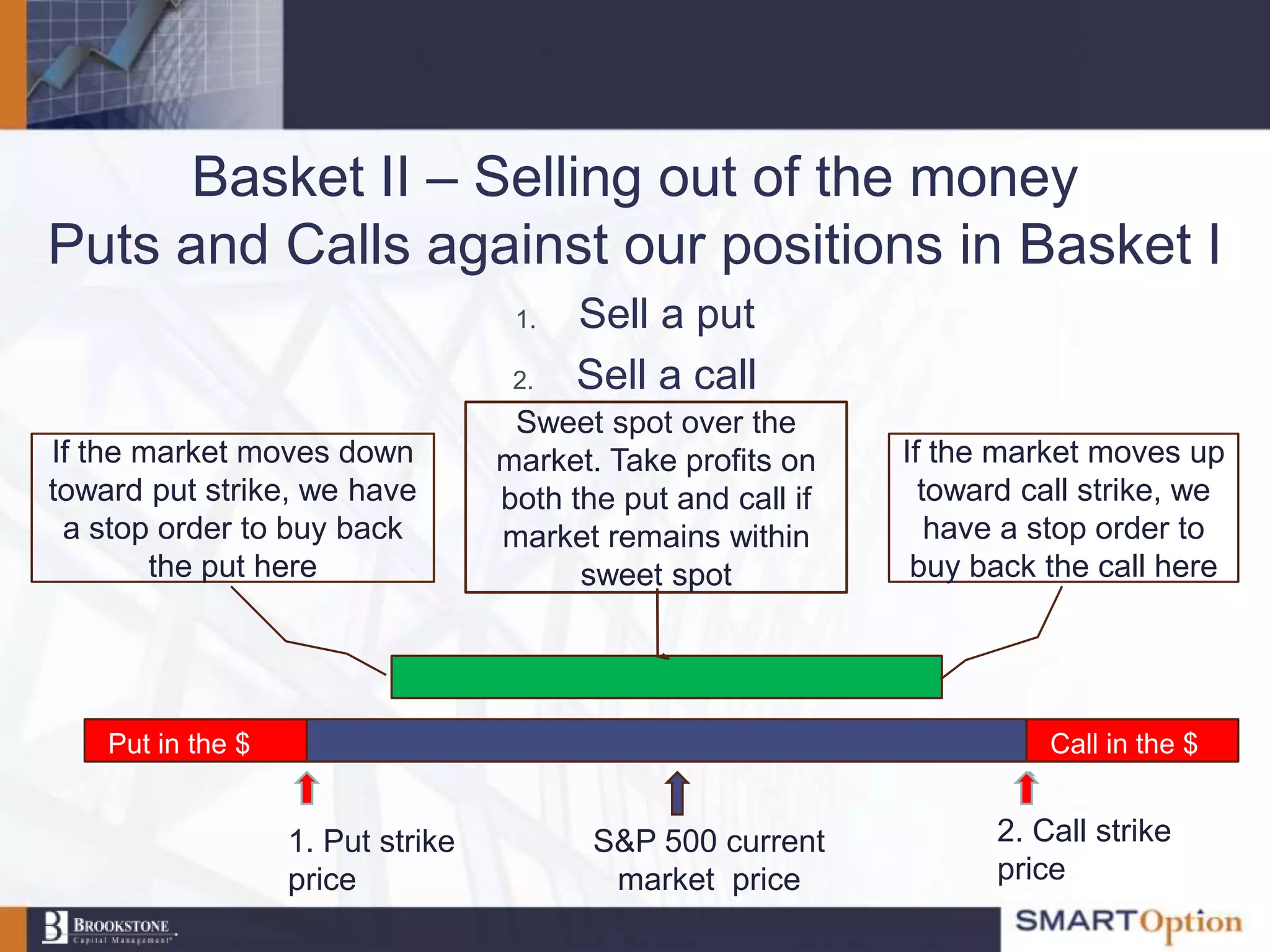

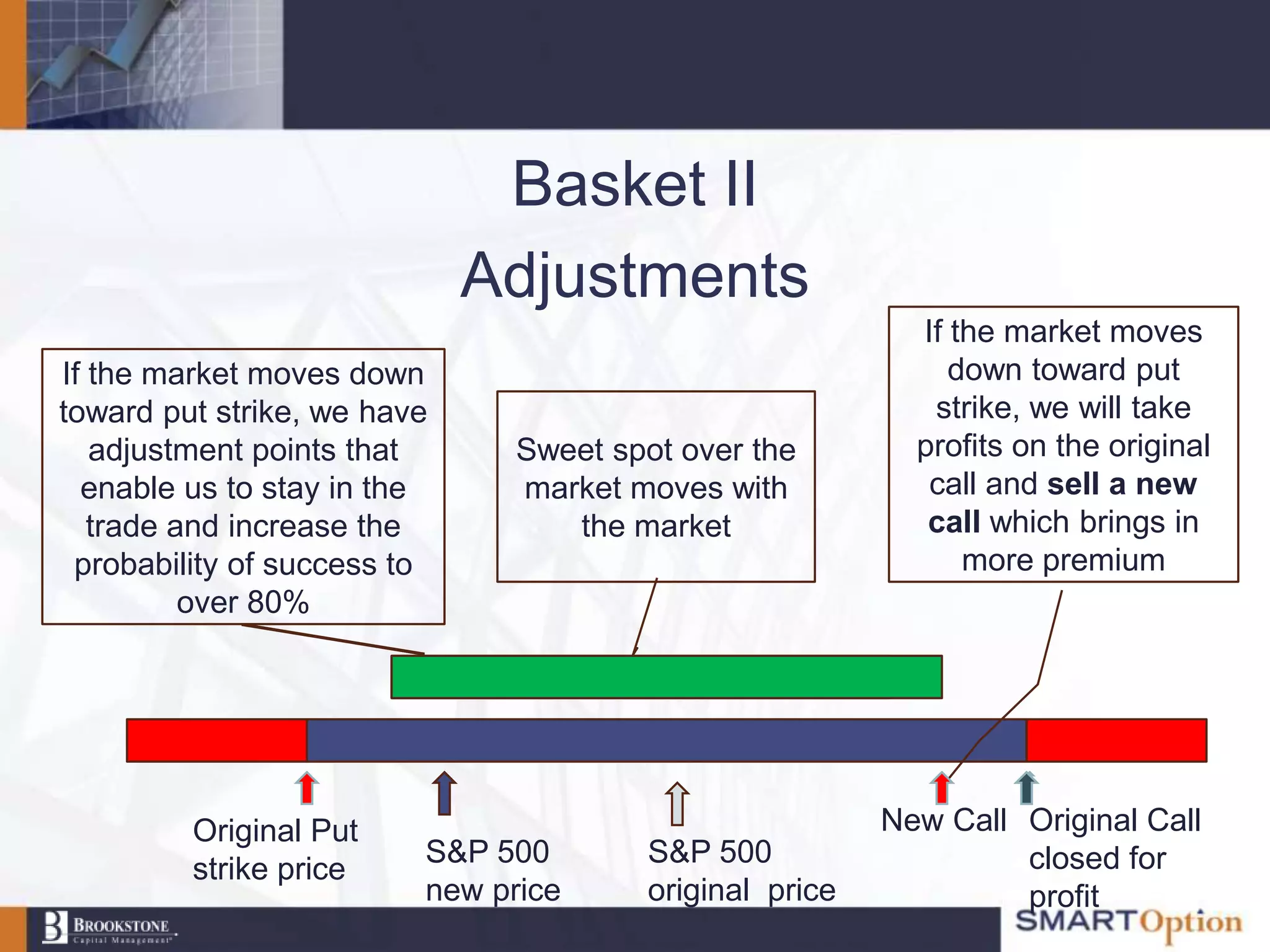

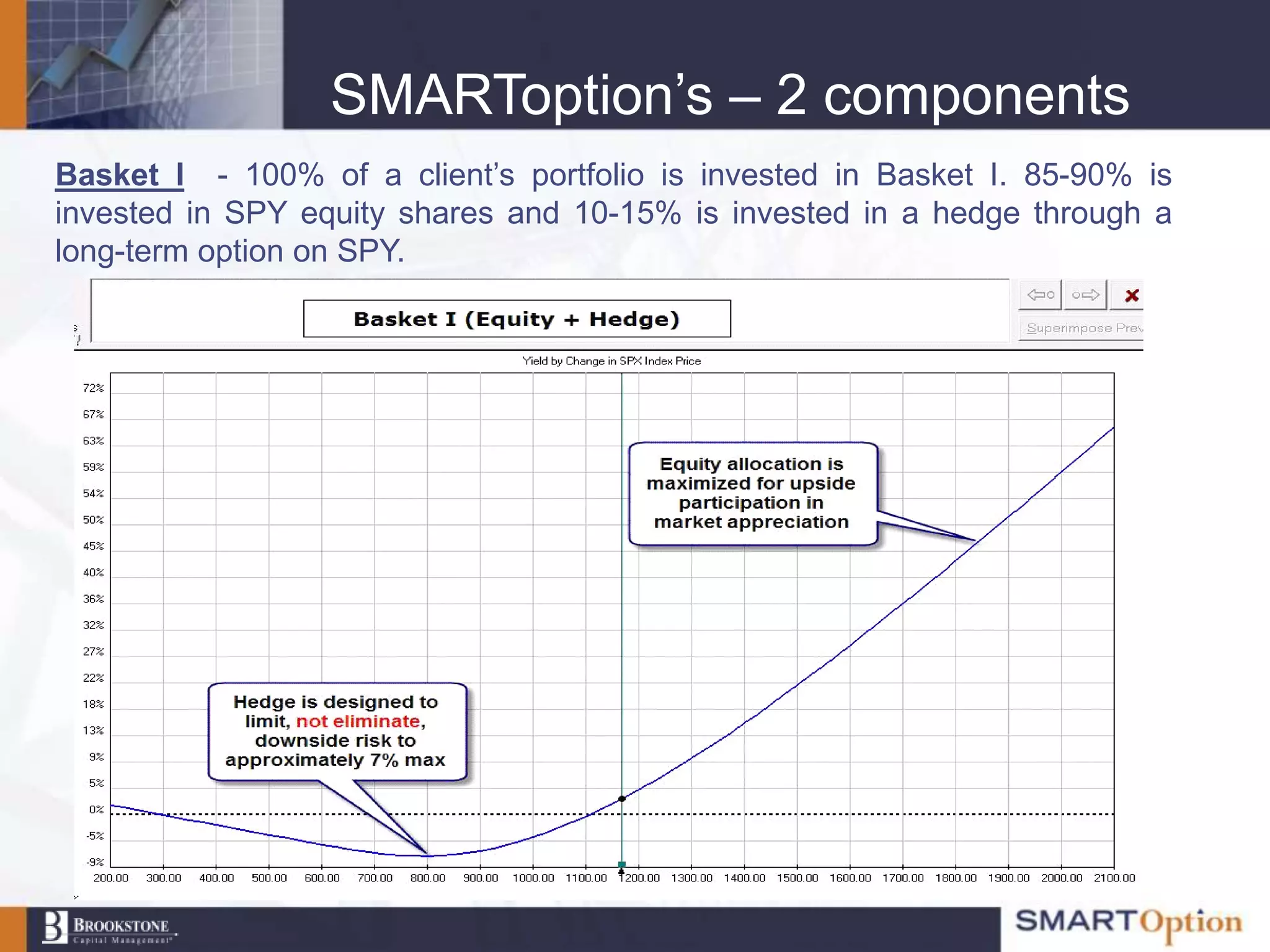

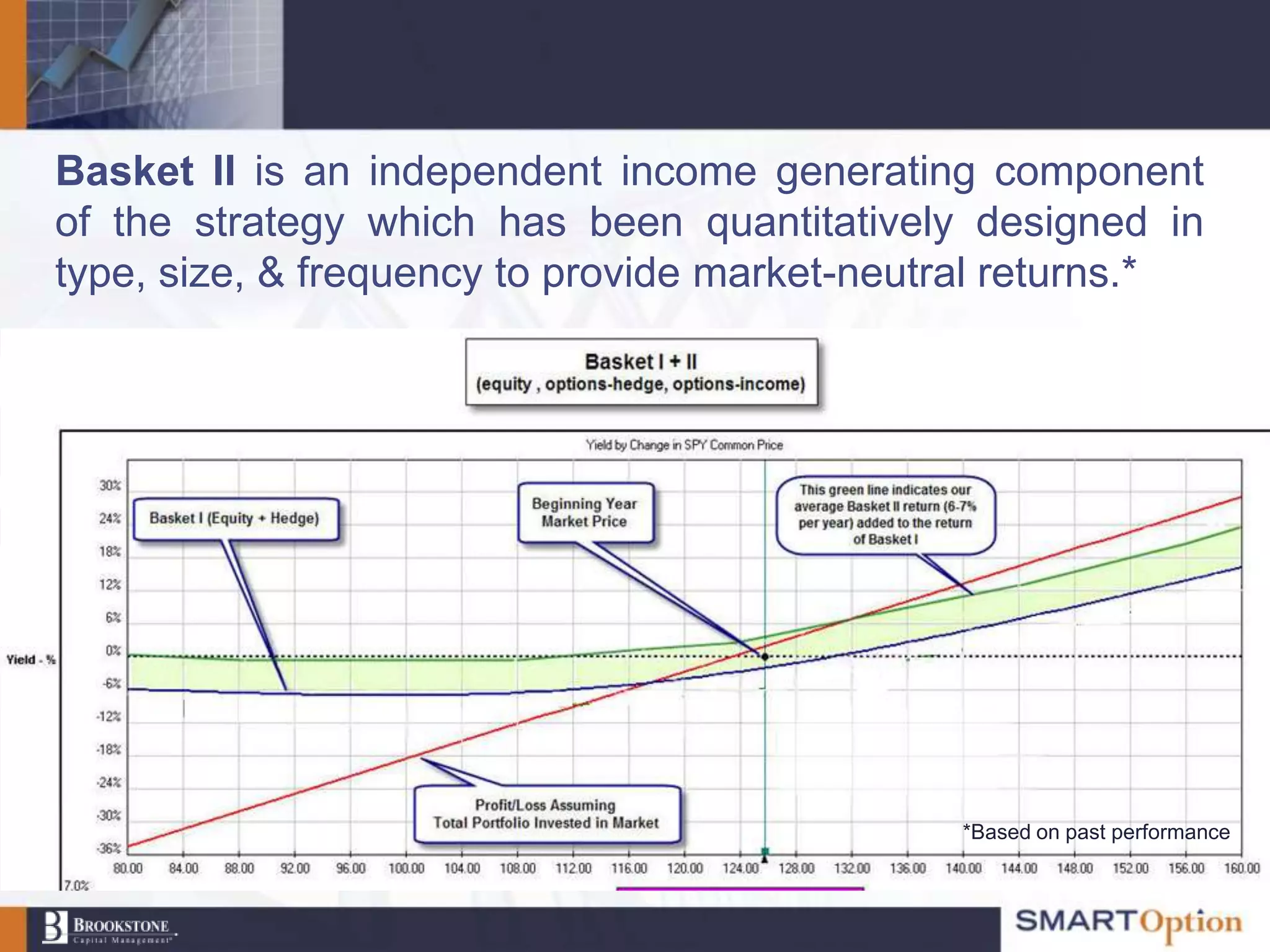

