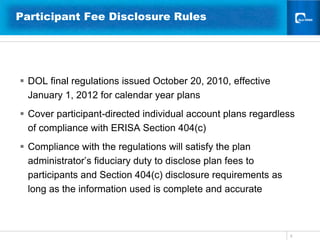

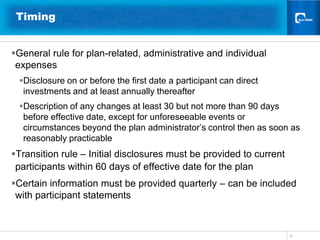

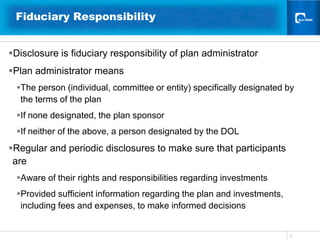

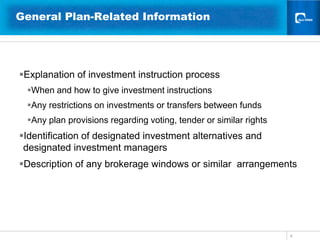

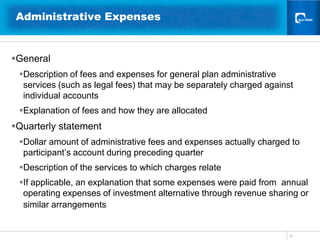

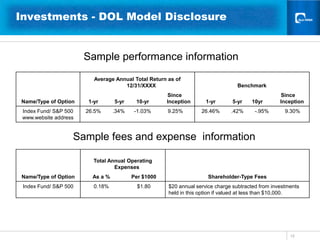

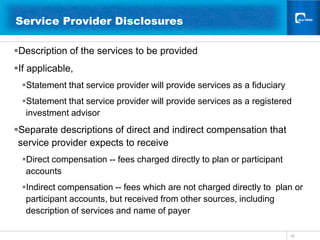

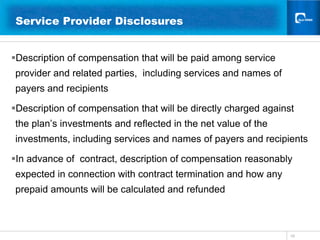

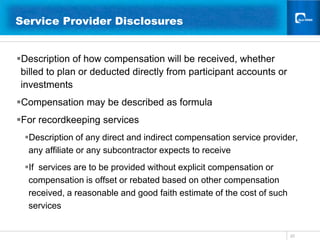

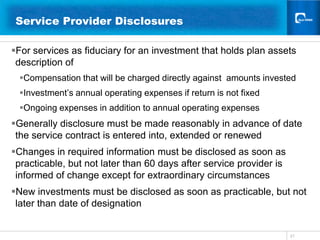

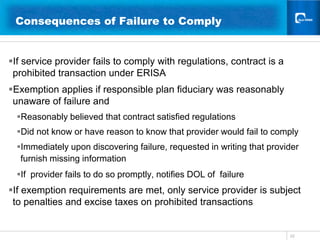

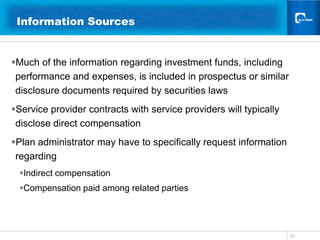

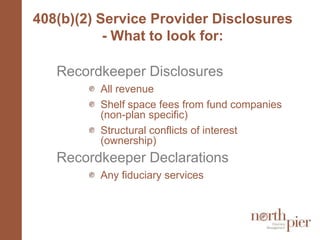

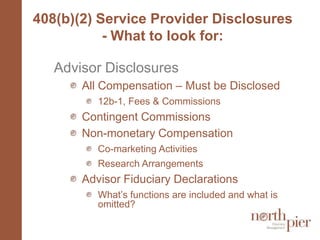

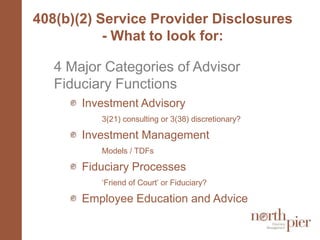

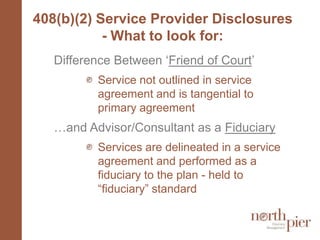

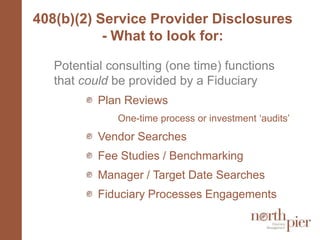

This document provides an overview and summary of new ERISA disclosure regulations for participant fees and service provider fees that take effect in January 2012. It discusses the requirements for disclosing plan-related information, administrative expenses, individual expenses, and investment expenses to plan participants. It also outlines the requirements for covered service providers to disclose fee and compensation information to the plan's responsible fiduciary. The presentation provides details on the timing, methods, and responsibilities for making these new disclosures under the DOL regulations.