Embed presentation

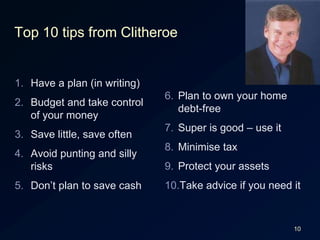

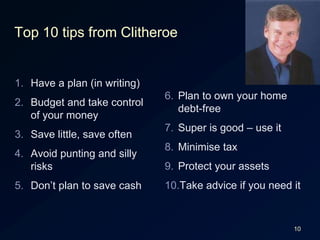

This document provides an overview of the key concepts from the unit "Financial Security" including the "three chunks of pie" metaphor for personal financial planning. It explains that the pie should be divided into three chunks: 1) plan to be generous through taxes, donations and support for others; 2) plan for the future such as paying off a house, superannuation, insurance, and saving for large expenses; 3) plan to be content through managing living expenses, focusing on contentment rather than upgrades, tracking expenses and cutting back 10%, and avoiding interest payments. It also lists Clitheroe's ten principles for managing money such as having a written financial plan, budgeting, saving often, avoiding risks, planning to own