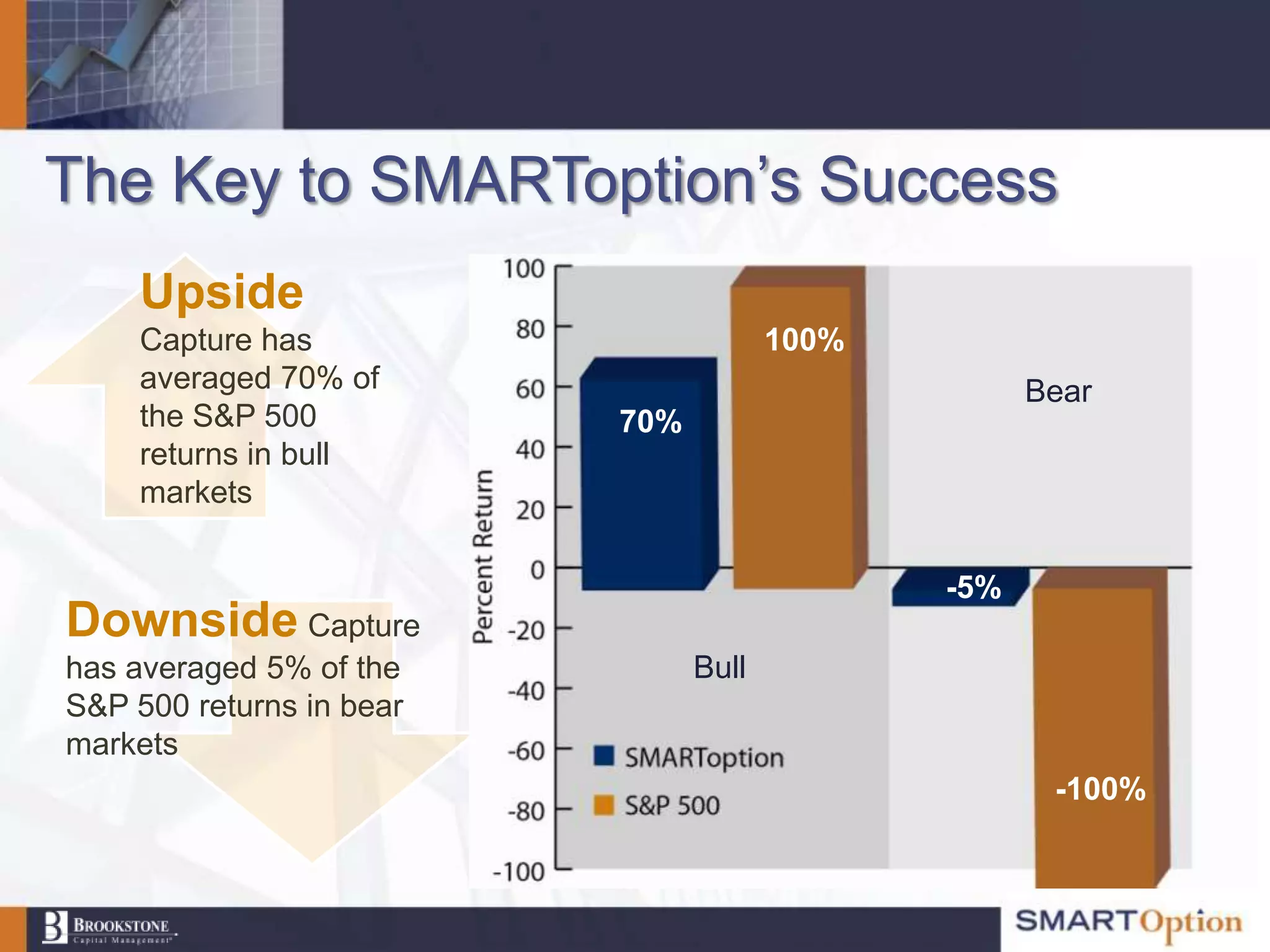

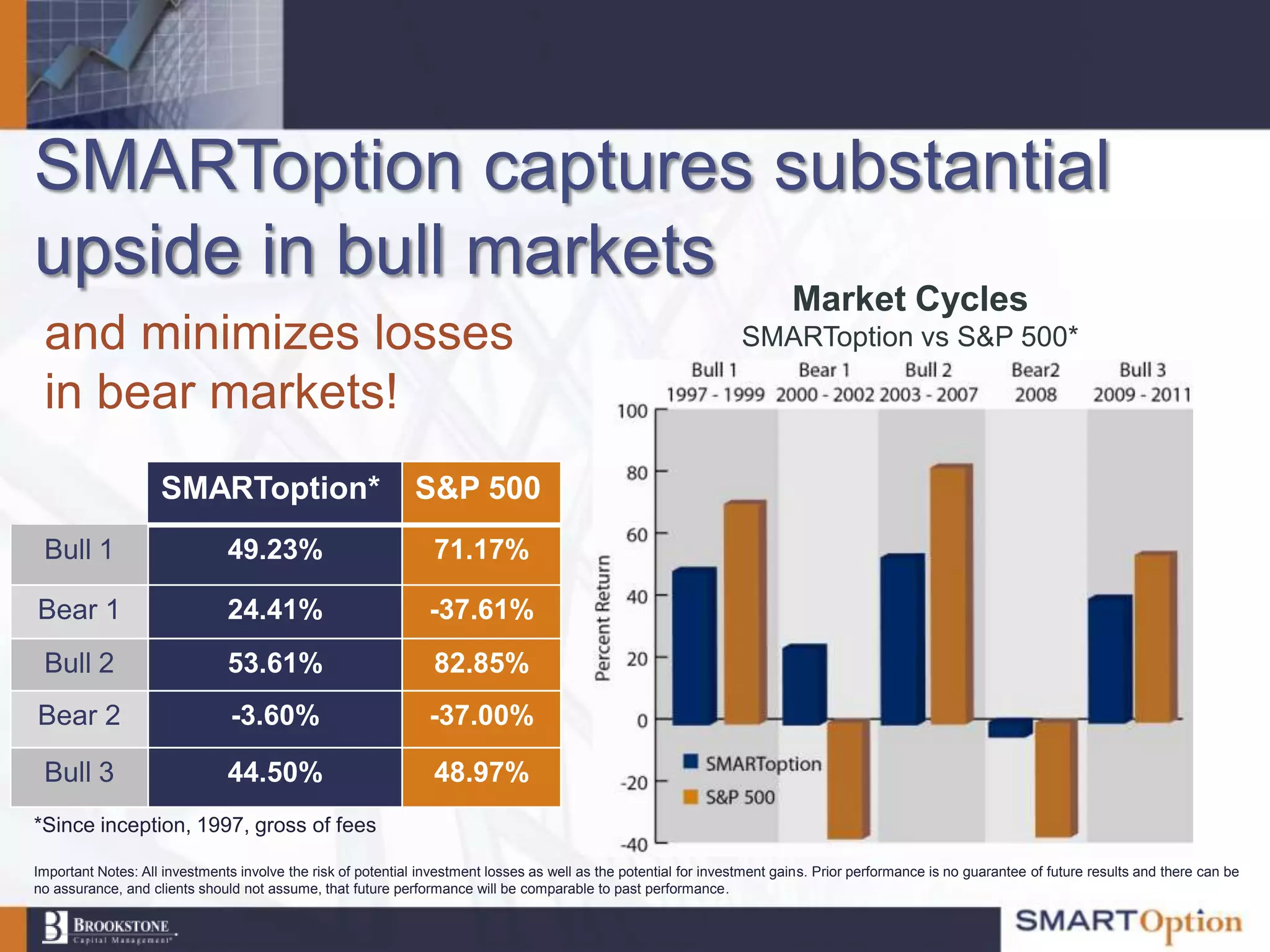

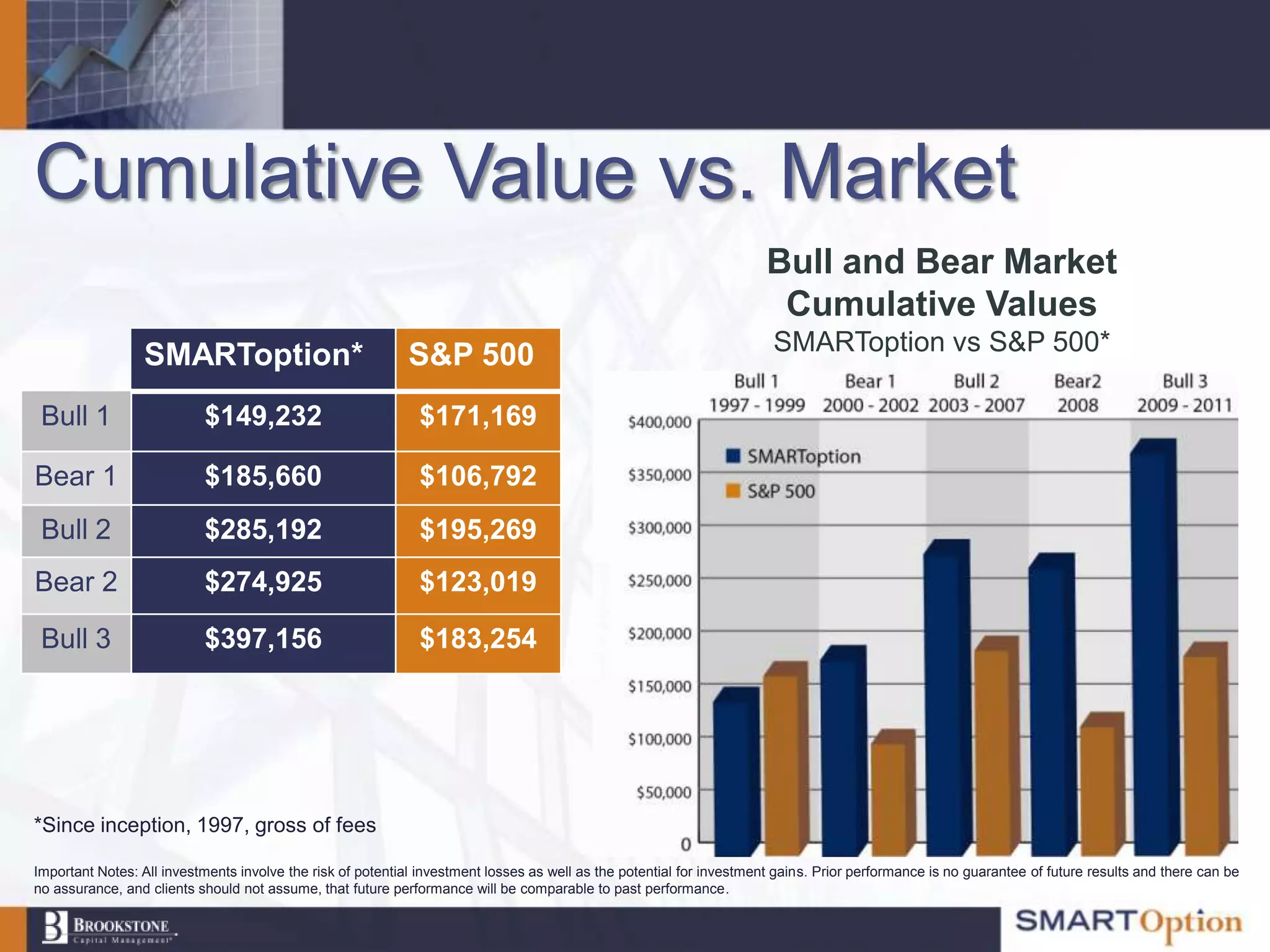

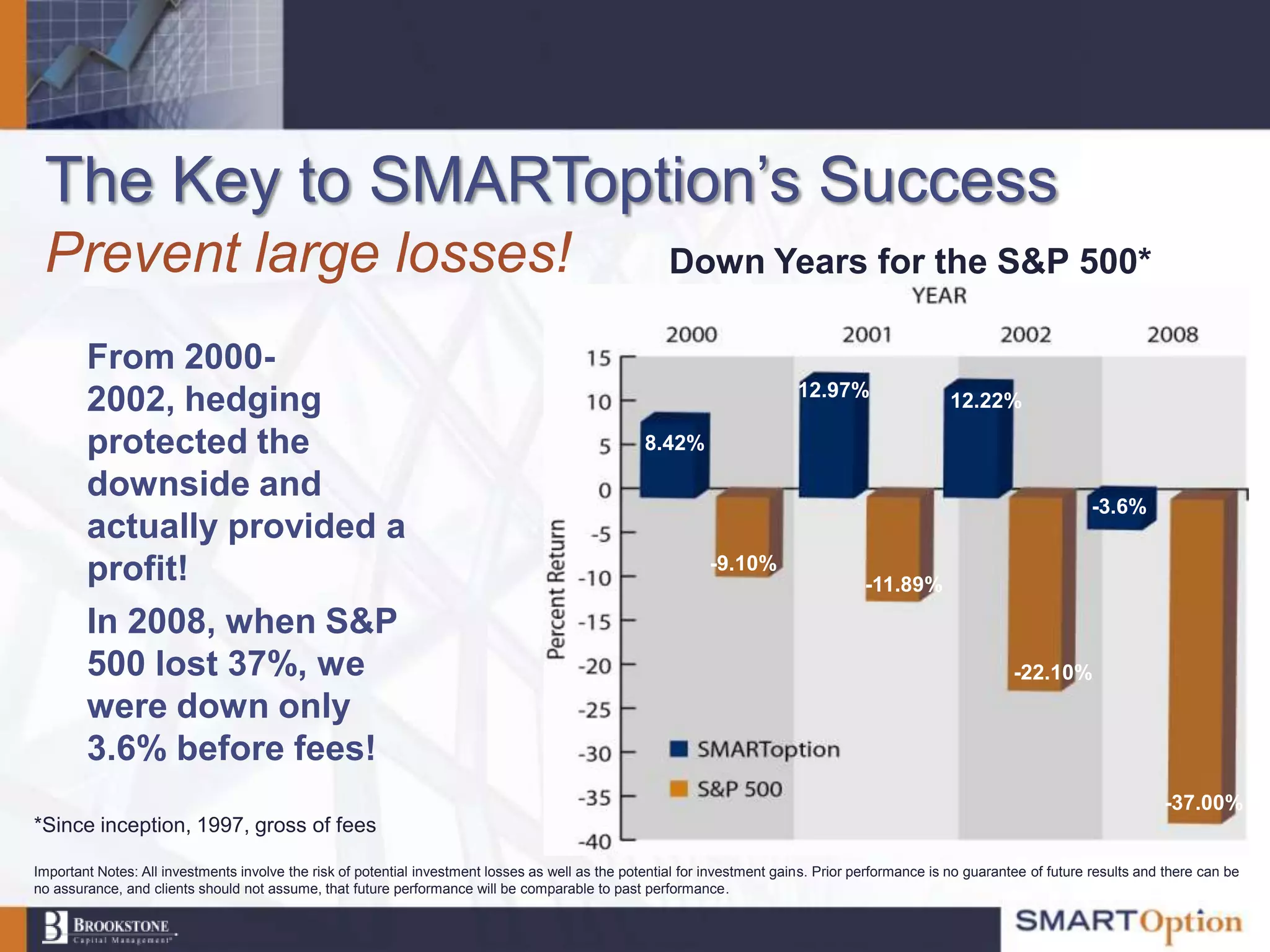

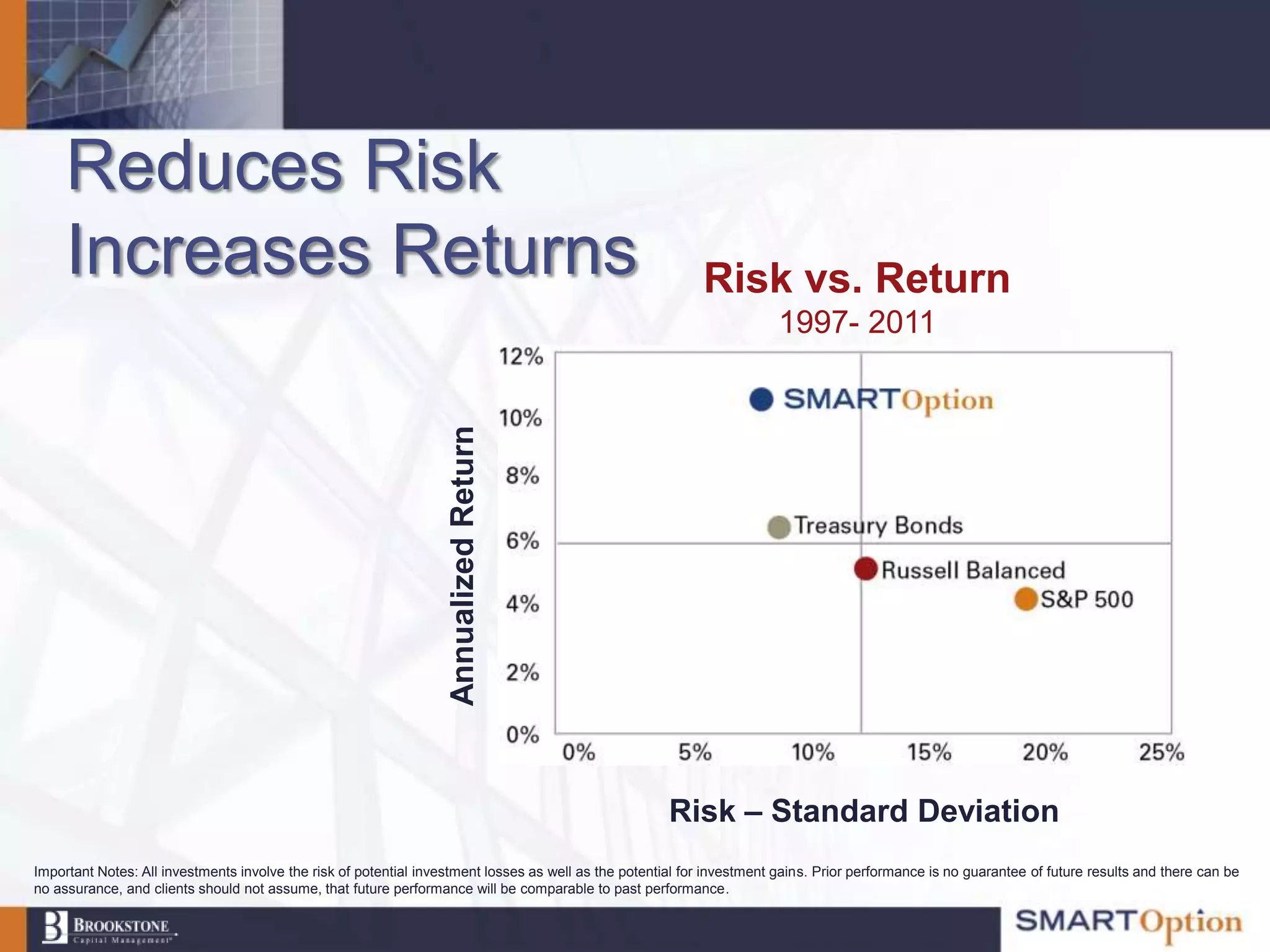

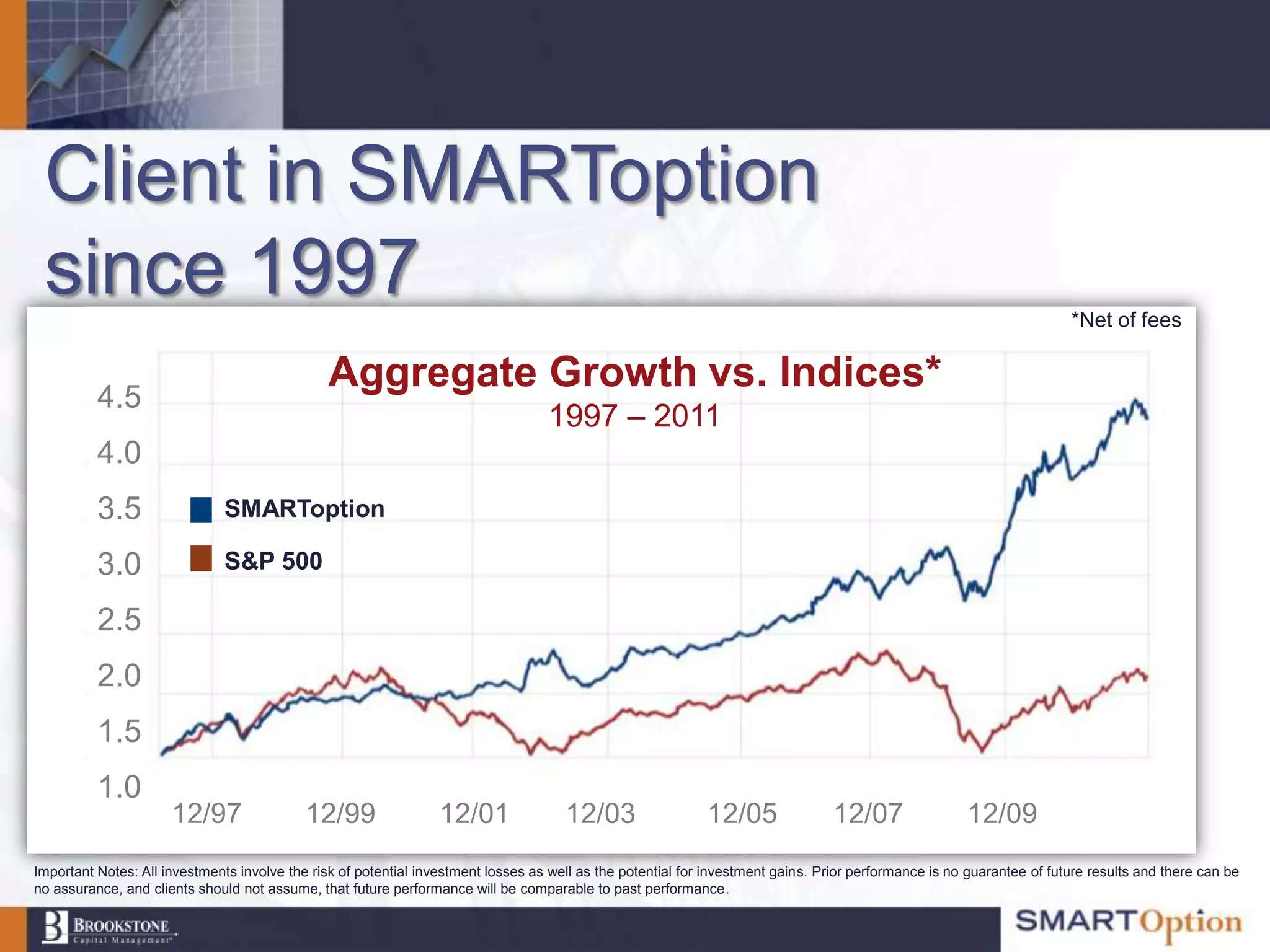

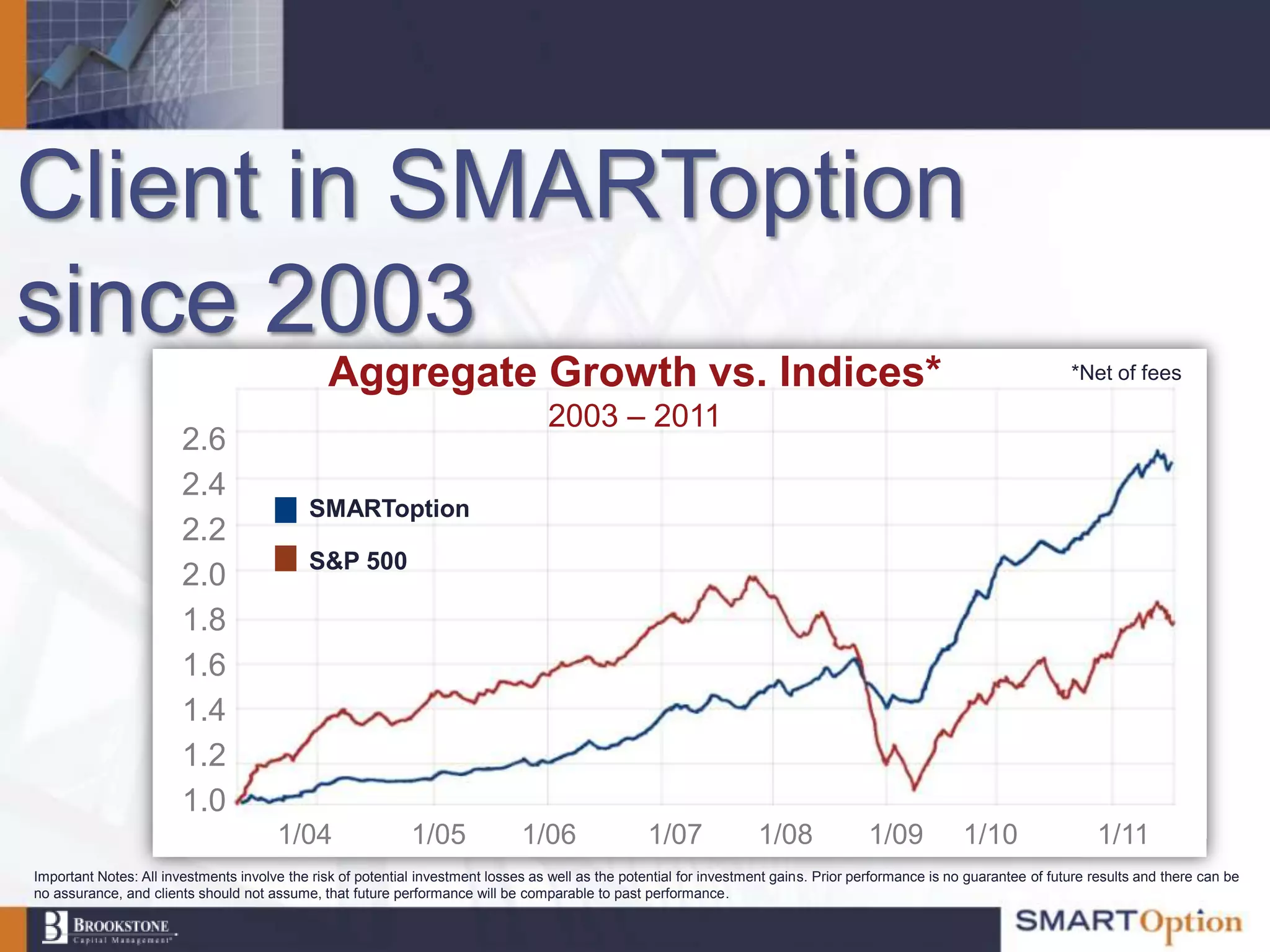

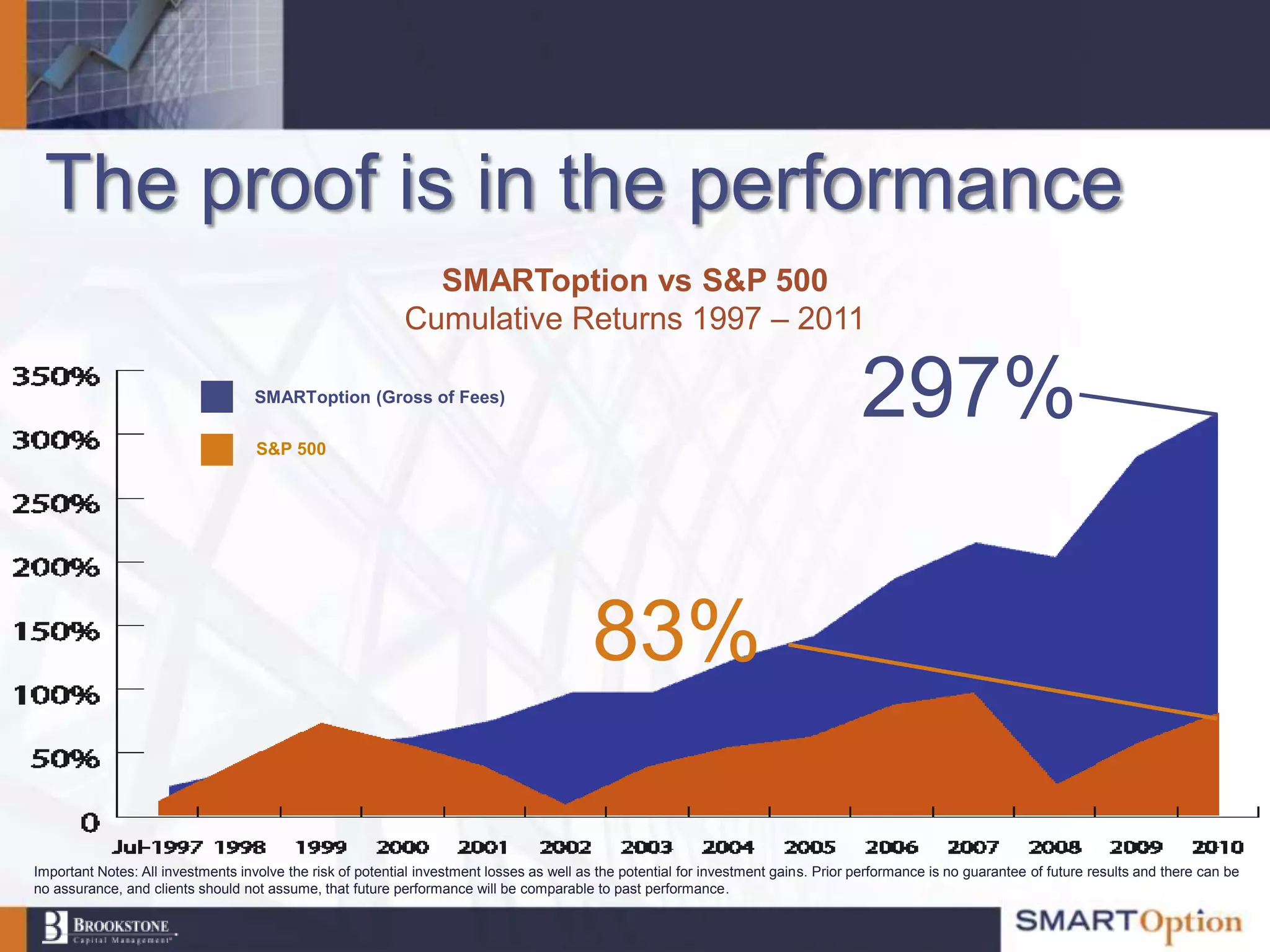

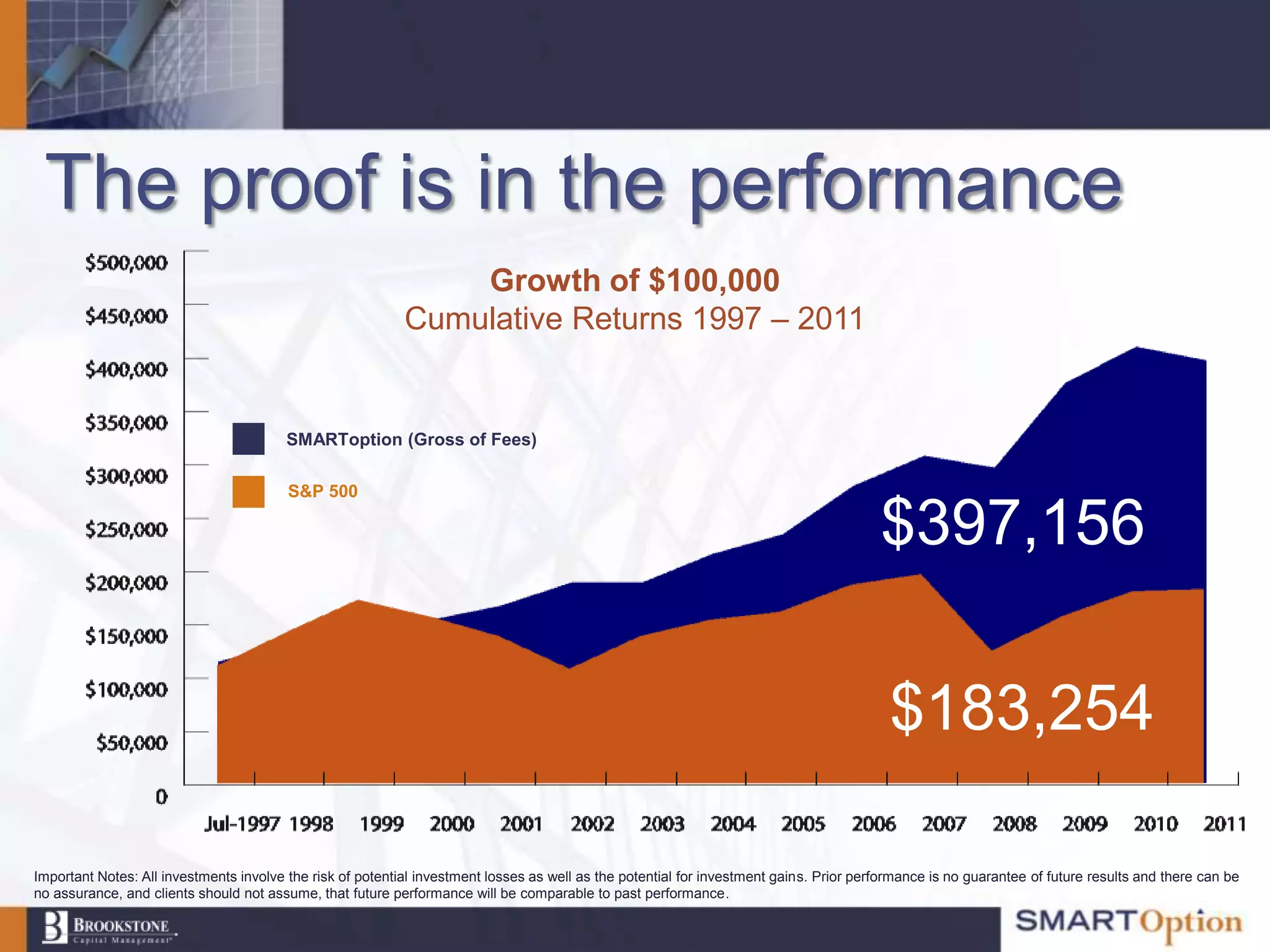

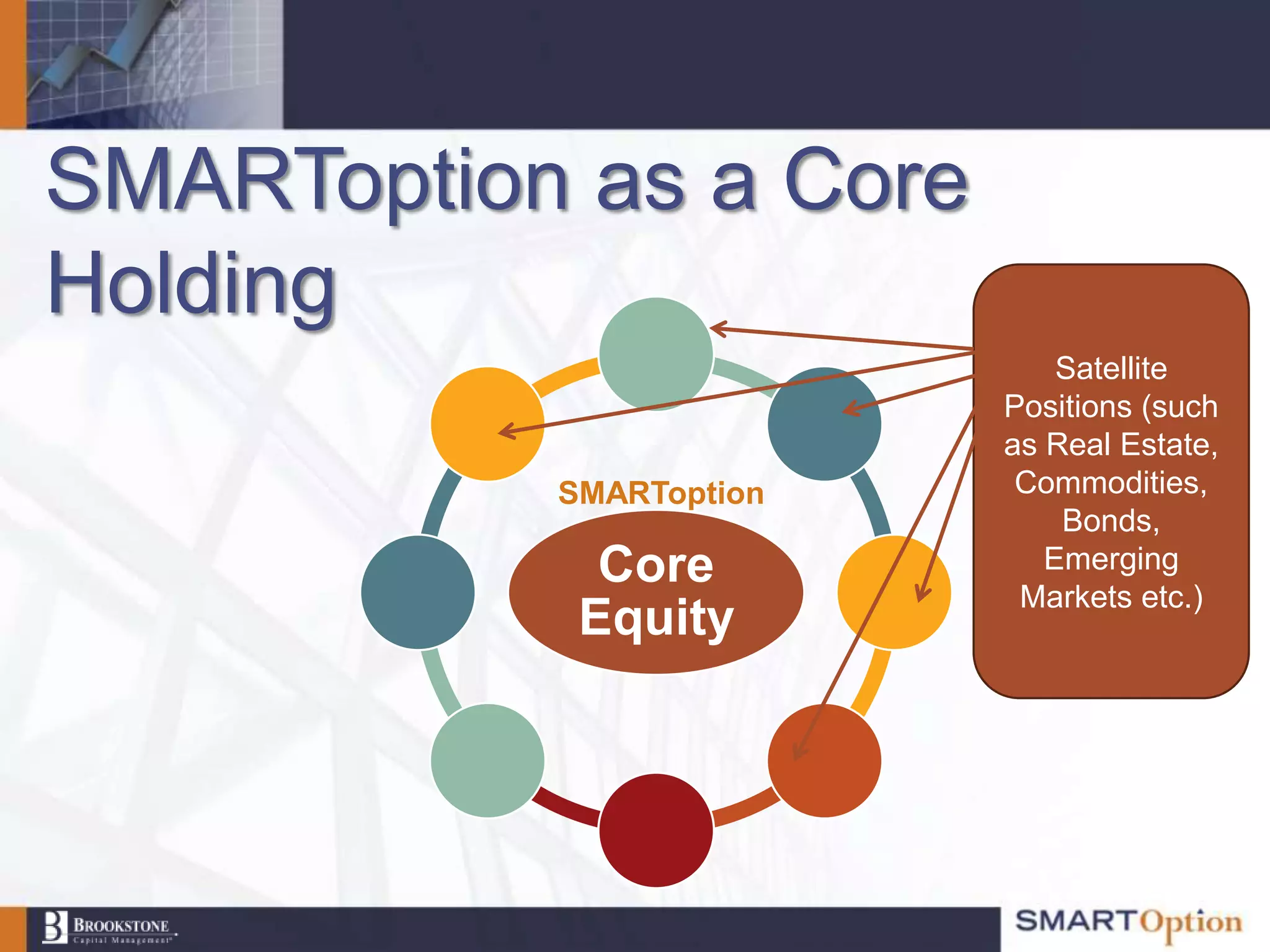

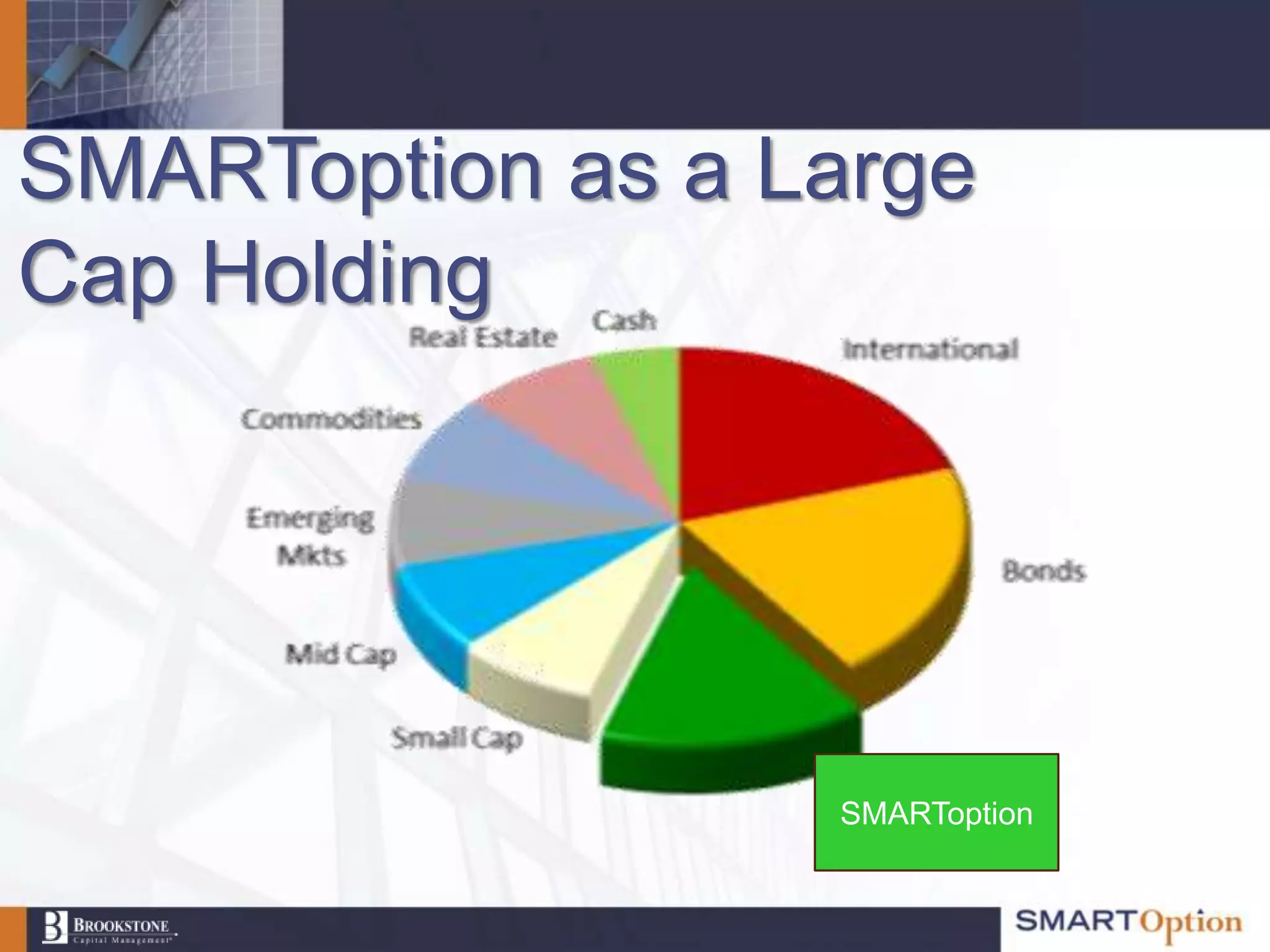

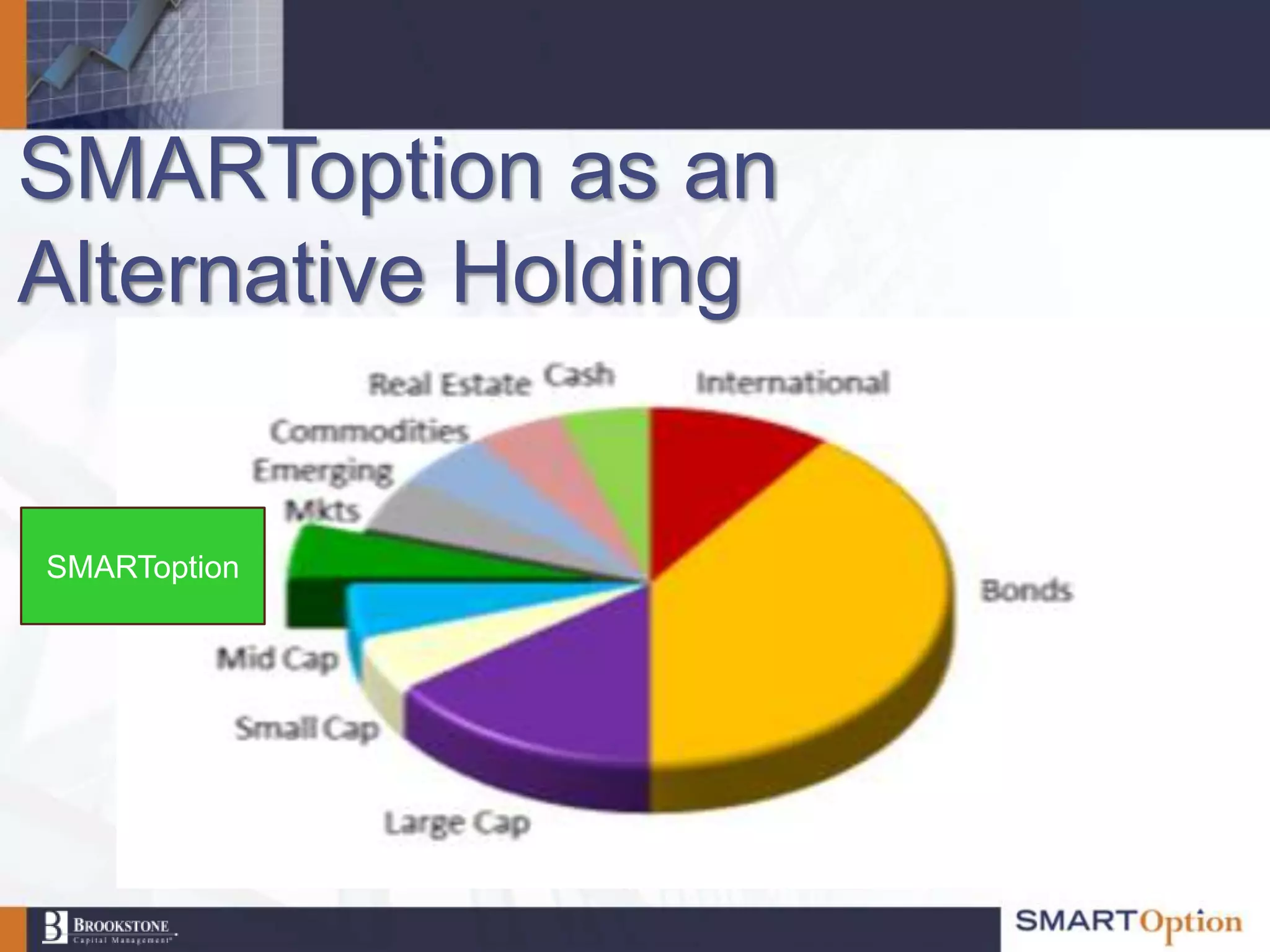

This document discusses various investment strategies including asset allocation, market timing, and buy and hold approaches. It notes that diversification works well until major market downturns, when most asset classes tend to decline together. The document then discusses how options strategies can be used to generate income, hedge risk, diversify a portfolio, and lock in profits. It provides examples of how put options, covered calls, and selling cash-secured puts work. The document concludes by outlining the two-basket approach used by SMARToption - Basket I invests in equities hedged with long-term put options, while Basket II independently generates income by selling short-term puts and calls. Historical performance data is presented showing how SMART